US Capital Gains

#1

Forum Regular

Thread Starter

Joined: Nov 2017

Posts: 39

If I am moving to the UK next year, would it make sense to consider cashing in long held US shares before the end of this year due to the (presumably) higher capital gains tax in the UK?

Any thoughts on this?

(Yes, I know this may not be the best time to sell shares!)

Any thoughts on this?

(Yes, I know this may not be the best time to sell shares!)

#2

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

The tax treatment of capital gains by HMRC may not be the reason to sell shares now, as the exchange rate fluctuations probably dominate tax rates. When completing the UK return the purchase and sales price of the shares must be converted to £s on the day. Easy to look up the historical rates using XE.com.

Suppose the purchase price was $10,000 and the sales price a few years later was $12,000.

if the rate on the date of purchase was £1 to $1.60 and the rate on date of purchase was $1.25.

purchase price = £6,250

sakes proceeds = £9,600

Cap Gain = £3,350

Suppose the purchase price was $10,000 and the sales price a few years later was $12,000.

if the rate on the date of purchase was £1 to $1.60 and the rate on date of purchase was $1.25.

purchase price = £6,250

sakes proceeds = £9,600

Cap Gain = £3,350

#3

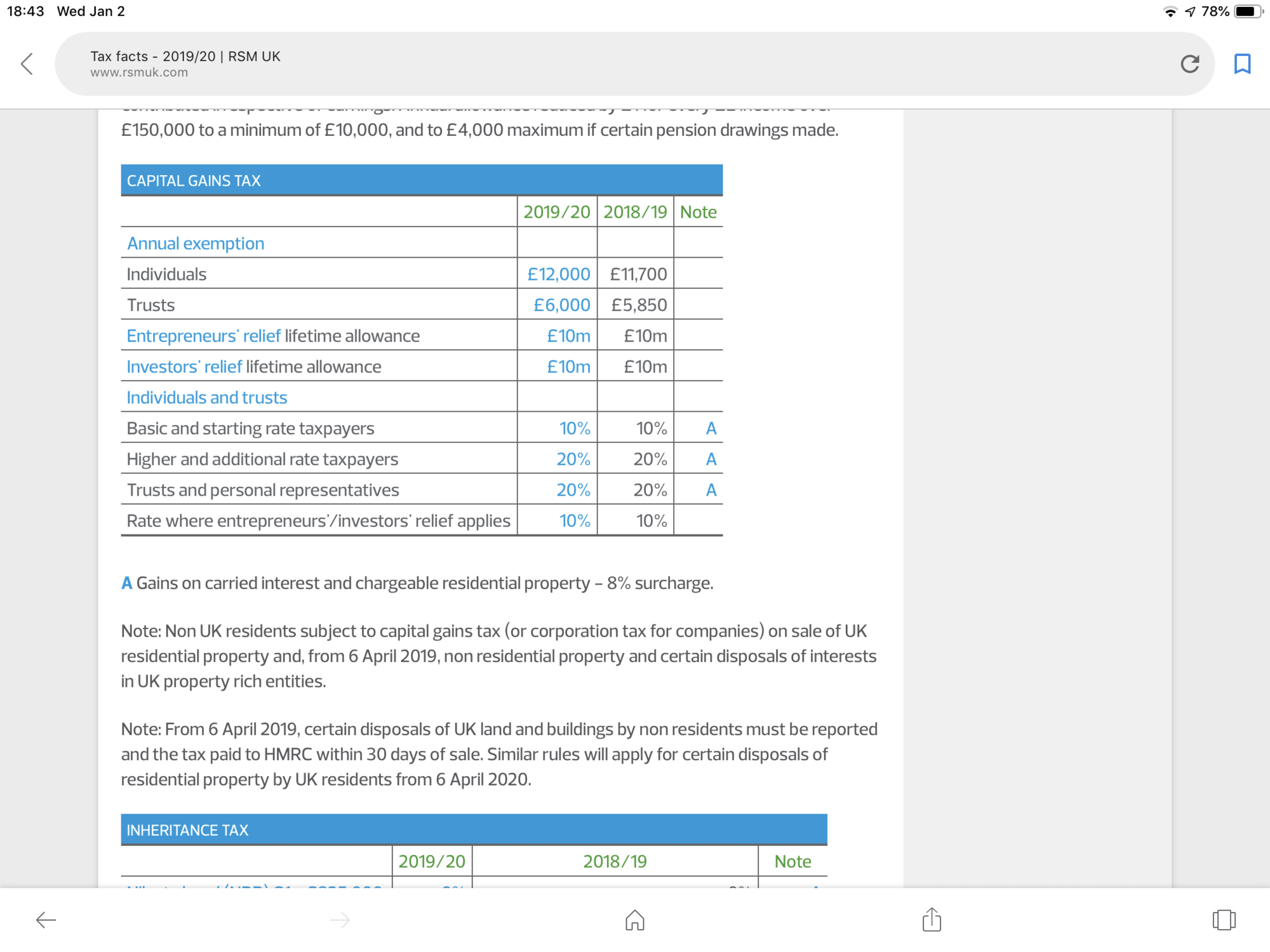

You will also want to factor in the fact that there is a Capital Gains Allowance in the UK (£11,700 for the current tax year), which is the amount of "profit" you can make on your shares, property etc before you start paying tax. There is no such equivalent allowance in the US. Any profit over and above the allowance amount is then treated as "taxable income" and taxed the same as other, earned income like salary. So the rate you would pay on "profit" is not always "higher" in the UK compared to the US, it depends on what your other income is for the relevant tax year. I understand this is not always the case in the US.

Tax Treatment of this area is so different between the US and the UK that it really is very difficult to give a simplistic answer. You need to work out some scenarios including the impact of being in the UK and owning US shares - eg if you are a US citizen you'll be continuing to file US tax returns anyway, but if you are not then you may want to avoid situations which make you liable to file US returns from the UK.

Tax Treatment of this area is so different between the US and the UK that it really is very difficult to give a simplistic answer. You need to work out some scenarios including the impact of being in the UK and owning US shares - eg if you are a US citizen you'll be continuing to file US tax returns anyway, but if you are not then you may want to avoid situations which make you liable to file US returns from the UK.

