Women and Pensions plus government gateway

#16

National Insurance paid over 30 years ago ... any use?

Edit To Add:

Regarding your original comment:

...

So I signed up with the government gate way, got the required ID and then you are taken to another page where you are to provided 2 out of 3 items. A valid UK passport #, Credit reference questions For example, the year you took out a credit card or phone contract or NI drivers license. Obviously I could only answer one question as we haven't resided in the UK for more than 20 yrs! I did try my old postcode which came up with my old address but it came up with we cannot confirm your address....

So I signed up with the government gate way, got the required ID and then you are taken to another page where you are to provided 2 out of 3 items. A valid UK passport #, Credit reference questions For example, the year you took out a credit card or phone contract or NI drivers license. Obviously I could only answer one question as we haven't resided in the UK for more than 20 yrs! I did try my old postcode which came up with my old address but it came up with we cannot confirm your address....

Last edited by Steerpike; Aug 11th 2021 at 2:39 am.

#17

Just Joined

Joined: Feb 2016

Location: Boston, MA

Posts: 28

On the subject of state pensions for widows can someone confirm that my American spouse will not be entitled to any part of my UK state pension if I die first? I am asking in the context of deciding whether to pay additional NI contributions to make up for missed years rather than put the money in a US 40! K which she would be able to access upon my death. My understanding is that the state pension terminates upon my death, and that no part is payable to my wife. Any confirmation or guidance would be appreciated. Thanks

#18

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

On the subject of state pensions for widows can someone confirm that my American spouse will not be entitled to any part of my UK state pension if I die first? I am asking in the context of deciding whether to pay additional NI contributions to make up for missed years rather than put the money in a US 40! K which she would be able to access upon my death. My understanding is that the state pension terminates upon my death, and that no part is payable to my wife. Any confirmation or guidance would be appreciated. Thanks

