Class 2 NI. What about us poor expats paying voluntary contributions?

#631

It is not even limited to "other non-US" pensions. Federal law allows certain state and local government employers to exclude employees from social security coverage if they provide an alternative pension scheme. Some school districts that I am aware of do this. These people also have WEP applied to them. Most people taking jobs with such employers are totally unaware of this. Now it may just be that the end result, with a good pension scheme, is a better deal.

IIRC it was in 1983 that continued participation in the federal employee retirement program became optional, and while many people who were already enrolled in the federal program likely chose to remain with that, forty years later there are likely very few people who are still contributing, and only a few caught up in the WEP implications of receiving a pension from that federal fund. AFAIK anyone joining the federal payroll after 1983 didn't have an option to join the federal retirement fund.

#632

Forum Regular

Joined: Jan 2012

Location: Mesa, Arizona

Posts: 64

[QUOTE=00derek;13203480]I'm jumping around the forum looking for information before I post a question that I have, .......

Believe it or not, I just finished reading the entire thread....yes, all 600-odd posts. What a ride! Remember the bit when Class 2 was getting abolished and then it wasn't ?! What a great moment in the plot!

I was looking for advice on whether to call first or simply send in form CF83; from reading I think I will send the form THEN call the international pensions center. I'm also going to document my story and start a new thread to help other people going forward. I think it's useful to create a clean timeline that doesn't get cluttered by going off-topic as this one did occasionally.

Huge thanks to everyone who has contributed so far, and hopefully a simpler "how-to" that's up to date on the newest advice will help others.

Believe it or not, I just finished reading the entire thread....yes, all 600-odd posts. What a ride! Remember the bit when Class 2 was getting abolished and then it wasn't ?! What a great moment in the plot!

I was looking for advice on whether to call first or simply send in form CF83; from reading I think I will send the form THEN call the international pensions center. I'm also going to document my story and start a new thread to help other people going forward. I think it's useful to create a clean timeline that doesn't get cluttered by going off-topic as this one did occasionally.

Huge thanks to everyone who has contributed so far, and hopefully a simpler "how-to" that's up to date on the newest advice will help others.

#633

Forum Regular

Joined: Jun 2022

Location: Austin, TX

Posts: 129

[QUOTE=00derek;13203568]

