GBP bank account for US-based people - HSBC Premier Checking?

#31

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Ah, OK - so 'tdrinker's branch closings were UK based, while 'karenkaren1's move to Citizens was a US issue; no direct link. Got it. So as a UK HSBC account holder I should remain unaffected, even if they close my branch. Very good!

So Wise are willing to do what most of the other banks are not willing to do - allow non-UK residents to open an account to house GBP. How come Wise are open to this while every other bank is not? Just curious!

So Wise are willing to do what most of the other banks are not willing to do - allow non-UK residents to open an account to house GBP. How come Wise are open to this while every other bank is not? Just curious!

their business is international transfers… so it kind of depends on them allowing international… while banks can send transfers by SWIFT to a foreign bank..

#32

BE Enthusiast

Joined: Dec 2008

Posts: 525

Many, probably all, UK banks / building societies are or have closed some of their branches, but the accounts remain open. Also, people frequently move away from their home branch.

"Wise isn't a bank. We're an e-money institution", according to their website.

"Wise isn't a bank. We're an e-money institution", according to their website.

#33

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

Ah, OK - so 'tdrinker's branch closings were UK based, while 'karenkaren1's move to Citizens was a US issue; no direct link. Got it. So as a UK HSBC account holder I should remain unaffected, even if they close my branch. Very good!

So Wise are willing to do what most of the other banks are not willing to do - allow non-UK residents to open an account to house GBP. How come Wise are open to this while every other bank is not? Just curious!

So Wise are willing to do what most of the other banks are not willing to do - allow non-UK residents to open an account to house GBP. How come Wise are open to this while every other bank is not? Just curious!

#34

So I could hold circa 5k GBP for convenience, as long as I am willing to risk the 'insurance' aspect? I've reduced my holdings already to under $10k to avoid the various US reporting issues; but if the amount were over $10k, would I need to report such holdings as a foreign account?

#35

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

So I could hold circa 5k GBP for convenience, as long as I am willing to risk the 'insurance' aspect? I've reduced my holdings already to under $10k to avoid the various US reporting issues; but if the amount were over $10k, would I need to report such holdings as a foreign account?

Maybe some other members here have an idea on this?

To be safe you could assume that GBP accounts use the Wise company address in Britain.

https://wise.com/help/articles/29741...group-entities

6th Floor Tea Building, 56 Shoreditch High Street, London, United Kingdom, E1 6JJ

Last edited by durham_lad; Jan 3rd 2023 at 8:17 am.

#36

BE Enthusiast

Joined: Dec 2008

Posts: 525

The UK govt. guarantees bank deposits of up to £85k. It's a bit more complicated, as it guarantees £85k deposited per banking licence and some banks share a licence so if you have multiple bank accounts to protect your funds, you should investigate whether the banks share a licence. Beyond the deposit protection, the Govt. would not want a bank to fail so might very well step in and support a failing bank.

https://www.bankofengland.co.uk/prud...nsation-scheme

EU has a similar deposit protection scheme protecting up to EUR 100k.

https://finance.ec.europa.eu/banking...tee-schemes_en

Wise isn't a bank, so its deposits aren't guaranteed by the Govt. in the event Wise failed. This doesn't mean you would lose some or all of your money if this happened, but you might.

https://www.bankofengland.co.uk/prud...nsation-scheme

EU has a similar deposit protection scheme protecting up to EUR 100k.

https://finance.ec.europa.eu/banking...tee-schemes_en

Wise isn't a bank, so its deposits aren't guaranteed by the Govt. in the event Wise failed. This doesn't mean you would lose some or all of your money if this happened, but you might.

#37

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

Wise “safeguards” your money as explained below so I think it is pretty safe really.

https://wise.com/help/articles/29498...y-wise-account

https://wise.com/help/articles/29498...y-wise-account

Safeguarding means that, by law, we have to keep all of your money in accounts that are completely separate from the ones we use to run our business. So your money is backed by assets that we hold in separate accounts. These funds are called ‘safeguarded funds’.

Where is my money held?

