Class 2 NI. What about us poor expats paying voluntary contributions?

#586

Lost in BE Cyberspace

Joined: Jan 2006

Location: San Francisco

Posts: 12,865

#587

I am overseas and when dealing with the state pension have a dedicated overseas line. +44 (0) 191 218 7777 I cannot recall if I was on a separate line for the NIC 2 payment. in April 23. I suspect not. I must admit, just like you, I had researched and asked the questions re the final payment twelve months earlier i.e April 22. I was told to do it this way as if I relied on the usual method, i.e. check and mail to the UK it could be a long time before it got processed/allocated. They did assure me if there were any delays the monies would be retroactively paid.

The agent I called in April 23 could see there was an open slot for the 22-23 NIc 2 payment and let me pay over the phone using my UK bank TSB (Account Number and Sort Code.) I think the problem is if you don't follow up re: the allocation, it can just sit there in a paid state for several months and not get credited to your forecast.

And to be fair, the whole process of doing an online state pension claim in Feb 23, getting it approved and making the final NIC2 contribution in April 23 to getting the final payment allocated in May 23 and it being reflected in a full state pension was surprisingly easy.

The agent I called in April 23 could see there was an open slot for the 22-23 NIc 2 payment and let me pay over the phone using my UK bank TSB (Account Number and Sort Code.) I think the problem is if you don't follow up re: the allocation, it can just sit there in a paid state for several months and not get credited to your forecast.

And to be fair, the whole process of doing an online state pension claim in Feb 23, getting it approved and making the final NIC2 contribution in April 23 to getting the final payment allocated in May 23 and it being reflected in a full state pension was surprisingly easy.

Googling 'your number' (191 218 7777) uncovers this page - https://www.gov.uk/international-pension-centre. "International Pension Centre"

Googling 'my number' (191 203 7010) uncovers this page - https://www.gov.uk/government/organi...n-uk-residents "National Insurance: non-UK residents"

How long did it take to get through, and what time did you call? I'm on the West coast, US, so 8 hours behind which makes for difficult calls.

I have a couple of years to go yet, so no urgency in this but always good to know.

#588

Lost in BE Cyberspace

Joined: Jul 2016

Posts: 10,009

I am overseas and when dealing with the state pension have a dedicated overseas line. +44 (0) 191 218 7777 I cannot recall if I was on a separate line for the NIC 2 payment. in April 23. I suspect not. I must admit, just like you, I had researched and asked the questions re the final payment twelve months earlier i.e April 22. I was told to do it this way as if I relied on the usual method, i.e. check and mail to the UK it could be a long time before it got processed/allocated. They did assure me if there were any delays the monies would be retroactively paid.

The agent I called in April 23 could see there was an open slot for the 22-23 NIc 2 payment and let me pay over the phone using my UK bank TSB (Account Number and Sort Code.) I think the problem is if you don't follow up re: the allocation, it can just sit there in a paid state for several months and not get credited to your forecast.

And to be fair, the whole process of doing an online state pension claim in Feb 23, getting it approved and making the final NIC2 contribution in April 23 to getting the final payment allocated in May 23 and it being reflected in a full state pension was surprisingly easy.

The agent I called in April 23 could see there was an open slot for the 22-23 NIc 2 payment and let me pay over the phone using my UK bank TSB (Account Number and Sort Code.) I think the problem is if you don't follow up re: the allocation, it can just sit there in a paid state for several months and not get credited to your forecast.

And to be fair, the whole process of doing an online state pension claim in Feb 23, getting it approved and making the final NIC2 contribution in April 23 to getting the final payment allocated in May 23 and it being reflected in a full state pension was surprisingly easy.

#589

Just Joined

Joined: Aug 2022

Posts: 6

Best recollection, I called 44 (0) 191 218 7777 to get my claim for the state pension underway on Feb 8th at 6 am CT. I think I was on hold for 20-25 mins before I got an agent and then spent another 30 mins completing the application. I use LocalPhone so the 30 mins on with an agent cost $1.80.

