Class 2 NI. What about us poor expats paying voluntary contributions?

#796

Forum Regular

Joined: Jan 2024

Posts: 40

Personally, I think it was originally an accident, a loophole that was left open, not planned deliberately, as Class 2 contributions are primarily for the self employed, it's an oddity that they are also available to expats. But if a conscious decision was taken to leave that loophole open, then I suspect it was on the assumption that [1] "most expats would return home", at least when they retire, if not sooner, which would place the burden of impoverished pensioners back on the British government anyway, and [2] that expats "working in the (former) colonies" wouldn't have access to an equivalent pension saving scheme to the British state pension, .... and per [1] above would return home to the UK without adequate provision for their retirement. Though honestly, I think that the whole thing is a bit of a (bad) joke as anyone today relying solely on the UK state pension would probably be barely able to survive, even if they owned their own home, so had no rent.

#797

Those are all good reasons to allow expats to keep up their NI payments and they could do that by paying Class 3 NI. What I don't understand is why Class 3 was replaced by Class 2. Maybe not enough expats were paying Class 3 NI and there was a rash of people returning with poor lifetime NI records. Anyway the bottom line for people who have known how to work the system for the last 30 years is a UK SP that ends up being highly subsidized...I think my lifetime NI payments are around £6k so I'll be ahead in around 6 months after claiming the state pension. That's ridiculous.

#798

Forum Regular

Joined: Jan 2024

Posts: 40

#799

#800

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,872

Sent my GBP 179.40 for 2023-2024 today. Decided to delete the save account and start fresh to see if I could get my payment auto credited without the phone call. Paying UK account to UK account @ HSBC, which would not accept the “account name” shown on the letter, so used what was on the GOV.UK site.

#801

Sent my GBP 179.40 for 2023-2024 today. Decided to delete the save account and start fresh to see if I could get my payment auto credited without the phone call. Paying UK account to UK account @ HSBC, which would not accept the “account name” shown on the letter, so used what was on the GOV.UK site.