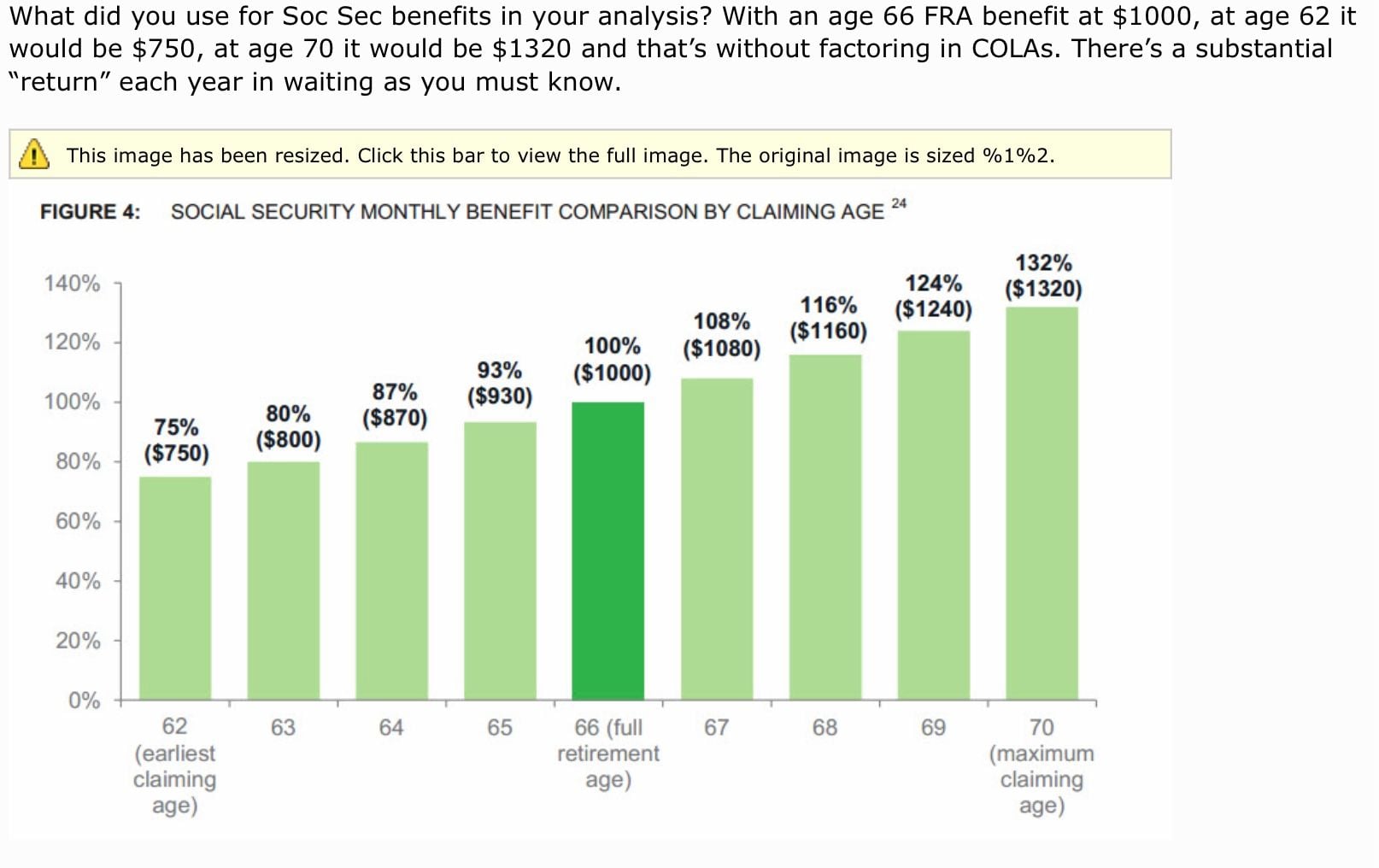

My plan to mitigate that is to delay taking my US SS until age 70. My SS is more than double than that of my wife and delaying until age 70 makes a very big difference. Actuarially you get the same total amount if you take SS at 62 or 70 but the monthly payments are much higher the later you take it. When I die her SS will be bumped up to the value of my SS.

Before I stopped working I also did not pay NI voluntary contributions but put the money into our 401ks instead. I was very fortunate to be able to retire at age 55, as did my wife, and we were again fortunate enough to be able to afford voluntary contributions to bump up our OAPs.

The SS website has a good tool to allow you to see what your SS will be at various ages including the option to say “no payments into it after age x”. I attach an example from a retirement website I frequent.

Last edited by durham_lad; Sep 6th 2021 at 8:05 am.

#19

That is correct.

My plan to mitigate that is to delay taking my US SS until age 70. My SS is more than double than that of my wife and delaying until age 70 makes a very big difference. Actuarially you get the same total amount if you take SS at 62 or 70 but the monthly payments are much higher the later you take it. When I die her SS will be bumped up to the value of my SS.

My plan to mitigate that is to delay taking my US SS until age 70. My SS is more than double than that of my wife and delaying until age 70 makes a very big difference. Actuarially you get the same total amount if you take SS at 62 or 70 but the monthly payments are much higher the later you take it. When I die her SS will be bumped up to the value of my SS.

I've been an expat for over 30 years and I had no difficulty signing up to the UK Government gateway, but with these systems there are sometimes errors in some data fields so that a small set of people have issues. For example I was never able to sign into the state Obamacare site, I think it might have been a problem with me not having a middle name.

You can now make NICs via electronic bank transfer which makes things very easy, but you do need tp verify online as HMRC didn't send me a paper receipt last year. I'm paying Class 2 and have 36 years now. I only need 35 for full state pension, but they are so inexpensive that I keep paying just in case the Government move the goal posts again - who knows what will happen to NICs with the social care legislation that is being proposed.

Last edited by nun; Sep 6th 2021 at 1:30 pm.