I then received a physical letter at the end of March to say my application had been approved.

I think I called 44 (0)191 203 7010 on April 7th to pay the final NIC 2 contribution. Again, on hold for about 30 mins at 6 am CT. I was then on the call for about 15 mins as we made a payment from my TSB account to the appropriate NIC account. Again used Local Phone so less than $1

Before 2023, I made all payments by check so was very happy to find I could make the final payment over the phone given the proximity of my birth date to the end of the tax year. Given your birthday is 7 months after the end of the tax year you can probably pay by your normal method and then just chase them up to make sure it's allocated in a timely manner.

I then received a physical letter at the end of March to say my application had been approved.

I think I called 44 (0)191 203 7010 on April 7th to pay the final NIC 2 contribution. Again, on hold for about 30 mins at 6 am CT. I was then on the call for about 15 mins as we made a payment from my TSB account to the appropriate NIC account. Again used Local Phone so less than $1

Before 2023, I made all payments by check so was very happy to find I could make the final payment over the phone given the proximity of my birth date to the end of the tax year. Given your birthday is 7 months after the end of the tax year you can probably pay by your normal method and then just chase them up to make sure it's allocated in a timely manner.

#591

That's good news, sort of, but a reflection of what an almighty cluster it has become!

That's good news, sort of, but a reflection of what an almighty cluster it has become!I think it is especially good news for anyone needing to pay Class 3 as that gives a decent amount of time to find a way to pay for several years of arrears.

Last edited by Pulaski; Jun 12th 2023 at 8:16 pm.

#592

Just Joined

Joined: Dec 2021

Posts: 7

Thank you so much to the posters in this thread. You information alerted me to this unexpected opportunity to shore up our retirement finances.