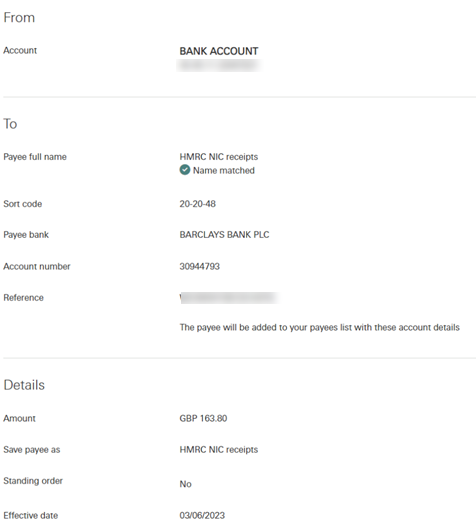

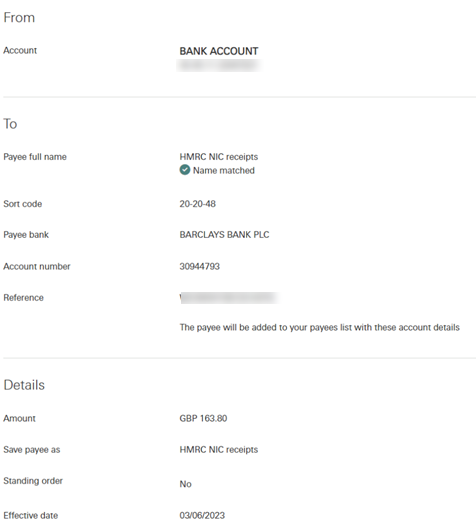

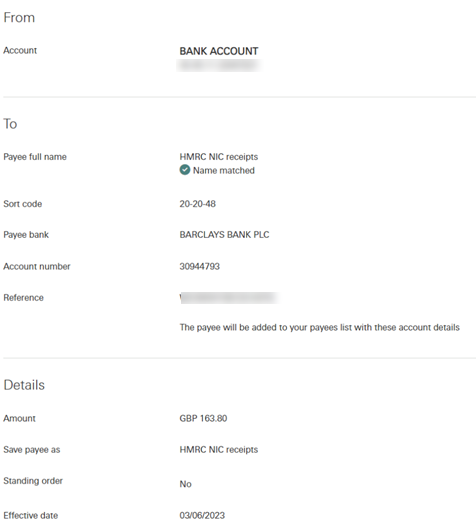

Regarding "Decided to delete the save account and start fresh to see if I could get my payment auto credited without the phone call." I presume you mean you deleted the saved 'pay to' definition within the HSBC account (which presumably you used last year) and created a new entry with the hope of better targeting your desired account this year, but HSBC wouldn't let you create the 'pay to' definition the way you wanted it. For the past several years I've struggled with the 'pay to' and 'reference' details also, and have noted the contradiction between the instructions in the letter, and the instructions on the website. The good news is, I've ALWAYS found my payments have been correctly credited; I've never had to call them to sort it out. The bad news is, it's always a convoluted process! I'm pretty sure I documented it all in this thread, but I also have detailed notes; this is a screenshot from the HSBC 'transfer' screen last year:

The instructions in the letter for 'Pay to account name' is:

But I could never get that to work; I think the website says to use 'HMRC NIC receipts', which is what I used.

The instructions in the letter for the 'Reference' is

I structured it as ( NI Number ) + IC + ( first seven characters of my surname )

since my surname is over 6 characters, and thus a) needs to be truncated and b) there's no room for first initial. I think the website addresses the 'long name' condition but the letter still does not (who writes these things? Who thinks 'Anne Jones' is a good example to give!?).

I'll be going through this tomorrow; I'm sure HSBC will drive me insane with security measures ... (I only log on twice a year; once to initiate these payments, once to verify the money was taken out).

EDIT - went ahead and did it right after posting the above. It went remarkably smoothly. It seems like HSBC have removed the need to generate a second 'transaction' security code (with sub-60-second expiration) separate from the initial 'log on security code' that expires in 15 seconds (!) (and separate from the 're-authentication security code ...')

Next step - wait till September and see if the UK Govt. website 'status' reflects my payment.

Last edited by Steerpike; May 14th 2024 at 5:40 pm.

#802

Looking at my info at the HMRC site today, it would appear I'm finally going to be eligible for my UK pension later this year (WOOHOO!).

I've been so focused on getting approved for Class 2 payments, then getting the Class 2 payments made and credited, I lost track of the actual 'purpose' of the whole thing - actually receiving the pension!

So - do I need to start doing anything now, for a November start? Will they start mailing me a check/cheque? I guess my preference would be to receive US dollars in my US account (or receive a check/cheque in US dollars), but if necessary I could receive GBP in my UK HSBC account.

So what lies ahead, oh wonderfully helpful expats?

I've been so focused on getting approved for Class 2 payments, then getting the Class 2 payments made and credited, I lost track of the actual 'purpose' of the whole thing - actually receiving the pension!

So - do I need to start doing anything now, for a November start? Will they start mailing me a check/cheque? I guess my preference would be to receive US dollars in my US account (or receive a check/cheque in US dollars), but if necessary I could receive GBP in my UK HSBC account.

So what lies ahead, oh wonderfully helpful expats?

#803

BE Enthusiast

Joined: Dec 2008

Posts: 698

Looking at my info at the HMRC site today, it would appear I'm finally going to be eligible for my UK pension later this year (WOOHOO!).

I've been so focused on getting approved for Class 2 payments, then getting the Class 2 payments made and credited, I lost track of the actual 'purpose' of the whole thing - actually receiving the pension!

So - do I need to start doing anything now, for a November start? Will they start mailing me a check/cheque? I guess my preference would be to receive US dollars in my US account (or receive a check/cheque in US dollars), but if necessary I could receive GBP in my UK HSBC account.

So what lies ahead, oh wonderfully helpful expats?

I've been so focused on getting approved for Class 2 payments, then getting the Class 2 payments made and credited, I lost track of the actual 'purpose' of the whole thing - actually receiving the pension!

So - do I need to start doing anything now, for a November start? Will they start mailing me a check/cheque? I guess my preference would be to receive US dollars in my US account (or receive a check/cheque in US dollars), but if necessary I could receive GBP in my UK HSBC account.