In keeping with FCA regulations, Wise uses two approaches to safeguard your funds. We deposit your funds at banking institutions and invest them in government backed liquid assets, primarily government bonds.

Where is my money held?

In keeping with FCA regulations, Wise uses two approaches to safeguard your funds. We deposit your funds at banking institutions and invest them in government backed liquid assets, primarily government bonds.

#38

It’s a good question that I would like to know the answer to for my daughter’s sake. I don’t hold GBP in my Wise account as I use it to receive USD from my US brokerage account IRA distributions etc. then send straight to my UK bank into GBP. However my daughter does hold GBP with them but is it a US company that happens to hold GBP or is it a “foreign financial institution “ under the definition of the FBAR rules. What is the business address?

Maybe some other members here have an idea on this?

To be safe you could assume that GBP accounts use the Wise company address in Britain.

https://wise.com/help/articles/29741...group-entities

Maybe some other members here have an idea on this?

To be safe you could assume that GBP accounts use the Wise company address in Britain.

https://wise.com/help/articles/29741...group-entities

1. So long as the regulations in the foreign country provide some kind of protection then your funds are pretty safe if Wise was to get into some kind of trouble although it might take a while to get them back.

2. USD are held by a regulated US financial institution and therefore do not need to be declared on an FBAR or Form 8938.

3. Foreign currency is held in a foreign financial institution and therefore would need to be declared on an FBAR and Form 8938.

Wise itself takes the time to explain about FATCA, FBARs and Form 8939 on its website but does not go as far as to state that a Wise account is subject to those regulations (or that it is not). That tells me they covering their liability by informing clients of those regulations, the situation (like many IRS international tax regulations) is not at all clear cut, and they don’t want to provide guidance which might be wrong because of course in the US they would be sued either way. Someone would claim damages by going to the effort of declaring the funds unnecessarily, and on the other hand others would claim damages because they did not declare them when they should have.

The FBAR and Form 8938 requirement work on the aggregate balances of all foreign accounts. If you are reporting other accounts I would include the Wise Account. Why not, it just takes a few minutes to add to the forms. If you are not reporting other accounts because you do not meet the thresholds I would think about the fact that the requirements are to report the highest balance within the year. When you transfer funds into Wise from a foreign account the balance is counted in the foreign account, when it reaches Wise the funds are counted again because they are now in a Wise account, so the amount of money transferred is doubled from the perspective of the reporting regulations meaning that if you transfer $5,000 or more in one day the you just hit the $10,000 FBAR threshold.

The situation is not black and white. Maybe you do have to report, maybe you don’t. But you don’t want to be the person that finds out you did not report when it was required. With all foreign accounts, the golden rule is declare it unless you are 100% certain it is not required.

Personally, up until now I never considered reporting my Wise account but I will now unless anyone can provide definitive information indicating it is not a foreign account.

Last edited by Glasgow Girl; Jan 3rd 2023 at 3:04 pm.

#39

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

Thanks GG, good analysis and advice as always.

#40

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Here is my understanding of the situation. Funds are held in an independent financial institution in the country of your currency. So USD are held in a US institution independent of Wise, GBP are held in a British institution independent of Wise, Swiss Franc’s are held in a Swiss financial institution independent of Wise, etc. Those funds are regulated by the appropriate foreign country. Those two facts mean that:

1. So long as the regulations in the foreign country provide some kind of protection then your funds are pretty safe if Wise was to get into some kind of trouble although it might take a while to get them back.

2. USD are held by a regulated US financial institution and therefore do not need to be declared on an FBAR or Form 8938.

3. Foreign currency is held in a foreign financial institution and therefore would need to be declared on an FBAR and Form 8938.

Wise itself takes the time to explain about FATCA, FBARs and Form 8939 on its website but does not go as far as to state that a Wise account is subject to those regulations (or that it is not). That tells me they covering their liability by informing clients of those regulations, the situation (like many IRS international tax regulations) is not at all clear cut, and they don’t want to provide guidance which might be wrong because of course in the US they would be sued either way. Someone would claim damages by going to the effort of declaring the funds unnecessarily, and on the other hand others would claim damages because they did not declare them when they should have.