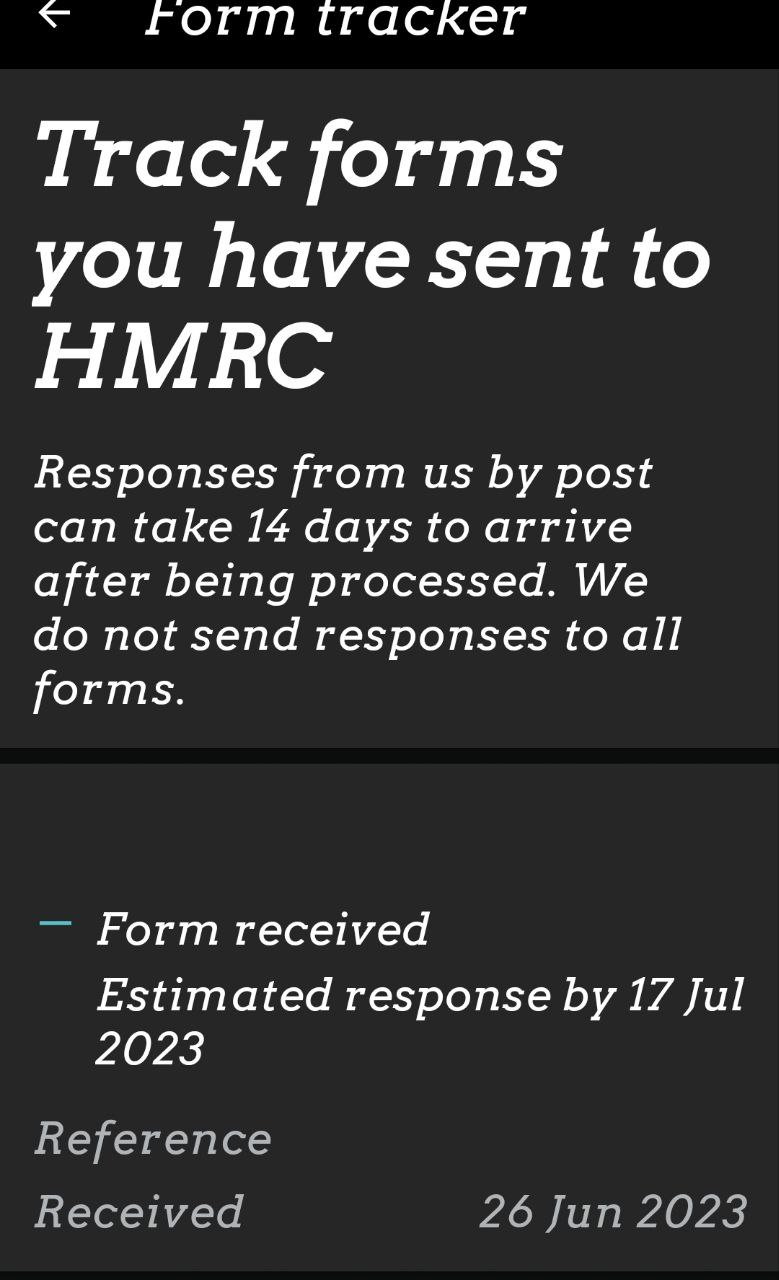

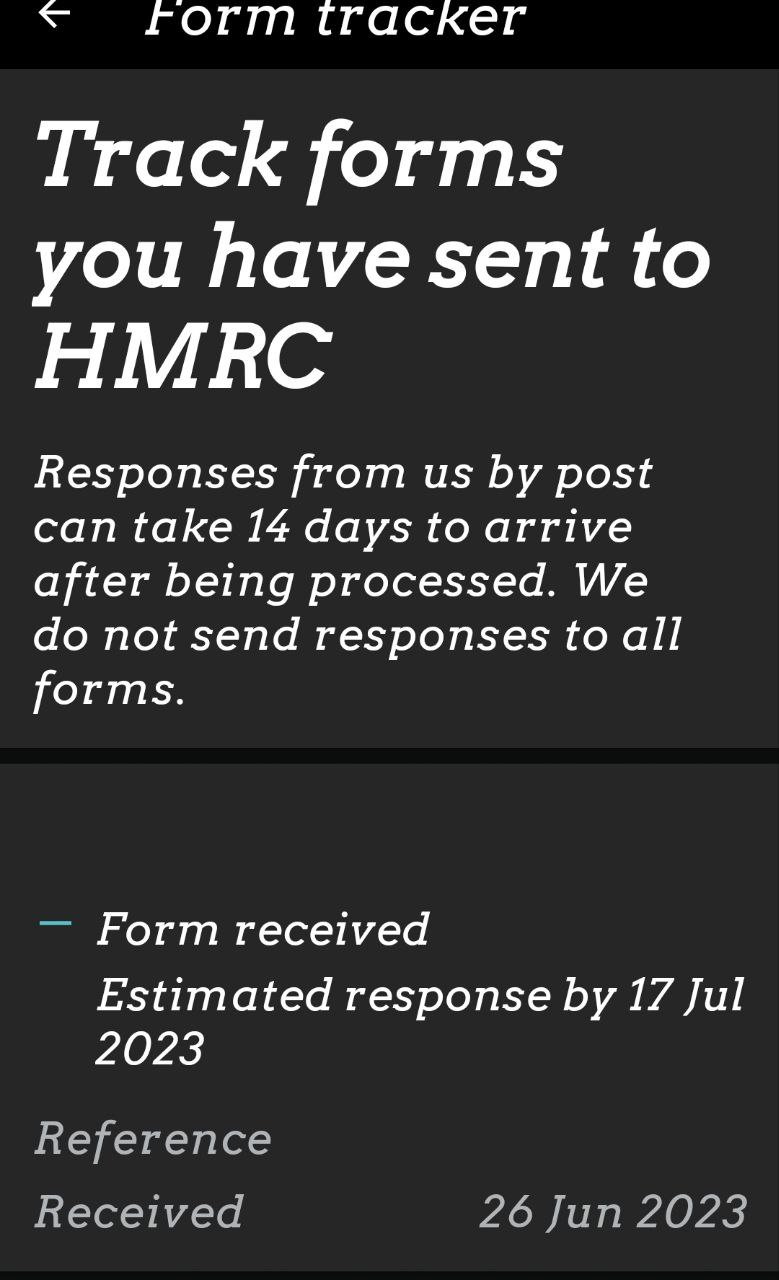

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

#593

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Thank you so much to the posters in this thread. You information alerted me to this unexpected opportunity to shore up our retirement finances.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