So what lies ahead, oh wonderfully helpful expats?

#804

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,872

I just got my letter yesterday (dated April 6, so ~5 weeks to get here). I also need to pay GBP 179.40, and I also have an HSBC account in UK which I will be using to make the payment online tomorrow.

Regarding "Decided to delete the save account and start fresh to see if I could get my payment auto credited without the phone call." I presume you mean you deleted the saved 'pay to' definition within the HSBC account (which presumably you used last year) and created a new entry with the hope of better targeting your desired account this year, but HSBC wouldn't let you create the 'pay to' definition the way you wanted it. For the past several years I've struggled with the 'pay to' and 'reference' details also, and have noted the contradiction between the instructions in the letter, and the instructions on the website. The good news is, I've ALWAYS found my payments have been correctly credited; I've never had to call them to sort it out. The bad news is, it's always a convoluted process! I'm pretty sure I documented it all in this thread, but I also have detailed notes; this is a screenshot from the HSBC 'transfer' screen last year:

The instructions in the letter for 'Pay to account name' is:

But I could never get that to work; I think the website says to use 'HMRC NIC receipts', which is what I used.

The instructions in the letter for the 'Reference' is

I structured it as ( NI Number ) + IC + ( first seven characters of my surname )

since my surname is over 6 characters, and thus a) needs to be truncated and b) there's no room for first initial. I think the website addresses the 'long name' condition but the letter still does not (who writes these things? Who thinks 'Anne Jones' is a good example to give!?).

I'll be going through this tomorrow; I'm sure HSBC will drive me insane with security measures ... (I only log on twice a year; once to initiate these payments, once to verify the money was taken out).

EDIT - went ahead and did it right after posting the above. It went remarkably smoothly. It seems like HSBC have removed the need to generate a second 'transaction' security code (with sub-60-second expiration) separate from the initial 'log on security code' that expires in 15 seconds (!) (and separate from the 're-authentication security code ...')

Next step - wait till September and see if the UK Govt. website 'status' reflects my payment.

Regarding "Decided to delete the save account and start fresh to see if I could get my payment auto credited without the phone call." I presume you mean you deleted the saved 'pay to' definition within the HSBC account (which presumably you used last year) and created a new entry with the hope of better targeting your desired account this year, but HSBC wouldn't let you create the 'pay to' definition the way you wanted it. For the past several years I've struggled with the 'pay to' and 'reference' details also, and have noted the contradiction between the instructions in the letter, and the instructions on the website. The good news is, I've ALWAYS found my payments have been correctly credited; I've never had to call them to sort it out. The bad news is, it's always a convoluted process! I'm pretty sure I documented it all in this thread, but I also have detailed notes; this is a screenshot from the HSBC 'transfer' screen last year:

The instructions in the letter for 'Pay to account name' is:

But I could never get that to work; I think the website says to use 'HMRC NIC receipts', which is what I used.

The instructions in the letter for the 'Reference' is

I structured it as ( NI Number ) + IC + ( first seven characters of my surname )

since my surname is over 6 characters, and thus a) needs to be truncated and b) there's no room for first initial. I think the website addresses the 'long name' condition but the letter still does not (who writes these things? Who thinks 'Anne Jones' is a good example to give!?).

I'll be going through this tomorrow; I'm sure HSBC will drive me insane with security measures ... (I only log on twice a year; once to initiate these payments, once to verify the money was taken out).

EDIT - went ahead and did it right after posting the above. It went remarkably smoothly. It seems like HSBC have removed the need to generate a second 'transaction' security code (with sub-60-second expiration) separate from the initial 'log on security code' that expires in 15 seconds (!) (and separate from the 're-authentication security code ...')

Next step - wait till September and see if the UK Govt. website 'status' reflects my payment.

In terms of paying beyond 35 years, I am of a mind to maybe pay a few extra years. I don’t think it will matter, because I already have 40 quarters or whatever the US requirement is, but some of the years I have are full credits both in the UK and US, because I was PAYE in the UK paying class 1, but an LPR and resident in the US and commuting to the UK so I also then declared that income again and paid self employed FICA on that same income….

