Car insurance

#1

Just Joined

Thread Starter

Joined: Jan 2024

Posts: 3

Hi

Recently arrived in Seattle.

Looking to get our own cars now. Used an insurance broker to get quotes for insurance, and it's $1600+ for 6 months. I had searched previously and saw some old threads mentioning Liberty Mutual honoring UK no claims history. I mentioned this to him, but he came back and said they don't offer that.

I can't see any mention of it on their website. Just wondered if anyone had got it through them recently, or knew of any other potentially cheaper insurance options?

Recently arrived in Seattle.

Looking to get our own cars now. Used an insurance broker to get quotes for insurance, and it's $1600+ for 6 months. I had searched previously and saw some old threads mentioning Liberty Mutual honoring UK no claims history. I mentioned this to him, but he came back and said they don't offer that.

I can't see any mention of it on their website. Just wondered if anyone had got it through them recently, or knew of any other potentially cheaper insurance options?

#2

For the first couple of years in the US car insurance is eyewateringly expensive; it always has been, and still is.

I am deeply sceptical that any insurer has ever truely honored an UK (non-US) no claims history, as it always seems to me that it is a marketing hook not an actual discount. In other words they tell you they're giving you credit for your non-US no claims history, but are actually just giving you a discretionary discount avaialble for new customers, and telling you its for your UK no claims history, as a means to recruit a new customer and make them feel happy with the premiums they're being charged.

I am deeply sceptical that any insurer has ever truely honored an UK (non-US) no claims history, as it always seems to me that it is a marketing hook not an actual discount. In other words they tell you they're giving you credit for your non-US no claims history, but are actually just giving you a discretionary discount avaialble for new customers, and telling you its for your UK no claims history, as a means to recruit a new customer and make them feel happy with the premiums they're being charged.

#4

Heading for Poppyland

Joined: Jul 2007

Location: North Norfolk and northern New York State

Posts: 14,547

For the first couple of years in the US car insurance is eyewateringly expensive; it always has been, and still is.

I am deeply sceptical that any insurer has ever truely honored an UK (non-US) no claims history, as it always seems to me that it is a marketing hook not an actual discount. In other words they tell you they're giving you credit for your non-US no claims history, but are actually just giving you a discretionary discount avaialble for new customers, and telling you its for your UK no claims history, as a means to recruit a new customer and make them feel happy with the premiums they're being charged.

I am deeply sceptical that any insurer has ever truely honored an UK (non-US) no claims history, as it always seems to me that it is a marketing hook not an actual discount. In other words they tell you they're giving you credit for your non-US no claims history, but are actually just giving you a discretionary discount avaialble for new customers, and telling you its for your UK no claims history, as a means to recruit a new customer and make them feel happy with the premiums they're being charged.

#5

Just Joined

Joined: Dec 2019

Posts: 9

Try not to get a speeding ticket, here in Mass it stays on your insurance for 5 years putting the cost way up - over $2500 for the year. I've had two tickets in the time I have lived here, so 10 years of paying extra insurance out of 22.

hate the insurance industry - you pay for something you don't want to use because if you do it goes up

Brendan

hate the insurance industry - you pay for something you don't want to use because if you do it goes up

Brendan

#6

Try not to get a speeding ticket, here in Mass it stays on your insurance for 5 years putting the cost way up - over $2500 for the year. I've had two tickets in the time I have lived here, so 10 years of paying extra insurance out of 22.

I hate the insurance industry - you pay for something you don't want to use because if you do it goes up. ....

I hate the insurance industry - you pay for something you don't want to use because if you do it goes up. ....

I have had three tickets*, one for speeding, the other for BS lane-changing infractions (US cops don't understand how British drivers are taught to use their mirrors), but two of the three tickets were entirely eliminated, they never existed, legally speaking. The other ticket, the one for speeding, was downgraded to "defective equipment".

Also some states also allow you to take a classroom education program instead of the ticket (but limited to once every three years).

* There would have been a fourth, but I was driving too fast for the cop to get a speed reading. At least that is what he told me when he found me, a couple of miles down the road, parked and walking into a salon to get a haircut - I hadn't even realized he was following me!

