Getting a credit card, no income but has credit score.

#1

Forum Regular

Thread Starter

Joined: Jan 2016

Location: Cambridge, MA

Posts: 239

Does anyone have an experience with applying for a credit card with no income history, but does have a credit score. My wife has an SSN for 6+ yrs, according to CreditKarma has a 800+ credit score, but she has no income of her own. We would like to get her her own credit card (a little morbid, but should something happen to me, then don't want her to be left in the position of having no credit card and no ability to get one), at present she is a second card holder on mine.

I don't want to get a negative report on her credit report by applying for a card if the chance of getting one is zero, because of no income history, and hence would we be better off just getting a secured credit card and building up a history for 12+ months.

Anyone have experience in this area?

I don't want to get a negative report on her credit report by applying for a card if the chance of getting one is zero, because of no income history, and hence would we be better off just getting a secured credit card and building up a history for 12+ months.

Anyone have experience in this area?

#2

#4

#6

Her credit score is based on your credit score since you are the primary holder of the credit card and she is a secondary holder. This is how we built up my husband's credit score. I put him on my card and within a year he had an 800+ score also.

She needs to use your income, as others have said, to get a credit card. But then it isn't really a credit card based on her alone but based again on you. Can't she find employment, even part time, to have a small income that will help her show financial credibility?

She needs to use your income, as others have said, to get a credit card. But then it isn't really a credit card based on her alone but based again on you. Can't she find employment, even part time, to have a small income that will help her show financial credibility?

#7

Forum Regular

Thread Starter

Joined: Jan 2016

Location: Cambridge, MA

Posts: 239

#8

BE Enthusiast

Joined: Feb 2017

Location: Newnan, GA

Posts: 802

someone provided a wallethub link, cerditkarma, as you listed, is pretty good as well. They should filter out those she'd be unlikely to get. My wife got a Wells Fargo one (we assume only one :-) )

#9

Forum Regular

Thread Starter

Joined: Jan 2016

Location: Cambridge, MA

Posts: 239

Thanks for the help on this. Thought I would update the thread in case anyone finds it in the future.

We changed the account my salary is paid into to a joint account, because we read that in order to claim spouse income on the credit application, then they need to have access to it. Possible this was not necessary but if asked we were covered.

SHe applied for a card from Chase, used my salary and for the question of “primary source of income” entered other. She was instantly approved with a respectable credit limit.

So the whole thing turned out easy and my fear of getting it denied and a negative report on her credit was not a concern.

We changed the account my salary is paid into to a joint account, because we read that in order to claim spouse income on the credit application, then they need to have access to it. Possible this was not necessary but if asked we were covered.

SHe applied for a card from Chase, used my salary and for the question of “primary source of income” entered other. She was instantly approved with a respectable credit limit.

So the whole thing turned out easy and my fear of getting it denied and a negative report on her credit was not a concern.

#10

Just Joined

Joined: Jan 2019

Location: Maryland, USA

Posts: 4

I see you've already applied, but my suggestion would have been to either add her as an authorized user to your cards or open a secured line card, which requires a deposit to establish the credit line.

#11

BE Enthusiast

Joined: Feb 2015

Location: New Jersey, USA

Posts: 565

I worked in the credit card industry and this is NOT correct. Lots of people do it, but you're not technically supposed to use anyone else's income. Only the holder of the credit card is responsible for paying for it, regardless of whether anyone else is authorized to use the card or could pay for the bills, and only the holder of the card's income should be considered.

I see you've already applied, but my suggestion would have been to either add her as an authorized user to your cards or open a secured line card, which requires a deposit to establish the credit line.

I see you've already applied, but my suggestion would have been to either add her as an authorized user to your cards or open a secured line card, which requires a deposit to establish the credit line.

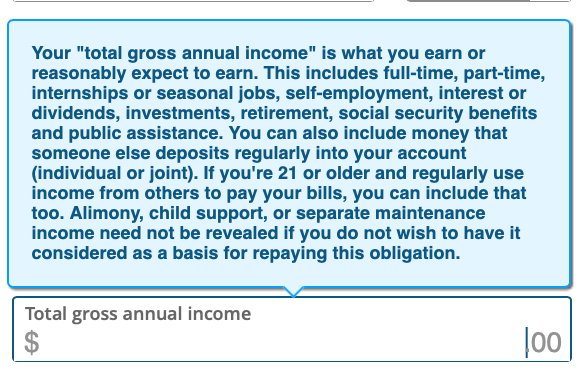

Just two examples from Chase and American Express... note the wording. "If you're 21 or older and regularly use income from others to pay your bills, you can include that too".

#12

I worked in the credit card industry and this is NOT correct. Lots of people do it, but you're not technically supposed to use anyone else's income. Only the holder of the credit card is responsible for paying for it, regardless of whether anyone else is authorized to use the card or could pay for the bills, and only the holder of the card's income should be considered.

I see you've already applied, but my suggestion would have been to either add her as an authorized user to your cards or open a secured line card, which requires a deposit to establish the credit line.

I see you've already applied, but my suggestion would have been to either add her as an authorized user to your cards or open a secured line card, which requires a deposit to establish the credit line.

This blog post explains why you can use your spouse income and also give links to the relevant legal bits

https://lendedu.com/blog/when-applyi...spouse-income/