Class 2 NI. What about us poor expats paying voluntary contributions?

#286

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I submitted the CF83 application in Jan 2019, I got a letter back at the end of April 2019 asking for details of all my employment / self employment from April 2006 to date including which countries it was in etc. This activity today on here reminded me and I finally dug out all the data and responded today, so guessing another long wait to get a response.

#288

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,131

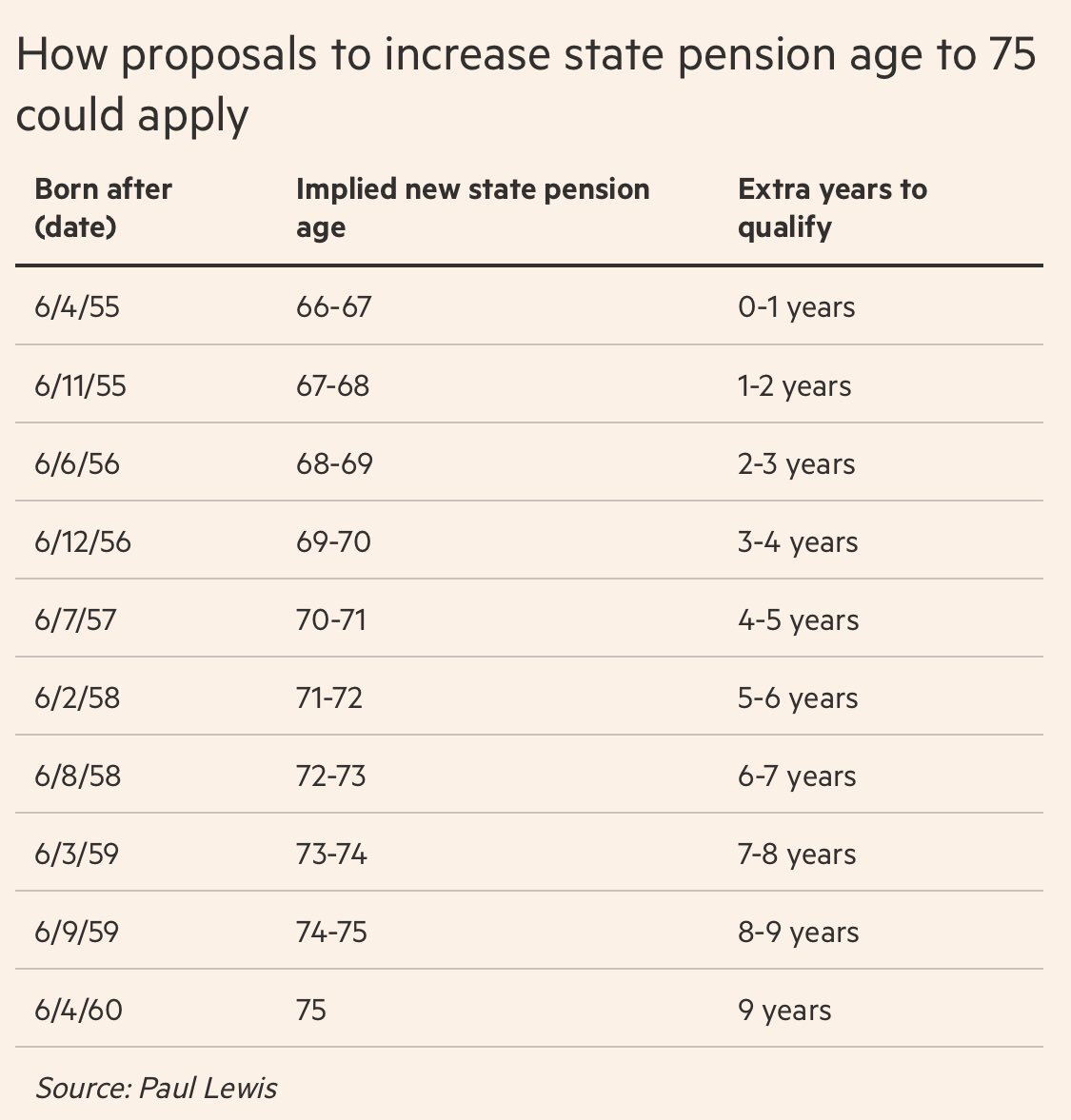

When May’s government manifesto had much milder proposals to save money on the OAP they lost their majority in the last election which she had called specifically to increase their majority. I think we are a LONG way from increasing pension age to 75.