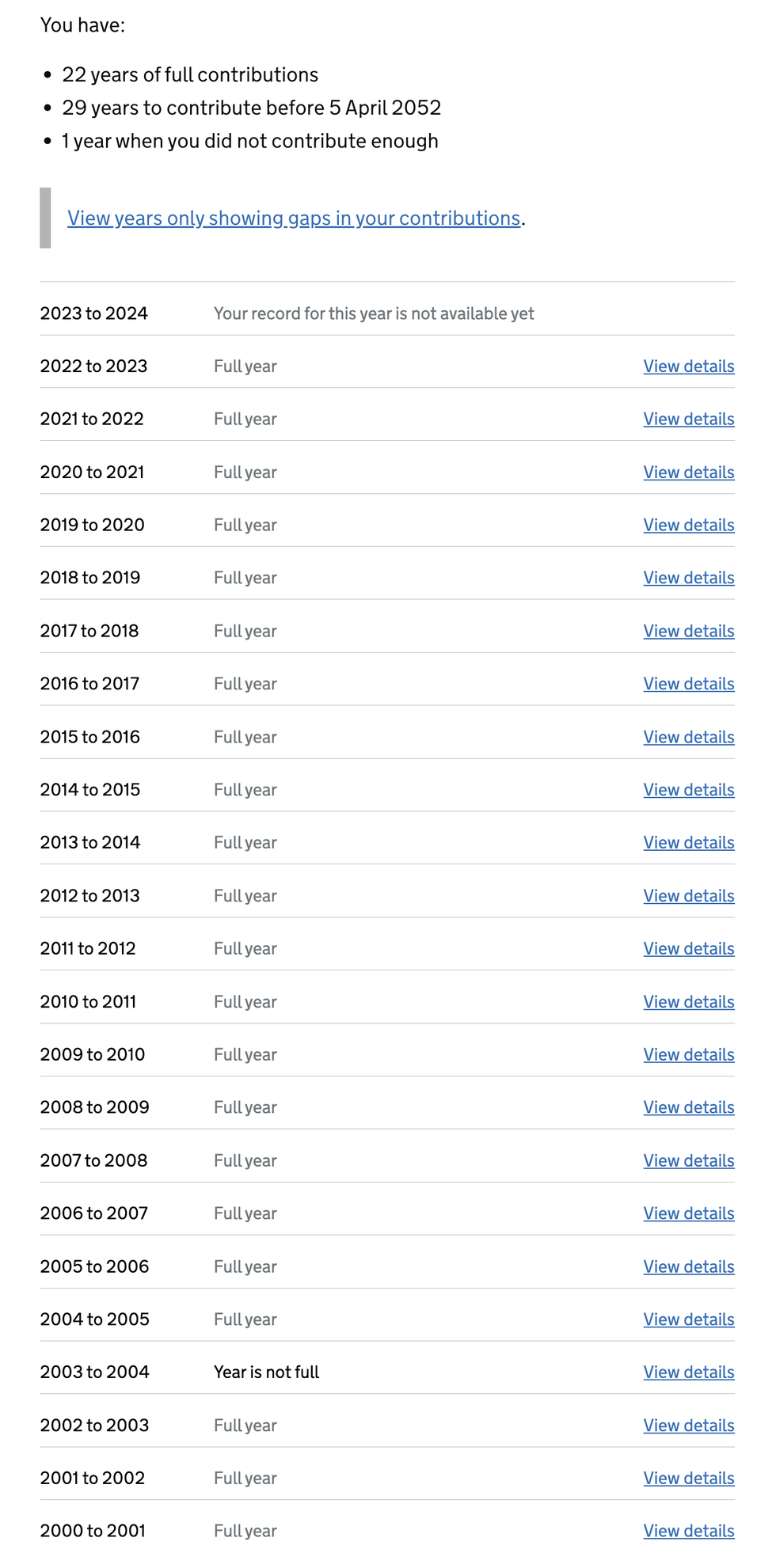

Thank you for doing this! I recently moved to the US, and am planning to do voluntary class 2 in due course. I have 22 years of full contributions to date, so 13 more needed (in the next 29 years) to get full pension. Seems a no-brainer.

I was looking for advice on whether to call first or simply send in form CF83; from reading I think I will send the form THEN call the international pensions center. I'm also going to document my story and start a new thread to help other people going forward. I think it's useful to create a clean timeline that doesn't get cluttered by going off-topic as this one did occasionally.

#634

You are probably too young to backfill 2006 thru 2016, so your choices would be to backfill the prior 6 years and pay the next 7, or just pay the next 13 years. I would do the former because you never know if they will change the rules in the future. So, get as many years in as soon as you can.

Either way, just fill in CF83, apply for Class 2 and mail it in. Very easy and uncomplicated. Expect a very long delay in getting a response, so get the ball rolling sooner than later.

Either way, just fill in CF83, apply for Class 2 and mail it in. Very easy and uncomplicated. Expect a very long delay in getting a response, so get the ball rolling sooner than later.

#635

Forum Regular

Joined: Jun 2022

Location: Austin, TX

Posts: 129

You are probably too young to backfill 2006 thru 2016, so your choices would be to backfill the prior 6 years and pay the next 7, or just pay the next 13 years. I would do the former because you never know if they will change the rules in the future. So, get as many years in as soon as you can.

Either way, just fill in CF83, apply for Class 2 and mail it in. Very easy and uncomplicated. Expect a very long delay in getting a response, so get the ball rolling sooner than later.

Either way, just fill in CF83, apply for Class 2 and mail it in. Very easy and uncomplicated. Expect a very long delay in getting a response, so get the ball rolling sooner than later.

But thanks for your guidance, I will print CF83 today and get it sent.

#636

BE Enthusiast

Joined: Dec 2008

Posts: 525

Don't assume you'll get a full pension with 35 years of contributions; check your NI record to make sure if you haven't already done so (can be done online). If you were contracted out for any years up to 2016 you may have a COPE pension deduction and need to contribute extra years to make up the shortfall.

http://www.gov.uk/government/publica...online-service

http://www.gov.uk/government/publica...online-service

Last edited by tdrinker; Jul 14th 2023 at 6:17 pm.

#637

Forum Regular

Joined: Jun 2022

Location: Austin, TX

Posts: 129

Don't assume you'll get a full pension with 35 years of contributions; check your NI record to make sure if you haven't already done so (can be done online). If you were contracted out for any years up to 2016 you may have a COPE pension deduction and need to contribute extra years to make up the shortfall.

http://www.gov.uk/government/publica...online-service

http://www.gov.uk/government/publica...online-service

It also says:

Estimate based on your National Insurance record up to 5 April 2023: £153.35 a week.

Forecast if you contribute another 9 years before 5 April 2052: £203.85 a week

Forecast if you contribute another 9 years before 5 April 2052: £203.85 a week

#638

According to that data you only need another 9 years to get the full pension, not 13. That would be the case if you built up a SERPS amount or an Additional State Pension prior to 2016 likely because you earned higher than average earnings and never contracted out. So the ROI is even better.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

#639

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

According to that data you only need another 9 years to get the full pension, not 13. That would be the case if you built up a SERPS amount or an Additional State Pension prior to 2016 likely because you earned higher than average earnings and never contracted out. So the ROI is even better.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

#640

Forum Regular

Joined: Jun 2022

Location: Austin, TX

Posts: 129

According to that data you only need another 9 years to get the full pension, not 13. That would be the case if you built up a SERPS amount or an Additional State Pension prior to 2016 likely because you earned higher than average earnings and never contracted out. So the ROI is even better.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

It reinforces what tdrinker said about checking your state pension forecast and not just assuming you need 35 full years. Sometimes it can be a little more and sometimes a little less depending upon your history prior to 2016.

