Class 2 NI. What about us poor expats paying voluntary contributions?

#721

BE Enthusiast

Joined: Dec 2008

Posts: 525

If it is from a government gateway account, it should have an explanation. Otherwise you may be able to set up account and get the information:

http://www.gov.uk/check-national-insurance-record

As others have said, it's probably because you were "contracted out" for a period, it which case your record will include this statement:

"You’ve been in a contracted-out pension scheme" and have a link which will click through to show the amount of your "cope" deduction.

Your pension forecast will also say how many additional years you need to contribute to get a full pension.

#722

#723

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,132

The other week while logged onto the HMRC government gateway I had a look at the DWP page and it says that “coming soon” you will be able to pay for voluntary contributions on line. That will be nice if and when that happens.

#724

Just Joined

Joined: Apr 2016

Posts: 17

For those tracking turnaround times on the CF83 my experience is similar to LT1 upthread. I sent in my CF83 on July 21 last year and received a letter (dated 24 January) from HMRC to my US home address today accepting my application to pay Class 2 NIC and detailing my shortfall that I can pay back to 2006. Like others have mentioned on this thread I enclosed a detailed US employment history showing when I was working/not working and for the time periods where I was out of work they put me on Class 3, but the total for the last 15 years is basically about 3,400 quid.

It also confirms that I can pay class 2 by direct debit. What's weird is I got a separate letter today for the 8/10/23 through 6/1/24 period telling me I have voluntary Class 3 contributions due. I'll have to give them a call and find out why they don't have me down for class 2 for the current period.

It also confirms that I can pay class 2 by direct debit. What's weird is I got a separate letter today for the 8/10/23 through 6/1/24 period telling me I have voluntary Class 3 contributions due. I'll have to give them a call and find out why they don't have me down for class 2 for the current period.

Last edited by Ravenscroft; Feb 12th 2024 at 6:20 pm. Reason: added date for letter from UK

#725

Although the focus of this site is obviously 'British', the audience of this thread is largely US residents. I've been in the US for over 40 years and my first instinct is to interpret dates using the US style. I'd suggest you use a less ambiguous date format in your posts. 8/10/23 could be 8-Oct-23 or 10-Aug-23, and 6/1/24 could be 6-Jan-24 or 1-Jun-24. Personally, I always use the 3-letter abbreviation for month rather than the numeric indicator.

#726

For those tracking turnaround times on the CF83 my experience is similar to LT1 upthread. I sent in my CF83 on July 21 last year and received a letter (dated 24 January) from HMRC to my US home address today accepting my application to pay Class 2 NIC and detailing my shortfall that I can pay back to 2006. Like others have mentioned on this thread I enclosed a detailed US employment history showing when I was working/not working and for the time periods where I was out of work they put me on Class 3, but the total for the last 15 years is basically about 3,400 quid.

It also confirms that I can pay class 2 by direct debit. What's weird is I got a separate letter today for the 8/10/23 through 6/1/24 period telling me I have voluntary Class 3 contributions due. I'll have to give them a call and find out why they don't have me down for class 2 for the current period.

It also confirms that I can pay class 2 by direct debit. What's weird is I got a separate letter today for the 8/10/23 through 6/1/24 period telling me I have voluntary Class 3 contributions due. I'll have to give them a call and find out why they don't have me down for class 2 for the current period.

#727

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

Thanks to the info I found on this forum I submitted a CF83 last September. I had previously ignored the possibility of doing voluntary N.I. but the Class 2 option seems such a bargain it would be stupid to pass it up. So for 3400 quid you got 18 years' worth back to 2006? That's about 190 pounds for each year - what a deal!

If I do that I will have about 32 years in the UK system, and if I retire next year I will also have 30 years of SS contributions, so 62 years in two systems. As far as I know there is no WEP on the US side because of my 30+ years, so this 'double dipping' is all ok? Hopefully I'm not missing anything here and I will indeed be able to claim from both systems without one side or the other deducting something.

