US savings accounts

#1

I am sure this has been done to death, but i can't find anything on a search. Now you can get some reasonable interest rates on savings (2.25%), i am looking at some online savings accounts here in the US. I got half way through applying for an Ally bank and it asked me if I can certify i am exempt from FATCA reporting. I am a permanent resident here but have accounts back in the UK (all duly reported) so i don't think i can agree to this. I don't know if it is usual to ask this, anyone know of any banks that don't ask this?

#2

BE Forum Addict

Joined: Aug 2013

Location: Athens GA

Posts: 2,133

I am sure this has been done to death, but i can't find anything on a search. Now you can get some reasonable interest rates on savings (2.25%), i am looking at some online savings accounts here in the US. I got half way through applying for an Ally bank and it asked me if I can certify i am exempt from FATCA reporting. I am a permanent resident here but have accounts back in the UK (all duly reported) so i don't think i can agree to this. I don't know if it is usual to ask this, anyone know of any banks that don't ask this?

This is a good site for seeing what savings and CD accounts are available: https://www.depositaccounts.com/

#3

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,854

I am sure this has been done to death, but i can't find anything on a search. Now you can get some reasonable interest rates on savings (2.25%), i am looking at some online savings accounts here in the US. I got half way through applying for an Ally bank and it asked me if I can certify i am exempt from FATCA reporting. I am a permanent resident here but have accounts back in the UK (all duly reported) so i don't think i can agree to this. I don't know if it is usual to ask this, anyone know of any banks that don't ask this?

I had no issues opening an account with TD Bank N.A. And they were offering 2.5% for 12 months on new money.

#4

@MidAtlantic - thanks for the link - yes, that has the Ally bank account i was trying to open. I did try phoning in, but the person on the other end was useless

@tht - yes, FATCA. I don't know why they would care if i had to report my foreign accounts under FATCA or not, i don't see how it impacts them. It looks like they are asking me to complete their online equivalent of a W-9. Can get 2.25% with no minimum and instant access with some of these accounts

@tht - yes, FATCA. I don't know why they would care if i had to report my foreign accounts under FATCA or not, i don't see how it impacts them. It looks like they are asking me to complete their online equivalent of a W-9. Can get 2.25% with no minimum and instant access with some of these accounts

#5

BE Forum Addict

Joined: Apr 2011

Location: The Shire

Posts: 1,117

There was another individual on BE in 2017 attempting to open an account with Capital One 360 who ran up against the same problem with a FATCA question.

US banks and FATCA reporting

US banks and FATCA reporting

#6

BE Enthusiast

Joined: Feb 2015

Location: New Jersey, USA

Posts: 565

The question relates to the specific institution that you're opening an account with, not if you have an overall FATCA reporting requirement as an individual. Ally is a US bank so there is no FATCA requirement and you can safely answer no.

Incidentally CIT Bank has a savings account that pays 2.45% if you put $25k in there or pay in $100 a month so you might be better off with that.

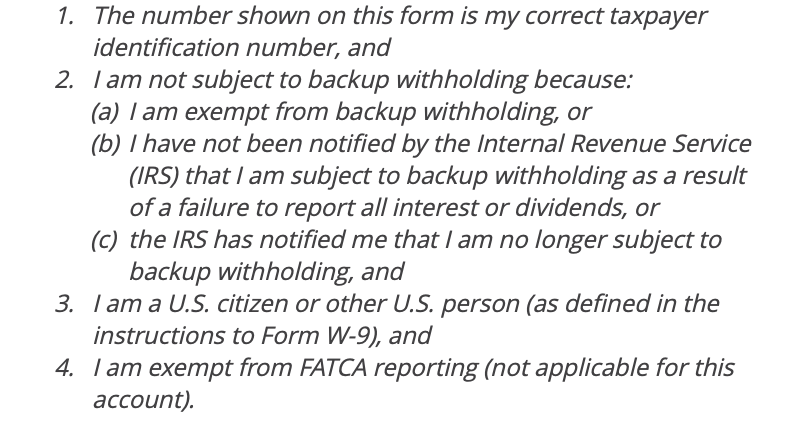

Banks should make it clearer - the wording comes from a W-9 and isn't relevant most of the time. I just opened a Chase YouInvest account and it specifically says 'not applicable for this account':

Incidentally CIT Bank has a savings account that pays 2.45% if you put $25k in there or pay in $100 a month so you might be better off with that.