Last edited by Pulaski; Mar 9th 2024 at 10:03 pm.

#7

BE Enthusiast

Joined: May 2019

Posts: 348

#8

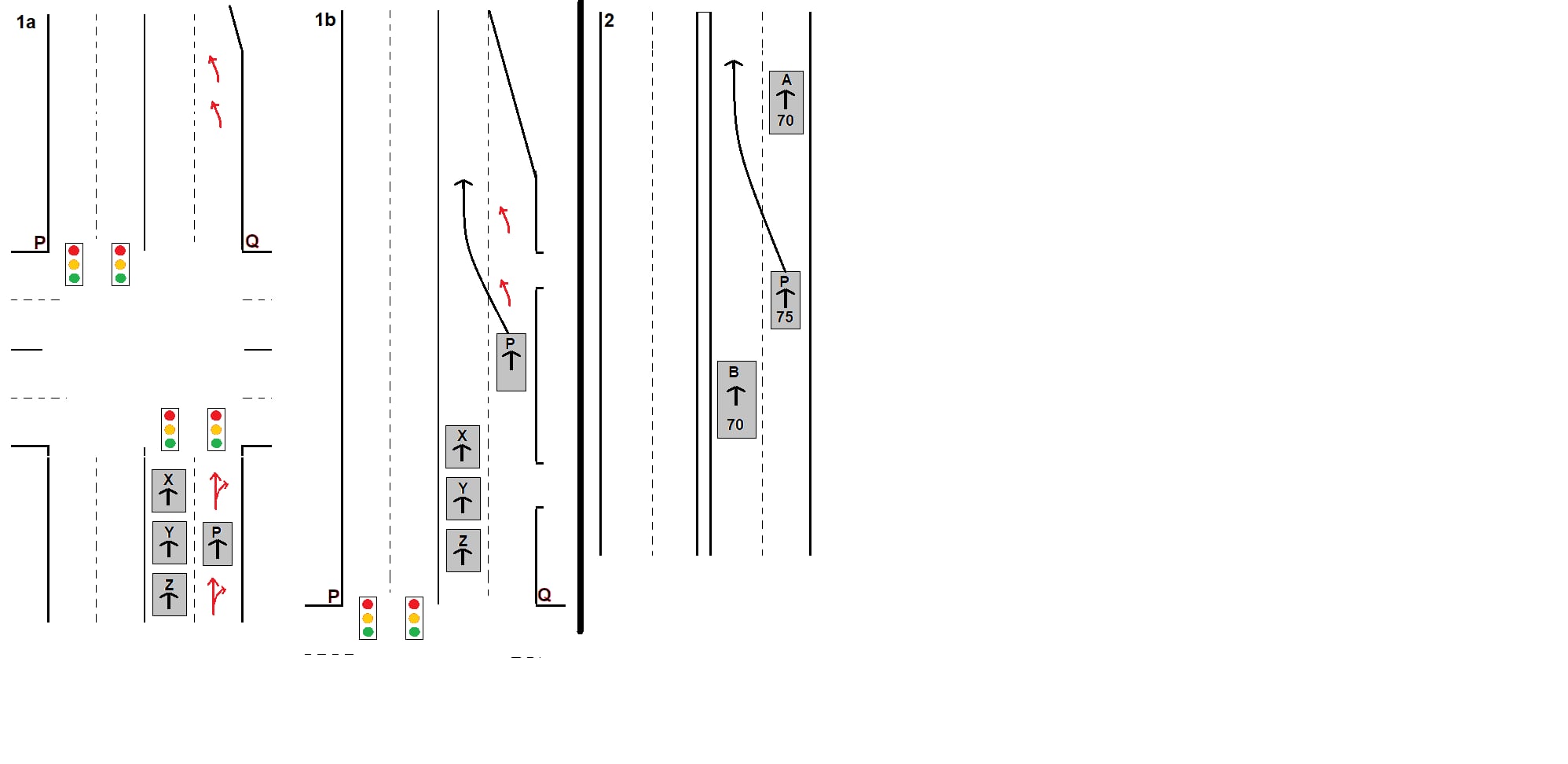

In scenario 1 I went straight across a crossroad junction in the right lane, which was in accordance with the arrows painted on the road, then moved to the left, also in accordance with the arrows on the road. A cop was in the line of traffic in the left lane, not at the front but 5-6 cars back (there were more than the three cars in the diagram. I assume he think I sliced across into the left lane, but I knew exactly where Car X was, and I was also going faster than it. Car X did not have to brake or swerve, nor sound its horn, I believe the cop just didn't have a good view of what happened, and I assume that he assumed that I wasn't using my mirrors, when in fact I had also glanced over my shoulder, as taught when learning to drive, before changing lanes.

In scenario 2 Car B was just hanging out, cruising in the left lane of a 2-lane interstate. So he actually had no business to be there, per the written rules (that almost nobody follows), of moving back to the right after passing a slower vehicle, and I could not have made an "unsafe maneuver" if he had moved back to the right. Anyway I was travelling faster, and had been in the right lane for a while (having moved back to the right after completing my previous passing maneuver

) when I caught up with Car A. I checked my mirrors, indicated, checked again, looked over my shoulder, then move into the left lane in front of Car B, accelerating as I did so. Then I discovered that Car B was an unmarked MD state trooper as the car lit up like a Christmas tree!

) when I caught up with Car A. I checked my mirrors, indicated, checked again, looked over my shoulder, then move into the left lane in front of Car B, accelerating as I did so. Then I discovered that Car B was an unmarked MD state trooper as the car lit up like a Christmas tree!

Last edited by Pulaski; Mar 10th 2024 at 6:09 am.

#9

BE Enthusiast

Joined: May 2019

Posts: 348

Car B was just hanging out, cruising in the left lane of a 2-lane interstate. So he actually had no business to be there, per the written rules (that almost nobody follows), of moving back to the right after passing a slower vehicle, ... Then I discovered that Car B was an unmarked MD state trooper as the car lit up like a Christmas tree!

#10

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