If I do that I will have about 32 years in the UK system, and if I retire next year I will also have 30 years of SS contributions, so 62 years in two systems. As far as I know there is no WEP on the US side because of my 30+ years, so this 'double dipping' is all ok? Hopefully I'm not missing anything here and I will indeed be able to claim from both systems without one side or the other deducting something.

#728

That was the poster above me there ( I'm pretty much in the same boat, but right at the back of the line having jnow just submitted the form)..

Somewhat ashamed I haven't gotten to this sooner, but since the lengthy back pay option (i.e since 2006) deadline was extended a couple of times (till April next year), seems I should be able to get in on it. Many far more knowledgeable posters than I here, and it's all in this thread or others somewhere, but yes, if you have 30 years in Social Security you will not be WEPd at all. Furthermore as I understand it, if less than 30 years worked in US, WEP wouldn't apply to the years of voluntary UK contributions (only the prior existing ones made while working in UK).

For me personally, I've only got 19 years in Social Security and I'm not at all sure I will make another 11 as looking at returning to the UK soon. As I'll also get a partial Brithsh Army pension when I turn 60 in 9 years time, I figure I'm staring down the barrel of some serious WEPpage.. There is however scope for me to continue paying into the US social security since I'm self employed working abroad in neither the UK nor US currently (and have been doing so for the last decade). That ability will however go away, I guess, if and when I establish enough time in the UK to establish residency there.

Somewhat ashamed I haven't gotten to this sooner, but since the lengthy back pay option (i.e since 2006) deadline was extended a couple of times (till April next year), seems I should be able to get in on it. Many far more knowledgeable posters than I here, and it's all in this thread or others somewhere, but yes, if you have 30 years in Social Security you will not be WEPd at all. Furthermore as I understand it, if less than 30 years worked in US, WEP wouldn't apply to the years of voluntary UK contributions (only the prior existing ones made while working in UK).

For me personally, I've only got 19 years in Social Security and I'm not at all sure I will make another 11 as looking at returning to the UK soon. As I'll also get a partial Brithsh Army pension when I turn 60 in 9 years time, I figure I'm staring down the barrel of some serious WEPpage.. There is however scope for me to continue paying into the US social security since I'm self employed working abroad in neither the UK nor US currently (and have been doing so for the last decade). That ability will however go away, I guess, if and when I establish enough time in the UK to establish residency there.

#729

Just Joined

Joined: Apr 2016

Posts: 17

So for 3400 quid you got 18 years' worth back to 2006? That's about 190 pounds for each year - what a deal!

As to WEP, there's discussion upthread during July of 2023 that covers this quite a bit, but hitting the 30 year threshold does save you from the WEP. Link to the social security document about this.

And cheers to Steerpike for the reminder on date conventions.

#730

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,132

As to WEP, there's discussion upthread during July of 2023 that covers this quite a bit, but hitting the 30 year threshold does save you from the WEP. Link to the social security document about this.

.

#731

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

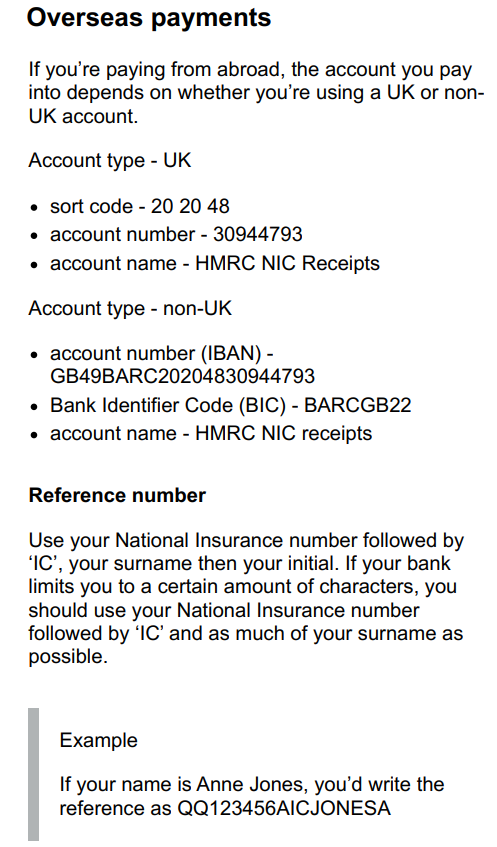

So I paid my 13 years via bank transfer following these instructions: www.gov.uk/pay-class-2-national-insurance (Class 2 NICs).