However, I agree with you that if the age rises to 75 the payback wouldn’t be so good.

#289

Lost in BE Cyberspace

Joined: Jan 2006

Location: San Francisco

Posts: 12,865

I agree that the full pension age is unlikely to go to 75 in a hurry, but it is true that significant changes have been made to the state pension at relatively short notice. The obvious two are the increase in full pension age to 67 from 65 (more years change for women) and the removal of the ability of someone who doesn't qualify based on their own record (e.g. an American spouse) to be able to get a UK pension based on their spouse's record. Not that I disagree with those changes - even though they both negatively impact me - but nevertheless they are examples of how the UK government has changed the financial calculus of people who were relatively close to retirement age. I will also say that a further increase in full pension age is pretty much inevitable, even if it's nothing as significant as 75.

#290

Last edited by mrken30; Aug 30th 2019 at 6:10 pm.

#291

Just Joined

Joined: Jan 2020

Posts: 7

Guys,

Hoping someone can help with advice.

I have been working in the US on a L1 Visa since July 2017 on an Ex-Pat contract (so paying NI contributions). As of 1st February I will be moving into the United States organization and paying US Social Security. I'm looking at option of making voluntary Class 2 contributions but have seen conflicting advice on whether this makes sense with reciprocal Social Security Agreements. I have made ~12 years of contributions so far and eventually plan to relocate back to the United Kingdom.

I assume many of you have been in a similar situation so hoping someone can help with pro's / con's!

Thanks,

Anthony

Hoping someone can help with advice.

I have been working in the US on a L1 Visa since July 2017 on an Ex-Pat contract (so paying NI contributions). As of 1st February I will be moving into the United States organization and paying US Social Security. I'm looking at option of making voluntary Class 2 contributions but have seen conflicting advice on whether this makes sense with reciprocal Social Security Agreements. I have made ~12 years of contributions so far and eventually plan to relocate back to the United Kingdom.

I assume many of you have been in a similar situation so hoping someone can help with pro's / con's!

Thanks,

Anthony

#292

You need 35 years NICS to get the full UK pension. If you work overseas for a few years and retire early then you might struggle to make the full 35 years without voluntary contributions. Each full years worth of contributions is worth 168 GBP a year for life at retirement, versus a one time cost of 150 GBP for a single years contributions. (Class 2 NICS are currently about 3.00 GBP per week).

In addition you never know how life will work out for you especially if you are young. Maybe you stay here for a lot longer than you intend, lots of folks do. If you are here for 10 years or more you will qualify for US Social security in addition to the UK pension. In that case the voluntary NICS will be the best investment you make in your lifetime (even if you get a WEP reduction). Maybe you move to a country without reciprocal social security arrangements in the future. Maybe the government changes the rules on how many years you need to qualify for the state pension. They recently changed it from 30 years to 35, and could change it again in the future. All of these scenarios would make your voluntary contributions priceless.

There are rules for qualifying for Voluntary Class 2 NICS. Only available if you worked in the UK immediately before leaving, and you’ve previously lived in the UK for at least 3 years in a row or paid at least 3 years of contributions. You probably qualify right now if you are working on a UK contract and paying NICS to date, which it sounds like you have been. Obviously that will change as time goes by. If you do not qualify for Class 2 then you have to pay Class 3 which are quite a bit more expensive, 15 GBP vs the 3 GBP for Class 2.

In my opinion if you qualify for Class 2, it is a no brainer to go ahead. You are basically paying 150 GBP as insurance for 168 GBP for life at retirement, and you can do that for as many years as you qualify for voluntary contributions. The worst case scenario is that while you are here you pay US SS and UK NICS unnecessarily (because of the reciprocal agreement) but the cost is minimal at 150 GBP a year and the upside is huge. Class 3 is more of a judgement call.