#594

Thank you so much to the posters in this thread. You information alerted me to this unexpected opportunity to shore up our retirement finances.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

#595

Forum Regular

Joined: Jul 2022

Posts: 50

Thank you so much to the posters in this thread. You information alerted me to this unexpected opportunity to shore up our retirement finances.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

On June 2nd of this year, I sent my form CF83 applying to pay voluntary UK NICs for the years 2006 forward. Today I learned from posts above that the deadline has been extended and that one can check receipt of the form and estimated reply date on the UK government website. The website says that they received my form on 9th June and that they are currently processing forms received in August 2022, the estimated date for processing my form is in March 2024 -- about 41 weeks after receipt.

I do have a couple of questions. First, what about 2017 and 2018 timing. If my form is processed per the new deadline, I would likely be later for the normal six year look back period for those years. Is it likely that they would allow to make contributions based on the date my form was received -- i.e. for 2018 at least. The second question is about eligibility for Class 2 NICs in future years. I was employed up to leaving the UK in 1998 and then employed from arrival in the US in 1998 to early 2019. Since leaving employment I have been self-employed and plan to continue in self-employment at least until I reach age 65 in 2026. Will I likely be able to make Class 2 vol NICs for the self-employed years from 2019 forward, or would I get bumped to another Class? My reading of the rules was that I'd be eligible for Class 2 both when employed and when self-employed.

#596

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I think you can go back farther than 2017. We just paid for years from 2006 onwards. I am currently self employed in the US and I also wondered whether I would qualify for Class 2. When I called HMRC the guy was quick to point out that you have to "be doing work" - they don't differentiate between employed and self employed. The only year they wouldn't apply the payment to was one year when I had zero income (I was "doing work", I just had big write offs and didn't show a profit). They must be able to access Social Security records to get this information. For that one year they told me I could pay Class 3 and the cost would be around 800 GBP. I called and asked them to apply the payment to 2022/23, which they did. I am a sole proprietor.

#597

Lost in BE Cyberspace

Joined: Jan 2006

Location: San Francisco

Posts: 12,865

The only year they wouldn't apply the payment to was one year when I had zero income (I was "doing work", I just had big write offs and didn't show a profit). They must be able to access Social Security records to get this information. For that one year they told me I could pay Class 3 and the cost would be around 800 GBP. I called and asked them to apply the payment to 2022/23, which they did. I am a sole proprietor.

#598

FWIW I am still waiting to here if my recent payments for 2021-22, 2022-2023 as billed, and my speculative payment (separate cheque) for either 2006-07 or 2007-08 (I don't believe I had previously contributed for either year), have brought my payments up to 35 years.

Last edited by Pulaski; Jun 26th 2023 at 1:26 am.

#599

BE Enthusiast

Joined: Oct 2012

Posts: 677

Just sent in my class 2 NI form from overseas. I see it has been received this week from looking at the HMRC app. Been working overseas for 5 years now, hoping I have no issues paying class 2. Hoping to pay back the lost years also.

Fingers crossed!

Fingers crossed!

Last edited by alfista1; Jun 27th 2023 at 2:47 pm.

#600

Forum Regular

Joined: Apr 2010

Location: Toronto

Posts: 174

We sent our forms off in February and had a date in March to expect a reply. After checking again in March that date had gone and when I checked the general site it said to expect a reply in November. So don’t be surprised not to get a response for after 44 weeks which I believe is the current waiting time.

Last edited by Jerseygirl; Jun 27th 2023 at 4:43 pm. Reason: Fixed quote