1) Mandatory liability coverage for property damage. Required in all states. The state mandated minimum coverage limit is usually pathetically low (like $10k) but if you want to protect yourself increased coverage up to about 300k is available.

2) Mandatory liability coverage for injury to others. Required in all states. Again, the state mandated minimum coverage is pathetically low (typically about $20k) considering the cost of medical care. In an accident if you are at fault this is the thing the injured party and their lawyer will collect from first. You should have coverage *much* higher than the minimum but again the upper limit (about $300k typically) isn't really enough in the event of some else's serious injury. This line item is in my experience by far the most expensive thing on the list for obvious reasons if you've even had medical bills here.

3) Optional Comprehensive coverage for damage to your car from all causes (by you, others, fire, weather etc). This is actually very cheap.

Then the interesting stuff you think you might not need or might be confused if you need it or not....

4) Optional Uninsured motorist protection. In a perfect world where everyone is insured and the insurance limits for liability are not so pathetically low this would not be necessary, but.... This is for *your* injuries caused by an uninsured or underinsured motorist. As with all injury related costs this can bump up your premium significantly. Now you might reasonably ask, if you have comprehensive general medical insurance, why would you need this? And for many years I did not carry this for that very reason. And then you get into a crash (caused by someone else) and their liability limit is $10k and your injuries add up to a lot more than that so so seek medical help and you find that your regular GP and related specialists WILL NOT TREAT YOU (the ER will stabilize you - they have to by law) but follow up care can be denied by your regular medical providers in some states (Florida for one...). So they direct you to a specialist department which deals with car crashes and they do not take your regular comprehensive medical insurance - they only take auto injury insurance, and if the 'at fault' party has minimal liability you will probably need to hire a personal injury lawyer who finds that the at fault party is a 20 year old kid with no assets so that's a dead end....). This to me was a total shock that my medical insurance was useless just when I needed it most. So yes you probably need uninsured motorist protection, unless you are sure you can pay your medical bills some other way.