#805

.... So - do I need to start doing anything now, for a November start? Will they start mailing me a check/cheque? I guess my preference would be to receive US dollars in my US account (or receive a check/cheque in US dollars), but if necessary I could receive GBP in my UK HSBC account.

So what lies ahead, oh wonderfully helpful expats?

So what lies ahead, oh wonderfully helpful expats?

Tdrinker's link should have all the information you need, but whatever you do, please do not request payment to be mailed by cheque - the time delay, and expense, in depositing and clearing a cheque from overseas (hypothetically, if you requested a USD check it would almost certainly be drawn on a bank in New York, or at least in the US), not to mention a seriously crappy exchange rate if the cheque isn't drawn in USD, would make the whole process painful.

Last edited by Pulaski; May 15th 2024 at 3:04 am.

#806

So, looking at the link in detail ... looks like I can start the process 4 months ahead of eligible date (birthday) - so July for me.

I can either call, 'email', or fill out a paper form and mail it.

For 'email' (actually filling out/submitting an online form), they say "It is taking longer than usual to reply to online queries". I can imagine the paper form is a bit time consuming also. Sounds like calling might be my best bet, although I imagine they will simply tell me to fill out some forms and mail them. Does anyone know what happens during that phone call - can you actually finalize the process or do they simply direct you to some paperwork? I can't imagine you can get away without filling out and signing forms! So I wonder if filling out and mailing the paper form is the logical way to go. At the very least, they need to know the bank account details which I can't imagine they will take over the phone.

Will they pay me the full amount I'm entitled to (the amount they are predicting I will get based on my contributions) or will there be tax withholdings? I don't see any reference in the above link to suggest any steps needed to avoid having tax withheld.

Congratulations on successfully navigating the NI maze and hitting the home straight.

Tdrinker's link should have all the information you need, but whatever you do, please do not request payment to be mailed by cheque - the time delay, and expense, in depositing and clearing a cheque from overseas (hypothetically, if you requested a USD check it would almost certainly be drawn on a bank in New York, or at least in the US), not to mention a seriously crappy exchange rate if the cheque isn't drawn in USD, would make the whole process painful.

Tdrinker's link should have all the information you need, but whatever you do, please do not request payment to be mailed by cheque - the time delay, and expense, in depositing and clearing a cheque from overseas (hypothetically, if you requested a USD check it would almost certainly be drawn on a bank in New York, or at least in the US), not to mention a seriously crappy exchange rate if the cheque isn't drawn in USD, would make the whole process painful.

Last edited by Steerpike; May 15th 2024 at 5:05 am.

#807

... The link provided says I can receive the pension in a UK or a US bank account. If US bank account, the amount will be converted to US Dollars at the then-prevailing exchange rate. I assume they will give me a better exchange rate than I would get 'retail' so no concerns there.

Last edited by Pulaski; May 15th 2024 at 6:47 am.

#808

Forum Regular

Joined: Jul 2018

Location: California

Posts: 257

Thanks for the link!

So, looking at the link in detail ... looks like I can start the process 4 months ahead of eligible date (birthday) - so July for me.

I can either call, 'email', or fill out a paper form and mail it.

For 'email' (actually filling out/submitting an online form), they say "It is taking longer than usual to reply to online queries". I can imagine the paper form is a bit time consuming also. Sounds like calling might be my best bet, although I imagine they will simply tell me to fill out some forms and mail them. Does anyone know what happens during that phone call - can you actually finalize the process or do they simply direct you to some paperwork? I can't imagine you can get away without filling out and signing forms! So I wonder if filling out and mailing the paper form is the logical way to go. At the very least, they need to know the bank account details which I can't imagine they will take over the phone.

Will they pay me the full amount I'm entitled to (the amount they are predicting I will get based on my contributions) or will there be tax withholdings? I don't see any reference in the above link to suggest any steps needed to avoid having tax withheld.

The link provided says I can receive the pension in a UK or a US bank account. If US bank account, the amount will be converted to US Dollars at the then-prevailing exchange rate. I assume they will give me a better exchange rate than I would get 'retail' so no concerns there.