#20

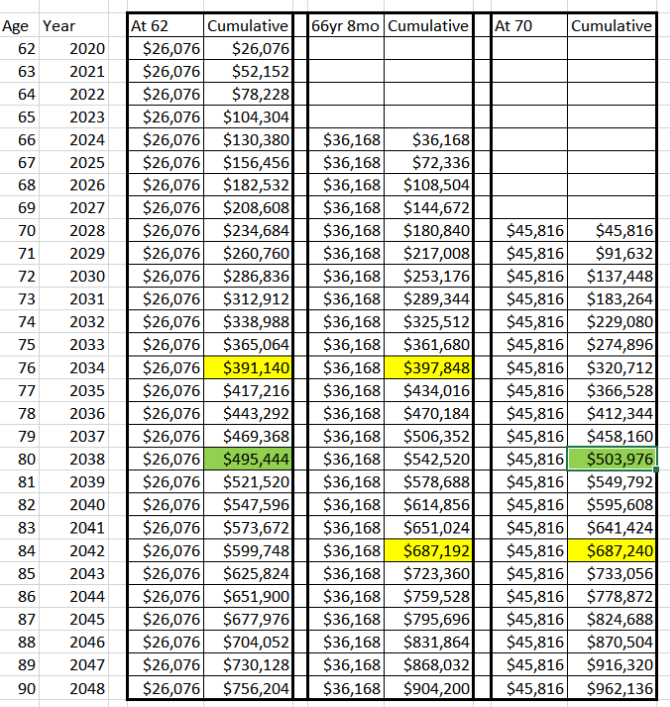

You guys seem to be agreeing that 80 is the break even point, and I can now see that is the case when comparing 62 vs 70. But then I compared 62 and 66.66, and then 66.66 and 70, and get different break-even points.

For the latter (66.66 vs 70), my calcs came out at 84-ish. Let me share my calcs / method in case I'm wrong. Would appreciate any input.

First, I looked up what my monthly SS payment would be at 62 (early), 66 2/3rds (normal), 70 (late).

They came out at

$2,173/mo, $3,014/mo, and $3,818/mo respectively. That's $26,076, $36,168, and $45,816 respectively per year. (these are calcs I did in late 2019; I haven't updated them since).

This is a spreadsheet I built using the above figures. Three sets of columns, one each for the 62, 66.66, and 70 figures. The 'cumulative' column simply adds in the annual payment from the column to its left.

The yellow highlights compare the two adjacent column sets (62 and 66.66, and 66.66 and 70). In the first comparison (62 vs 66.66), the break even point is roughly age 76, but in the second comparison (66.66 vs 70), the break even point is age 84. Focusing on this latter case, at age 84 I will have received $687k in both scenarios. After that point, I'm much better off with the '70' scenario, obviously - by age 90 I've received a total of $962k by waiting until 70, compared to $904k by starting at 66.66.

The green highlight compares first and last column sets (62 and 70) and there I do see the break even point at 80 - in both cases, I will have received a total of about $500k at age 80.

Is my approach/methodology correct? I think most people compare 66.66 vs 70, but I could be wrong.

Last edited by Steerpike; Sep 9th 2021 at 9:08 pm.

#21

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

I don’t really know what the exact crossover point is for an individual as I’m choosing 70 to take my SS as insurance for my younger fitter wife who will probably outlive me.

#22

The decision as to when to take your SS is way more complex than the cumulative return at the age of death, and since none of us know when we will die (no matter how healthy we are) that is a crap shoot anyway,

You need to take into account your spouses SS situation, the impact that your SS will have on taxes, medicare rates, and WEP on a UK pension if you have one. All of this is a moot point if you need your SS, but if you don’t then you also have to consider the opportunity cost of being able to invest your SS proceeds if you take it early or the opportunity cost of liquidating investments to provide income if you take it later. There are many, many scenario’s and multiple what if’s in doing such an analysis. Enough to explode your brain if you do it thoroughly, and still have no definitive conclusion because there are pros and cons for whatever strategy you decide upon.

Unless you need your SS, or your life would be more fun with it, or you are concerned about using up your assets and leaving less to you heirs if you pass sooner than expected, or you have a spouse that has a significantly larger SS amount than you have then

I think that delaying as long as possible will work for most of us. Ultimately, I suspect that we will reach 70 and we will be forced into taking it, or there will come a day when it will be clear that life will be easier with it than without.

Trying to maximize every last dollar that you collect from SS is impossible. My advice is take the money when you can enjoy it and still be comfortable.