Banks should make it clearer - the wording comes from a W-9 and isn't relevant most of the time. I just opened a Chase YouInvest account and it specifically says 'not applicable for this account':

#7

Olly - thanks, that makes sense and is exactly the question i put to the person on the end of the phone. Took them ages to answer (including a call to 'back office' who replied something about withholding) but they were unable to clarify. I might try again later and hope to speak to someone a bit more clued up. I saw the CIT bank offer, but the 2.45% applies ONLY to the $100 per month, or you need to keep a min $25K in there.

#8

BE Enthusiast

Joined: Feb 2015

Location: New Jersey, USA

Posts: 565

Olly - thanks, that makes sense and is exactly the question i put to the person on the end of the phone. Took them ages to answer (including a call to 'back office' who replied something about withholding) but they were unable to clarify. I might try again later and hope to speak to someone a bit more clued up. I saw the CIT bank offer, but the 2.45% applies ONLY to the $100 per month, or you need to keep a min $25K in there.

I opened an Ally account just before Christmas to take advantage of a promo they were running and to be honest I wasn't all that impressed, they don't seem to trust you to do one day outbound transfers of your own money so it takes three business days to move money out. Now they've paid the promo cash I've moved all my money out and closed the account down.

With CIT Bank if you transfer money out via ACH it appears in the destination account the next business day.

Last edited by Olly_; Feb 13th 2019 at 8:32 pm.

#9

Olly - ok, have just re-read the Ts and Cs and looks like you are correct. Thanks for pointing that out

#10

In the end i went for a Marcus account. Very easy to set up and it phrased the relevant question correctly. Into the arms of the vampire, face-eating squid i go

#11

FWIW, if you have enough cash that the paltry interest rates available would make a significant difference then you might like to consider a monthly income brokerage account with say, Vanguard, Fidelity etc...Get your money working for you.

For example

https://investor.vanguard.com/mutual...aged-payout/#/

Couple of hundred dollars may be handy come Christmas

YMMV

For example

https://investor.vanguard.com/mutual...aged-payout/#/

Couple of hundred dollars may be handy come Christmas

YMMV

Last edited by Hotscot; Feb 20th 2019 at 5:32 pm.

#12

FWIW, if you have enough cash that the paltry interest rates available would make a significant difference then you might like to consider a monthly income brokerage account with say, Vanguard, Fidelity etc...Get your money working for you.

For example

https://investor.vanguard.com/mutual...aged-payout/#/

Couple of hundred dollars may be handy come Christmas

YMMV

For example

https://investor.vanguard.com/mutual...aged-payout/#/

Couple of hundred dollars may be handy come Christmas

YMMV

#13

That's why the casual FWIW and YMMV.

But generally the biggies like Vanguard and Fidelity are relatively secure.

I know where my assets are...hardly a real dollar to my name.

But generally the biggies like Vanguard and Fidelity are relatively secure.

I know where my assets are...hardly a real dollar to my name.

Last edited by Hotscot; Feb 20th 2019 at 10:12 pm.

#14

"FDIC = Federal Deposit Insurance Corporation", with the key word being "deposit", meaning "money, US$, deposited in a bank account. Other investment accounts are not covered, ever.

Granted, there are some brokerage accounts with a linked bank account, and you can move money back and forth between a US$ deposit (which probably is FDIC insured, because banks in the US are required to be FDIC insured for consumer deposits up to the current limit, which is $250,000 per person, per bank) and brokered investments - primarily, bonds, equities and mutual funds, which most certainly are not FDIC insured. But under no circumstances will you find a regular, run-of-the-mill brokerage account that is covered by FDIC insurance.

Last edited by Pulaski; Feb 20th 2019 at 10:21 pm.

#15

Agreed, me neither - the primary beneficiary of a bank deposit is the bank. I prefer my money to be actually working for me, not lying around in a deposit account while moonlighting for the bl00dy bank!