#4

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

You will also want to factor in the fact that there is a Capital Gains Allowance in the UK (£11,700 for the current tax year), which is the amount of "profit" you can make on your shares, property etc before you start paying tax. There is no such equivalent allowance in the US. Any profit over and above the allowance amount is then treated as "taxable income" and taxed the same as other, earned income like salary. So the rate you would pay on "profit" is not always "higher" in the UK compared to the US, it depends on what your other income is for the relevant tax year. I understand this is not always the case in the US.

Tax Treatment of this area is so different between the US and the UK that it really is very difficult to give a simplistic answer. You need to work out some scenarios including the impact of being in the UK and owning US shares - eg if you are a US citizen you'll be continuing to file US tax returns anyway, but if you are not then you may want to avoid situations which make you liable to file US returns from the UK.

Tax Treatment of this area is so different between the US and the UK that it really is very difficult to give a simplistic answer. You need to work out some scenarios including the impact of being in the UK and owning US shares - eg if you are a US citizen you'll be continuing to file US tax returns anyway, but if you are not then you may want to avoid situations which make you liable to file US returns from the UK.

#7

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

No worries.

something else that may be of interest to the OP is something I did with our taxable mutual fund before moving back to the UK. I converted it to its equivalent ETF all equity fund that is HMRC reporting and put it in my wife’s name as her income is much lower than mine. The dividends it pays out have the first £2,000 tax free then taxed at 7.5% for basic rate tax payers and 32.5% for higher tax rate payers.

something else that may be of interest to the OP is something I did with our taxable mutual fund before moving back to the UK. I converted it to its equivalent ETF all equity fund that is HMRC reporting and put it in my wife’s name as her income is much lower than mine. The dividends it pays out have the first £2,000 tax free then taxed at 7.5% for basic rate tax payers and 32.5% for higher tax rate payers.