The FBAR and Form 8938 requirement work on the aggregate balances of all foreign accounts. If you are reporting other accounts I would include the Wise Account. Why not, it just takes a few minutes to add to the forms. If you are not reporting other accounts because you do not meet the thresholds I would think about the fact that the requirements are to report the highest balance within the year. When you transfer funds into Wise from a foreign account the balance is counted in the foreign account, when it reaches Wise the funds are counted again because they are now in a Wise account, so the amount of money transferred is doubled from the perspective of the reporting regulations meaning that if you transfer $5,000 or more in one day the you just hit the $10,000 FBAR threshold.

The situation is not black and white. Maybe you do have to report, maybe you don’t. But you don’t want to be the person that finds out you did not report when it was required. With all foreign accounts, the golden rule is declare it unless you are 100% certain it is not required.

Personally, up until now I never considered reporting my Wise account but I will now unless anyone can provide definitive information indicating it is not a foreign account.

1. So long as the regulations in the foreign country provide some kind of protection then your funds are pretty safe if Wise was to get into some kind of trouble although it might take a while to get them back.

2. USD are held by a regulated US financial institution and therefore do not need to be declared on an FBAR or Form 8938.

3. Foreign currency is held in a foreign financial institution and therefore would need to be declared on an FBAR and Form 8938.

Wise itself takes the time to explain about FATCA, FBARs and Form 8939 on its website but does not go as far as to state that a Wise account is subject to those regulations (or that it is not). That tells me they covering their liability by informing clients of those regulations, the situation (like many IRS international tax regulations) is not at all clear cut, and they don’t want to provide guidance which might be wrong because of course in the US they would be sued either way. Someone would claim damages by going to the effort of declaring the funds unnecessarily, and on the other hand others would claim damages because they did not declare them when they should have.

The FBAR and Form 8938 requirement work on the aggregate balances of all foreign accounts. If you are reporting other accounts I would include the Wise Account. Why not, it just takes a few minutes to add to the forms. If you are not reporting other accounts because you do not meet the thresholds I would think about the fact that the requirements are to report the highest balance within the year. When you transfer funds into Wise from a foreign account the balance is counted in the foreign account, when it reaches Wise the funds are counted again because they are now in a Wise account, so the amount of money transferred is doubled from the perspective of the reporting regulations meaning that if you transfer $5,000 or more in one day the you just hit the $10,000 FBAR threshold.

The situation is not black and white. Maybe you do have to report, maybe you don’t. But you don’t want to be the person that finds out you did not report when it was required. With all foreign accounts, the golden rule is declare it unless you are 100% certain it is not required.

Personally, up until now I never considered reporting my Wise account but I will now unless anyone can provide definitive information indicating it is not a foreign account.