5) State mandated 'no fault' injury liability. If applicable to your state this covers basic medical care after an accident regardless of who is at fault. It only provides about $10-20k of coverage but if applicable it is compulsory.

6) A bunch of other options for theft of valuables from inside the car and small stuff like that.

And with all these there are optional deductibles (excess) and coverage limits which all affect the premium (and in some cases 'stacked' and 'nonstacked' options related to whether the coverage for liability is added on top of other liability coverage in the policy, or just standalone), and limits per person and per accident. So when a broker quotes you a premium you need to read the proposed policy carefully, and compare with your comfort level with risk. I have found that choosing a higher deductible for each line item (say $2k) can bring down the premium considerably.

And finally, if you have substantial assets not protected from creditors and lawyers in any eventuality (savings accounts, some types of retirement accounts in some states not protected by federal law, real estate unless protected by state law from creditors), you might also consider a separate 'umbrella' policy to protect yourself in the event you injure somebody or damage their property and their costs exceed your auto liability insurance limits.

#11

Auto insurance anywhere in the USA has a load of options - far more than the UK. Depending which options you choose affects the premium. But in all cases, the main cost is affected by medical costs, which as you are probably aware can easily add up to millions for you and others you might injure. The cost of writing off your or someone else's car is trivial by comparison. The menu of required and optional items varies by state but here's the type of list I've had to deal with in Florida, Texas and California:

1) Mandatory liability coverage for property damage. Required in all states. The state mandated minimum coverage limit is usually pathetically low (like $10k) but if you want to protect yourself increased coverage up to about 300k is available.

2) Mandatory liability coverage for injury to others. Required in all states. Again, the state mandated minimum coverage is pathetically low (typically about $20k) considering the cost of medical care. In an accident if you are at fault this is the thing the injured party and their lawyer will collect from first. You should have coverage *much* higher than the minimum but again the upper limit (about $300k typically) isn't really enough in the event of some else's serious injury. This line item is in my experience by far the most expensive thing on the list for obvious reasons if you've even had medical bills here.

3) Optional Comprehensive coverage for damage to your car from all causes (by you, others, fire, weather etc). This is actually very cheap.

Then the interesting stuff you think you might not need or might be confused if you need it or not....

4) Optional Uninsured motorist protection. In a perfect world where everyone is insured and the insurance limits for liability are not so pathetically low this would not be necessary, but.... This is for *your* injuries caused by an uninsured or underinsured motorist. As with all injury related costs this can bump up your premium significantly. Now you might reasonably ask, if you have comprehensive general medical insurance, why would you need this? And for many years I did not carry this for that very reason. And then you get into a crash (caused by someone else) and their liability limit is $10k and your injuries add up to a lot more than that so so seek medical help and you find that your regular GP and related specialists WILL NOT TREAT YOU (the ER will stabilize you - they have to by law) but follow up care can be denied by your regular medical providers in some states (Florida for one...). So they direct you to a specialist department which deals with car crashes and they do not take your regular comprehensive medical insurance - they only take auto injury insurance, and if the 'at fault' party has minimal liability you will probably need to hire a personal injury lawyer who finds that the at fault party is a 20 year old kid with no assets so that's a dead end....). This to me was a total shock that my medical insurance was useless just when I needed it most. So yes you probably need uninsured motorist protection, unless you are sure you can pay your medical bills some other way.

5) State mandated 'no fault' injury liability. If applicable to your state this covers basic medical care after an accident regardless of who is at fault. It only provides about $10-20k of coverage but if applicable it is compulsory.

6) A bunch of other options for theft of valuables from inside the car and small stuff like that.

And with all these there are optional deductibles (excess) and coverage limits which all affect the premium (and in some cases 'stacked' and 'nonstacked' options related to whether the coverage for liability is added on top of other liability coverage in the policy, or just standalone), and limits per person and per accident. So when a broker quotes you a premium you need to read the proposed policy carefully, and compare with your comfort level with risk. I have found that choosing a higher deductible for each line item (say $2k) can bring down the premium considerably.