You need to take into account your spouses SS situation, the impact that your SS will have on taxes, medicare rates, and WEP on a UK pension if you have one. All of this is a moot point if you need your SS, but if you don’t then you also have to consider the opportunity cost of being able to invest your SS proceeds if you take it early or the opportunity cost of liquidating investments to provide income if you take it later. There are many, many scenario’s and multiple what if’s in doing such an analysis. Enough to explode your brain if you do it thoroughly, and still have no definitive conclusion because there are pros and cons for whatever strategy you decide upon.

Unless you need your SS, or your life would be more fun with it, or you are concerned about using up your assets and leaving less to you heirs if you pass sooner than expected, or you have a spouse that has a significantly larger SS amount than you have then

I think that delaying as long as possible will work for most of us. Ultimately, I suspect that we will reach 70 and we will be forced into taking it, or there will come a day when it will be clear that life will be easier with it than without.

Trying to maximize every last dollar that you collect from SS is impossible. My advice is take the money when you can enjoy it and still be comfortable.

#23

Just Joined

Joined: Jun 2016

Posts: 23

What happens if you die before age 70 and you haven't taken your SS? Does your wife still get the amount you were going to get?

#24

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

https://www.aarp.org/retirement/soci...ouse-dies.html

The survivor benefit is generally calculated on the benefit your late spouse was receiving from Social Security at the time of death (or was entitled to receive, based on age and earnings history, if he or she had not yet claimed benefits).

#25

Just Joined

Joined: Jun 2016

Posts: 23

If I die before age 70 then she will receive the sum I was entitled to at time of death.

https://www.aarp.org/retirement/soci...ouse-dies.html

https://www.aarp.org/retirement/soci...ouse-dies.html

#26

The decision as to when to take your SS is way more complex than the cumulative return at the age of death, and since none of us know when we will die (no matter how healthy we are) that is a crap shoot anyway,

You need to take into account your spouses SS situation, the impact that your SS will have on taxes, medicare rates, and WEP on a UK pension if you have one. All of this is a moot point if you need your SS, but if you don’t then you also have to consider the opportunity cost of being able to invest your SS proceeds if you take it early or the opportunity cost of liquidating investments to provide income if you take it later. There are many, many scenario’s and multiple what if’s in doing such an analysis. Enough to explode your brain if you do it thoroughly, and still have no definitive conclusion because there are pros and cons for whatever strategy you decide upon.

Unless you need your SS, or your life would be more fun with it, or you are concerned about using up your assets and leaving less to you heirs if you pass sooner than expected, or you have a spouse that has a significantly larger SS amount than you have then

I think that delaying as long as possible will work for most of us. Ultimately, I suspect that we will reach 70 and we will be forced into taking it, or there will come a day when it will be clear that life will be easier with it than without.

Trying to maximize every last dollar that you collect from SS is impossible. My advice is take the money when you can enjoy it and still be comfortable.

You need to take into account your spouses SS situation, the impact that your SS will have on taxes, medicare rates, and WEP on a UK pension if you have one. All of this is a moot point if you need your SS, but if you don’t then you also have to consider the opportunity cost of being able to invest your SS proceeds if you take it early or the opportunity cost of liquidating investments to provide income if you take it later. There are many, many scenario’s and multiple what if’s in doing such an analysis. Enough to explode your brain if you do it thoroughly, and still have no definitive conclusion because there are pros and cons for whatever strategy you decide upon.

Unless you need your SS, or your life would be more fun with it, or you are concerned about using up your assets and leaving less to you heirs if you pass sooner than expected, or you have a spouse that has a significantly larger SS amount than you have then

I think that delaying as long as possible will work for most of us. Ultimately, I suspect that we will reach 70 and we will be forced into taking it, or there will come a day when it will be clear that life will be easier with it than without.

Trying to maximize every last dollar that you collect from SS is impossible. My advice is take the money when you can enjoy it and still be comfortable.

One extra factor to consider is RMDs - Required Minimum Distributions on IRAs. If you don't start using up your own IRA you can get hit with RMDs at age 72. My g/f ended up taking SS at 67 because her own IRA money is making such ridiculous returns at the moment, she would rather keep that money invested and use the SS money. However - her IRA is very healthy, and she's going to face big problems with 'RMD's when she hits 72, and not using her IRA now is going to exacerbate that.

These are, of course, 'good problems to have' and I never want to lose sight of that!