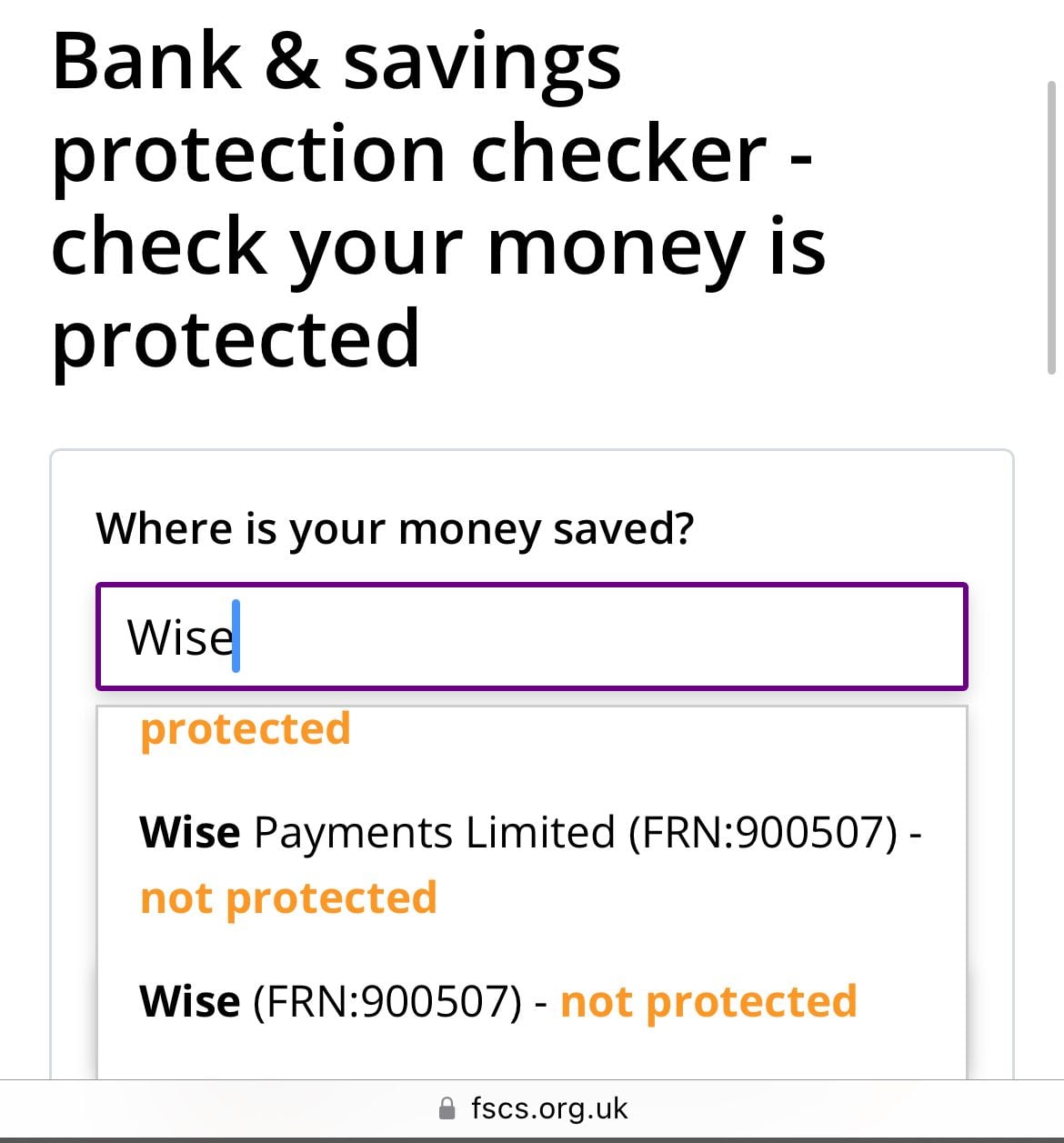

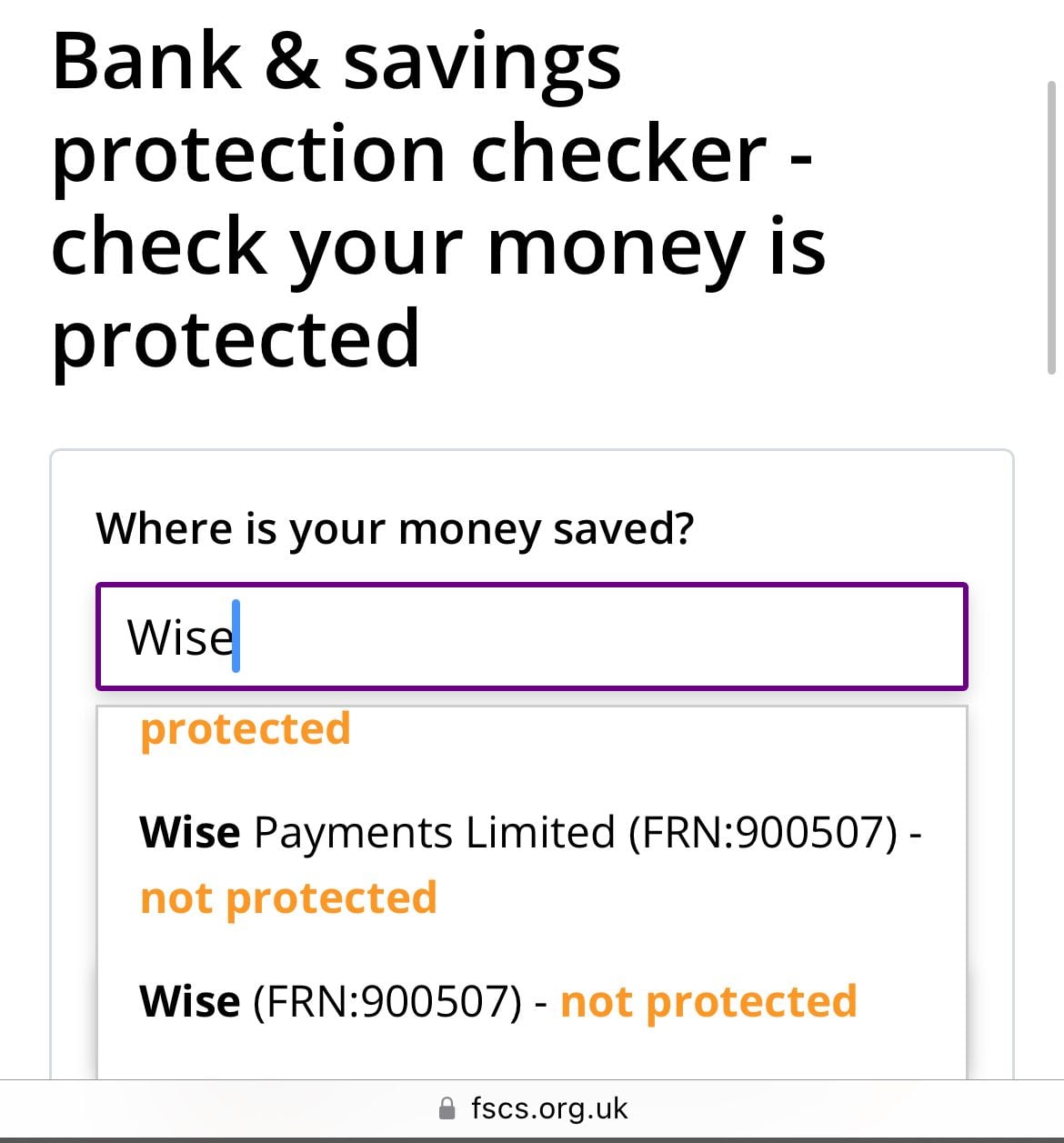

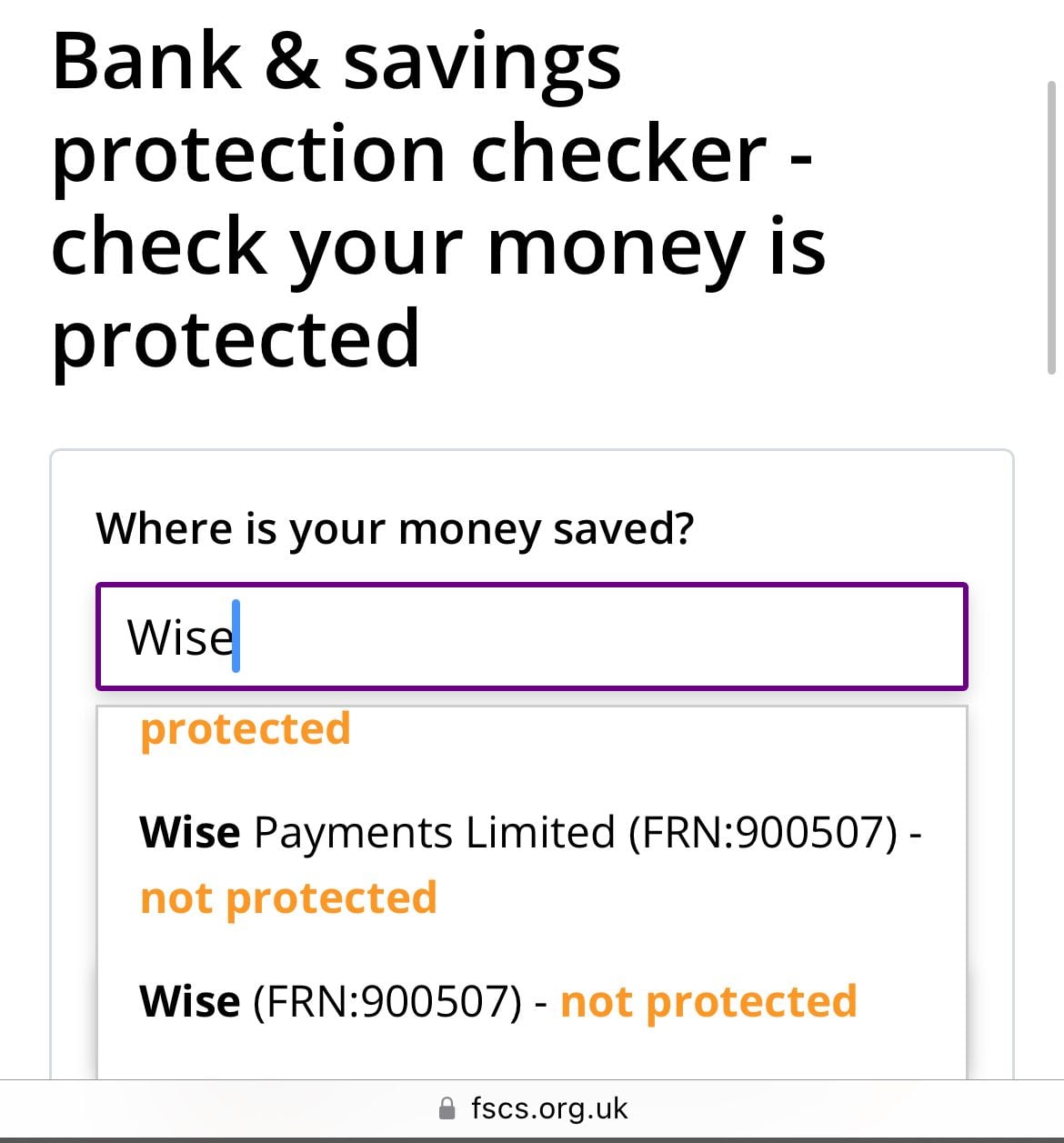

https://www.fscs.org.uk/check/check-...-is-protected/

I believe the bank protection only applies to the named individual on an account… even if Wise qualified an account with a bank would only be covered up to GBP 85k, so if they had millions of customer funds with 1 bank only a tiny % would be covered. Extra accounts does not help either, it’s per individual / joint account per covered institution.

#41

Thats not how I understand account insurance, look up Wise here:

https://www.fscs.org.uk/check/check-...-is-protected/

I believe the bank protection only applies to the named individual on an account… even if Wise qualified an account with a bank would only be covered up to GBP 85k, so if they had millions of customer funds with 1 bank only a tiny % would be covered. Extra accounts does not help either, it’s per individual / joint account per covered institution.

https://www.fscs.org.uk/check/check-...-is-protected/

I believe the bank protection only applies to the named individual on an account… even if Wise qualified an account with a bank would only be covered up to GBP 85k, so if they had millions of customer funds with 1 bank only a tiny % would be covered. Extra accounts does not help either, it’s per individual / joint account per covered institution.

#42

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

I think we are talking about two different things here. I agree with what you state about not being covered by the UK Financial Services Protection Scheme as you identified however I believe that exists because UK banks lend out most of their funds and hold the remaining funds themselves. If they go bust all the funds are gone and the UK Financial Protection Scheme steps in to compensate for the lost funds. Wise funds are held in an independent financial institution from Wise, if Wise went bust the funds are not lost, they still exist and would eventually be returned to the owner. ThIs is how many international SIPPs guarantee funds in the event of insolvency of the SIPP provider.