And finally, if you have substantial assets not protected from creditors and lawyers in any eventuality (savings accounts, some types of retirement accounts in some states not protected by federal law, real estate unless protected by state law from creditors), you might also consider a separate 'umbrella' policy to protect yourself in the event you injure somebody or damage their property and their costs exceed your auto liability insurance limits.

1) Mandatory liability coverage for property damage. Required in all states. The state mandated minimum coverage limit is usually pathetically low (like $10k) but if you want to protect yourself increased coverage up to about 300k is available.

2) Mandatory liability coverage for injury to others. Required in all states. Again, the state mandated minimum coverage is pathetically low (typically about $20k) considering the cost of medical care. In an accident if you are at fault this is the thing the injured party and their lawyer will collect from first. You should have coverage *much* higher than the minimum but again the upper limit (about $300k typically) isn't really enough in the event of some else's serious injury. This line item is in my experience by far the most expensive thing on the list for obvious reasons if you've even had medical bills here.

3) Optional Comprehensive coverage for damage to your car from all causes (by you, others, fire, weather etc). This is actually very cheap.

Then the interesting stuff you think you might not need or might be confused if you need it or not....

4) Optional Uninsured motorist protection. In a perfect world where everyone is insured and the insurance limits for liability are not so pathetically low this would not be necessary, but.... This is for *your* injuries caused by an uninsured or underinsured motorist. As with all injury related costs this can bump up your premium significantly. Now you might reasonably ask, if you have comprehensive general medical insurance, why would you need this? And for many years I did not carry this for that very reason. And then you get into a crash (caused by someone else) and their liability limit is $10k and your injuries add up to a lot more than that so so seek medical help and you find that your regular GP and related specialists WILL NOT TREAT YOU (the ER will stabilize you - they have to by law) but follow up care can be denied by your regular medical providers in some states (Florida for one...). So they direct you to a specialist department which deals with car crashes and they do not take your regular comprehensive medical insurance - they only take auto injury insurance, and if the 'at fault' party has minimal liability you will probably need to hire a personal injury lawyer who finds that the at fault party is a 20 year old kid with no assets so that's a dead end....). This to me was a total shock that my medical insurance was useless just when I needed it most. So yes you probably need uninsured motorist protection, unless you are sure you can pay your medical bills some other way.

5) State mandated 'no fault' injury liability. If applicable to your state this covers basic medical care after an accident regardless of who is at fault. It only provides about $10-20k of coverage but if applicable it is compulsory.

6) A bunch of other options for theft of valuables from inside the car and small stuff like that.

And with all these there are optional deductibles (excess) and coverage limits which all affect the premium (and in some cases 'stacked' and 'nonstacked' options related to whether the coverage for liability is added on top of other liability coverage in the policy, or just standalone), and limits per person and per accident. So when a broker quotes you a premium you need to read the proposed policy carefully, and compare with your comfort level with risk. I have found that choosing a higher deductible for each line item (say $2k) can bring down the premium considerably.

And finally, if you have substantial assets not protected from creditors and lawyers in any eventuality (savings accounts, some types of retirement accounts in some states not protected by federal law, real estate unless protected by state law from creditors), you might also consider a separate 'umbrella' policy to protect yourself in the event you injure somebody or damage their property and their costs exceed your auto liability insurance limits.

Last edited by Pulaski; Mar 11th 2024 at 3:47 am.

#12

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

And unfortunately, compared to the million+ pound liability coverage limits in the UK, the usual typical maximum auto liability coverage options in most (or maybe all?) states (about $300k typically) I think is not enough. And even umbrella coverage is only about $1M, which is still less than the UK.

#13

And unfortunately, compared to the million+ pound liability coverage limits in the UK, the usual typical maximum auto liability coverage options in most (or maybe all?) states (about $300k typically) I think is not enough. And even umbrella coverage is only about $1M, which is still less than the UK.

#14

Forum Regular

Joined: Jul 2022

Location: SoCal

Posts: 61

#15

We asked our broker, and they had to ask Erie, as it needed to be "approved", and Erie asked for supporting records as to why we needed a larger umbrella policy, but approval came back in just a day or two.