Keeping Roth and Investment Accounts

#1

Forum Regular

Thread Starter

Joined: Jun 2013

Location: SLC, UT

Posts: 199

If I move back to the UK as a US citizen I think I can keep any existing Roth and investment accounts as long as you report them via FBAR etc, with no extra tax payable if your total income is below the IRS's "Excludable amount" for the reporting tax year. You may not be able to contribute to them anymore if you are not domicile in the US for tax purposes.

Can anyone clarify or share their knowledge on this one?

Can anyone clarify or share their knowledge on this one?

#2

You may want to read this thread Are Fidelity closing non-resident accounts. Technically you are correct, but occasionally there are issues.

#3

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,126

I kept my Roth and investment accounts when I moved back to the U.K. I am a dual US/U.K. citizen. No need to report them on FBAR as they are not foreign accounts. Income from the investments is taxable in both countries and distributions from the Roth are tax free in both countries. Foreign tax credits are used to eliminate double taxation.

I can’t contribute to the Roth because I don’t have any earned income in the US, just pensions.

I can’t contribute to the Roth because I don’t have any earned income in the US, just pensions.

#4

I kept my Roth and investment accounts when I moved back to the U.K. I am a dual US/U.K. citizen. No need to report them on FBAR as they are not foreign accounts. Income from the investments is taxable in both countries and distributions from the Roth are tax free in both countries. Foreign tax credits are used to eliminate double taxation.

I can’t contribute to the Roth because I don’t have any earned income in the US, just pensions.

I can’t contribute to the Roth because I don’t have any earned income in the US, just pensions.

#5

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,126

My wife’s IRAs and investments were with Fidelity and mine were with Vanguard so before we moved back she opened an account with Vanguard and we moved all her Fidelity funds to Vanguard. We also implemented “agent authorization” over each other’s accounts so the accounts are very easily managed, even from the UK.

#6

Forum Regular

Thread Starter

Joined: Jun 2013

Location: SLC, UT

Posts: 199

Got it mrken30 and Durham lad - of course no FBAR, what was I thinking! As you say with the treaties I guess you'd only end up paying tax in 1 country.

I'd also have no earned income on returning to the UK so the accounts would just be there to fund stuff/retirement.

I'd also have no earned income on returning to the UK so the accounts would just be there to fund stuff/retirement.

#7

Forum Regular

Thread Starter

Joined: Jun 2013

Location: SLC, UT

Posts: 199

#8

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,126

it has been 5 years since we switched, they may have changed their policy since then. We were very happy with them for many years so if you like them then I’d check with them well ahead of moving overseas.

#9

My wife’s IRAs and investments were with Fidelity and mine were with Vanguard so before we moved back she opened an account with Vanguard and we moved all her Fidelity funds to Vanguard. We also implemented “agent authorization” over each other’s accounts so the accounts are very easily managed, even from the UK.

I am thinking maybe that's a smart thing to do as it may not raise the same flags. There are also options like Blooom that manage your account to reduce fees. Blooom is quite inexpensive, $95 a year. Thanks for this.

#10

Forum Regular

Thread Starter

Joined: Jun 2013

Location: SLC, UT

Posts: 199

Thanks for all the interesting info - Bloom looks intriguing. I'm currently in the US and probably wont return for at least a year or so.

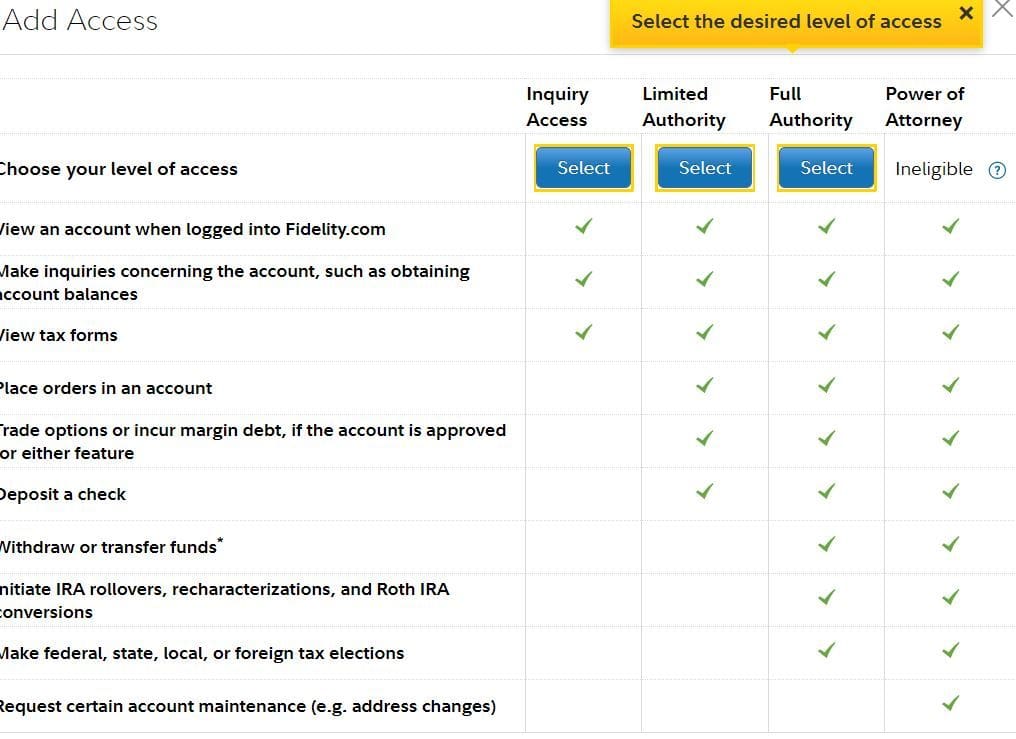

If anyone has used and "authorizing agent" how does it work? Is it like giving them a form of power of attorney to agreed/restricted parameters over your investment account/IRA/Roth?

If anyone has used and "authorizing agent" how does it work? Is it like giving them a form of power of attorney to agreed/restricted parameters over your investment account/IRA/Roth?

#11

Thanks for all the interesting info - Bloom looks intriguing. I'm currently in the US and probably wont return for at least a year or so.

If anyone has used and "authorizing agent" how does it work? Is it like giving them a form of power of attorney to agreed/restricted parameters over your investment account/IRA/Roth?

If anyone has used and "authorizing agent" how does it work? Is it like giving them a form of power of attorney to agreed/restricted parameters over your investment account/IRA/Roth?

#12

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,126

Do you have a US based agent authorized to manage your accounts?

I am thinking maybe that's a smart thing to do as it may not raise the same flags. There are also options like Blooom that manage your account to reduce fees. Blooom is quite inexpensive, $95 a year. Thanks for this.

I am thinking maybe that's a smart thing to do as it may not raise the same flags. There are also options like Blooom that manage your account to reduce fees. Blooom is quite inexpensive, $95 a year. Thanks for this.

#13

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,126

I think it works as you describe. When my wife and I set one another up as authorized agents over each other’s accounts then we were able to specify the levels of authority the agent would have. We gave each other complete authority over our accounts.

#14

I also have access to my wife's account so that I can legally contribute and buy/sell funds. These are my options. But I am thinking the US based agent/CPA/Financial adviser might be a good way to go. Thanks for this.