Before the banking crisis in 2007/8 banks used to mingle their individual accounts money with their commercial accounts so that failure in the commercial sector affected the personal accounts money. As part of banking reforms in the UK (not sure about elsewhere) banks were required to completely segregate the 2 halves of their business and to pay into a mandatory insurance scheme to protect the money of the individual savers and borrowers.

#43

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I think we are talking about two different things here. I agree with what you state about not being covered by the UK Financial Services Protection Scheme as you identified however I believe that exists because UK banks lend out most of their funds and hold the remaining funds themselves. If they go bust all the funds are gone and the UK Financial Protection Scheme steps in to compensate for the lost funds. Wise funds are held in an independent financial institution from Wise, if Wise went bust the funds are not lost, they still exist and would eventually be returned to the owner. ThIs is how many international SIPPs guarantee funds in the event of insolvency of the SIPP provider.

#44

BE Enthusiast

Joined: Dec 2008

Posts: 525

From durham lad's link:

Here’s how Wise safeguarded UK customer funds, as of the 25th June 2021:

JPMORGAN CHASE BANK, N.A - United Kingdom - Cash Deposit

RBS INTERNATIONAL (LONDON) - United Kingdom - Cash Deposit

BARCLAYS BANK PLC - United Kingdom - Cash Deposit

ADYEN N.V. - Netherlands - Cash Deposit

CITIBANK N.A. - United Kingdom - Cash Deposit

AS LHV Pank - Estonia - Cash Deposit

Government Bond US and UK - Held in the UK

It doesn't show the % or amounts though, so you don't know how much is in Estonia for example. The UK Govt. is highly likely to support a UK bank and prevent it failing as happened in the financial crises, but Icelandic banks failed and Cyprus (or was it Malta?) banks gave accounts holders a "haircut" on their deposits. Bond values can also fall. Where the funds are currently is also not shown.

None of this means Wise is unreliable or liable to fail, or the Estonian bank is vulnerable (and Wise may only have 1% deposited there), but whilst I use Wise to pass funds from A to B and would hold modest funds in it if my circumstances made it convenient, I wouldn't keep substantial funds there. And I don't think they expect you to, it's not how it's marketed.

Here’s how Wise safeguarded UK customer funds, as of the 25th June 2021:

JPMORGAN CHASE BANK, N.A - United Kingdom - Cash Deposit

RBS INTERNATIONAL (LONDON) - United Kingdom - Cash Deposit

BARCLAYS BANK PLC - United Kingdom - Cash Deposit

ADYEN N.V. - Netherlands - Cash Deposit

CITIBANK N.A. - United Kingdom - Cash Deposit

AS LHV Pank - Estonia - Cash Deposit

Government Bond US and UK - Held in the UK

It doesn't show the % or amounts though, so you don't know how much is in Estonia for example. The UK Govt. is highly likely to support a UK bank and prevent it failing as happened in the financial crises, but Icelandic banks failed and Cyprus (or was it Malta?) banks gave accounts holders a "haircut" on their deposits. Bond values can also fall. Where the funds are currently is also not shown.

None of this means Wise is unreliable or liable to fail, or the Estonian bank is vulnerable (and Wise may only have 1% deposited there), but whilst I use Wise to pass funds from A to B and would hold modest funds in it if my circumstances made it convenient, I wouldn't keep substantial funds there. And I don't think they expect you to, it's not how it's marketed.

#45

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Wise “safeguards” your money as explained below so I think it is pretty safe really.

https://wise.com/help/articles/29498...y-wise-account

https://wise.com/help/articles/29498...y-wise-account

The other key part later on the page is also this:

”The protections afforded by safeguarding stay in place even in the unlikely event that Wise were to become insolvent. However, if this happens, some of this money might be used by an insolvency administrator to pay for their own costs. This means the money returned to you could be lower than the total amount you had in your account. It might also take some time for that insolvency administrator to return the rest of your money back to you. “

So they seem to make a good effort with what they have, and are regulated, so the chance of an “FTX” are orders of magnitude lower. I am sure it’s fine for days to day use, but I would not leave the proceeds of a house sale etc there. The same way I would not keep a balance greater than bank insurance limit with any single bank.