I also have a WISE account so I could pay in GBP from that account using a UK bank sort code, but the instructions for that assume you are paying from the UK and it requires an 18 digit reference code. Has anyone called the helpline to see if you can get an 18 digit reference?

#732

BE Forum Addict

Joined: Sep 2005

Location: Vancouver, BC (originally from Huddersfield, W. Yorkshire)

Posts: 1,223

I pay mine each year using Wise. I have a UK account on there and added the recipient account details for HMRC so it's all set up and can be reused each year. I've been making voluntary contributions for the past few years and the reference I've used each time is my national insurance number followed by IC and last name (up to 18 characters total). If you have a short last name I think you add first initial, I can't remember exactly. Not sure if that's still how they do it, will check what it says when the letter comes in April.

Last edited by adele; Feb 24th 2024 at 5:49 pm.

#733

I received a letter this week from HMRC accepting my application to pay Class 2 NIC back through 2006. The letter also gave the payment instructions for overseas residents. When you paid via bank transfer was that from a US bank in USD? Is it possible to specify an exact amount in pounds at the recipient's end after exchange rate conversion and fees?

I also have a WISE account so I could pay in GBP from that account using a UK bank sort code, but the instructions for that assume you are paying from the UK and it requires an 18 digit reference code. Has anyone called the helpline to see if you can get an 18 digit reference?

I also have a WISE account so I could pay in GBP from that account using a UK bank sort code, but the instructions for that assume you are paying from the UK and it requires an 18 digit reference code. Has anyone called the helpline to see if you can get an 18 digit reference?

When I send money using XE, I can either specify how much I want to send in USD or how much I want to receive in GBP. I'm not certain, but I would imagine your US bank would offer something similar.

#734

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

[QUOTE=adele;13242286 the reference I've used each time is my national insurance number followed by IC and last name (up to 18 characters total)[/QUOTE]

On www.gov.uk that's the reference number format described if your account is located overseas (using IBAN transfers). For payments from the UK (using UK sort code) it says you need to call the helpline to get your code. I guess WISE users fall into a slightly different category of living overseas but paying with a UK bank sort code. It's good to know the international 18 digit international code works for that case too, but maybe first I'll try calling them just to confirm (no doubt there will be a long time on hold.....).

On www.gov.uk that's the reference number format described if your account is located overseas (using IBAN transfers). For payments from the UK (using UK sort code) it says you need to call the helpline to get your code. I guess WISE users fall into a slightly different category of living overseas but paying with a UK bank sort code. It's good to know the international 18 digit international code works for that case too, but maybe first I'll try calling them just to confirm (no doubt there will be a long time on hold.....).

#735

On www.gov.uk that's the reference number format described if your account is located overseas (using IBAN transfers). For payments from the UK (using UK sort code) it says you need to call the helpline to get your code. I guess WISE users fall into a slightly different category of living overseas but paying with a UK bank sort code. It's good to know the international 18 digit international code works for that case too, but maybe first I'll try calling them just to confirm (no doubt there will be a long time on hold.....).

I called HMRC to double check what to use as a Overseas Payer using a UK bank account (btw they answered within a couple of minutes) and they confirmed I had to use the NI Number+IC+Name as the reference number.

Now the website appears to have deleted the instructions for Overseas Payers paying from a UK bank account. No idea why.

Last edited by stephend-; Feb 25th 2024 at 5:39 pm.