So, looking at the link in detail ... looks like I can start the process 4 months ahead of eligible date (birthday) - so July for me.

I can either call, 'email', or fill out a paper form and mail it.

For 'email' (actually filling out/submitting an online form), they say "It is taking longer than usual to reply to online queries". I can imagine the paper form is a bit time consuming also. Sounds like calling might be my best bet, although I imagine they will simply tell me to fill out some forms and mail them. Does anyone know what happens during that phone call - can you actually finalize the process or do they simply direct you to some paperwork? I can't imagine you can get away without filling out and signing forms! So I wonder if filling out and mailing the paper form is the logical way to go. At the very least, they need to know the bank account details which I can't imagine they will take over the phone.

Will they pay me the full amount I'm entitled to (the amount they are predicting I will get based on my contributions) or will there be tax withholdings? I don't see any reference in the above link to suggest any steps needed to avoid having tax withheld.

The link provided says I can receive the pension in a UK or a US bank account. If US bank account, the amount will be converted to US Dollars at the then-prevailing exchange rate. I assume they will give me a better exchange rate than I would get 'retail' so no concerns there.

#809

BE Forum Addict

Joined: Aug 2013

Location: Athens GA

Posts: 2,140

Thanks for the link!

So, looking at the link in detail ... looks like I can start the process 4 months ahead of eligible date (birthday) - so July for me.

I can either call, 'email', or fill out a paper form and mail it.

For 'email' (actually filling out/submitting an online form), they say "It is taking longer than usual to reply to online queries". I can imagine the paper form is a bit time consuming also. Sounds like calling might be my best bet, although I imagine they will simply tell me to fill out some forms and mail them. Does anyone know what happens during that phone call - can you actually finalize the process or do they simply direct you to some paperwork? I can't imagine you can get away without filling out and signing forms! So I wonder if filling out and mailing the paper form is the logical way to go. At the very least, they need to know the bank account details which I can't imagine they will take over the phone.

Will they pay me the full amount I'm entitled to (the amount they are predicting I will get based on my contributions) or will there be tax withholdings? I don't see any reference in the above link to suggest any steps needed to avoid having tax withheld.

The link provided says I can receive the pension in a UK or a US bank account. If US bank account, the amount will be converted to US Dollars at the then-prevailing exchange rate. I assume they will give me a better exchange rate than I would get 'retail' so no concerns there.

So, looking at the link in detail ... looks like I can start the process 4 months ahead of eligible date (birthday) - so July for me.

I can either call, 'email', or fill out a paper form and mail it.

For 'email' (actually filling out/submitting an online form), they say "It is taking longer than usual to reply to online queries". I can imagine the paper form is a bit time consuming also. Sounds like calling might be my best bet, although I imagine they will simply tell me to fill out some forms and mail them. Does anyone know what happens during that phone call - can you actually finalize the process or do they simply direct you to some paperwork? I can't imagine you can get away without filling out and signing forms! So I wonder if filling out and mailing the paper form is the logical way to go. At the very least, they need to know the bank account details which I can't imagine they will take over the phone.

Will they pay me the full amount I'm entitled to (the amount they are predicting I will get based on my contributions) or will there be tax withholdings? I don't see any reference in the above link to suggest any steps needed to avoid having tax withheld.

The link provided says I can receive the pension in a UK or a US bank account. If US bank account, the amount will be converted to US Dollars at the then-prevailing exchange rate. I assume they will give me a better exchange rate than I would get 'retail' so no concerns there.

Payment to my US bank comes reliably and the exchange rate is good. It is impossible to do an absolute comparison because of timing, but my impression is that the end result is better than Wise.

#810

BE Enthusiast

Joined: Oct 2012

Posts: 690

Anyone recently received their letter of approval for class 2 payments and years of class 2 you can pay, BUT online still shows the old data for each year?

Do they send out letters then take time to update their systems to reflect the amounts online?

Would have assumed it would be the other way around!! (but this is HMRC so wouldn't surprise me)

Do they send out letters then take time to update their systems to reflect the amounts online?

Would have assumed it would be the other way around!! (but this is HMRC so wouldn't surprise me)