I guess I could wait a few years to start paying the nine, but I guess nothing to lose in doing it now, and I assume it'll only get more expensive each year to voluntarily pay.

One Q, say I send the forms in tomorrow, and it takes them a few months to process it, will this year count as I'd only have paid say half of the year's monthly DD? Any way I can/should top up to ensure this year is complete as well? Or am I better off choosing Annual Payment (not DD). This would actually be my preferred method, in which case do they send me an invoice to pay each year?

Sorry for the noob questions!

#641

You could wait, but there is the possibility they will terminate the ability to pay NIs for those of us living overseas. It is an outstanding deal for us, and a correspondingly bad deal for HMRC. It would be the first thing I would change if I wanted to find easy cost savings within HMRC. It almost got eliminated a few years back (by accident with some other changes). Therefore if you won’t be returning to the UK and paying NI as a result of UK based employment then it is better to backfill what you can and pay the remaining years as soon as you can to mitigate that risk. If you think you might move back to the UK and pay enough full NI years in the future then you could be wasting your money on voluntary NIs. But Class 2 rates are ridiculously cheap, and if you are unsure that you will return it is a relatively inexpensive gamble.

The cost goes up every year in line with cost of living, but the value of money goes down, so in inflation adjusted terms the cost is more or less the same year over year.

Personally, I would pay by monthly DD. That’s what I do, and have never had any issues in many years of making voluntary contributions. It’s easy, nothing to remember and at start up you can backfill outstanding months in the current year. You also avoid the pitfalls that some have found when choosing to pay annually which is that some have to call to get those payments credited each year, which sounds like a real PIA. Plus you actually have to do something although they will send an invoice. If you choose annually you can check a box on form CF83 to receive further information on how to pay any previous months or years that are available to you.

if you send your form in the next few day, don’t be expecting a response until about April of next year, unless something changes. They are totally overwhelmed right now.

The cost goes up every year in line with cost of living, but the value of money goes down, so in inflation adjusted terms the cost is more or less the same year over year.

Personally, I would pay by monthly DD. That’s what I do, and have never had any issues in many years of making voluntary contributions. It’s easy, nothing to remember and at start up you can backfill outstanding months in the current year. You also avoid the pitfalls that some have found when choosing to pay annually which is that some have to call to get those payments credited each year, which sounds like a real PIA. Plus you actually have to do something although they will send an invoice. If you choose annually you can check a box on form CF83 to receive further information on how to pay any previous months or years that are available to you.

if you send your form in the next few day, don’t be expecting a response until about April of next year, unless something changes. They are totally overwhelmed right now.

#643

Just Joined

Joined: Oct 2007

Location: Malden, MA

Posts: 16

Like Glasgow Girl I have been paying NI monthly by DD, for a couple years now, works very smoothly. There is a little delay at the end of the Tax Year before the year is credited but no big deal, it happens automatically e.g 2022/23 just got credited a week or so ago. Initially I paid a lump sum to back fill to 2006, that took quite a while and I ended up paying a mix of Class 2 and Class 3 as I was unemployed in States a couple of times and was honest on the CF83 about my employment dates.

#644

BE Enthusiast

Joined: Dec 2008

Posts: 525

If you pay by monthly direct debit they take the money 4 months in arrears, e.g. the the current month (July '23) payment is the final payment for tax year 2022/23 and the 2023/24 tax year payment period is August '23 - July '24. I expect the NI record won't be updated to show the year credited until all payments are made, i.e. 4 months after the end of the tax year.

You have to be aware of this if you decide to cancel the monthly direct debit payments for whatever reason, i.e. don't cancel immediately after the end of the tax year on the assumption you've filled that tax year.

You have to be aware of this if you decide to cancel the monthly direct debit payments for whatever reason, i.e. don't cancel immediately after the end of the tax year on the assumption you've filled that tax year.

#645

Forum Regular

Joined: Jan 2012

Location: Mesa, Arizona

Posts: 64

Don't assume you'll get a full pension with 35 years of contributions; check your NI record to make sure if you haven't already done so (can be done online). If you were contracted out for any years up to 2016 you may have a COPE pension deduction and need to contribute extra years to make up the shortfall.

http://www.gov.uk/government/publica...online-service

http://www.gov.uk/government/publica...online-service