In addition you never know how life will work out for you especially if you are young. Maybe you stay here for a lot longer than you intend, lots of folks do. If you are here for 10 years or more you will qualify for US Social security in addition to the UK pension. In that case the voluntary NICS will be the best investment you make in your lifetime (even if you get a WEP reduction). Maybe you move to a country without reciprocal social security arrangements in the future. Maybe the government changes the rules on how many years you need to qualify for the state pension. They recently changed it from 30 years to 35, and could change it again in the future. All of these scenarios would make your voluntary contributions priceless.

There are rules for qualifying for Voluntary Class 2 NICS. Only available if you worked in the UK immediately before leaving, and you’ve previously lived in the UK for at least 3 years in a row or paid at least 3 years of contributions. You probably qualify right now if you are working on a UK contract and paying NICS to date, which it sounds like you have been. Obviously that will change as time goes by. If you do not qualify for Class 2 then you have to pay Class 3 which are quite a bit more expensive, 15 GBP vs the 3 GBP for Class 2.

In my opinion if you qualify for Class 2, it is a no brainer to go ahead. You are basically paying 150 GBP as insurance for 168 GBP for life at retirement, and you can do that for as many years as you qualify for voluntary contributions. The worst case scenario is that while you are here you pay US SS and UK NICS unnecessarily (because of the reciprocal agreement) but the cost is minimal at 150 GBP a year and the upside is huge. Class 3 is more of a judgement call.

Last edited by Glasgow Girl; Jan 28th 2020 at 4:49 pm.

#293

Just Joined

Joined: Jan 2020

Posts: 7

You need 35 years NICS to get the full UK pension. If you work overseas for a few years and retire early then you might struggle to make the full 35 years without voluntary contributions. Each full years worth of contributions is worth 168 GBP a year for life at retirement, versus a one time cost of 150 GBP for a single years contributions. (Class 2 NICS are currently about 3.00 GBP per week).

In addition you never know how life will work out for you especially if you are young. Maybe you stay here for a lot longer than you intend, lots of folks do. If you are here for 10 years or more you will qualify for US Social security in addition to the UK pension. In that case the voluntary NICS will be the best investment you make in your lifetime (even if you get a WEP reduction). Maybe you move to a country without reciprocal social security arrangements in the future. Maybe the government changes the rules on how many years you need to qualify for the state pension. They recently changed it from 30 years to 35, and could change it again in the future. All of these scenarios would make your voluntary contributions priceless.

There are rules for qualifying for Voluntary Class 2 NICS. Only available if you worked in the UK immediately before leaving, and you’ve previously lived in the UK for at least 3 years in a row or paid at least 3 years of contributions. You probably qualify right now if you are working on a UK contract and paying NICS to date, which it sounds like you have been. Obviously that will change as time goes by. If you do not qualify for Class 2 then you have to pay Class 3 which are quite a bit more expensive, 15 GBP vs the 3 GBP for Class 2.

In my opinion if you qualify for Class 2, it is a no brainer to go ahead. You are basically paying 150 GBP as insurance for 168 GBP for life at retirement, and you can do that for as many years as you qualify for voluntary contributions. The worst case scenario is that while you are here you pay US SS and UK NICS unnecessarily (because of the reciprocal agreement) but the cost is minimal at 150 GBP a year and the upside is huge. Class 3 is more of a judgement call.

In addition you never know how life will work out for you especially if you are young. Maybe you stay here for a lot longer than you intend, lots of folks do. If you are here for 10 years or more you will qualify for US Social security in addition to the UK pension. In that case the voluntary NICS will be the best investment you make in your lifetime (even if you get a WEP reduction). Maybe you move to a country without reciprocal social security arrangements in the future. Maybe the government changes the rules on how many years you need to qualify for the state pension. They recently changed it from 30 years to 35, and could change it again in the future. All of these scenarios would make your voluntary contributions priceless.

There are rules for qualifying for Voluntary Class 2 NICS. Only available if you worked in the UK immediately before leaving, and you’ve previously lived in the UK for at least 3 years in a row or paid at least 3 years of contributions. You probably qualify right now if you are working on a UK contract and paying NICS to date, which it sounds like you have been. Obviously that will change as time goes by. If you do not qualify for Class 2 then you have to pay Class 3 which are quite a bit more expensive, 15 GBP vs the 3 GBP for Class 2.

In my opinion if you qualify for Class 2, it is a no brainer to go ahead. You are basically paying 150 GBP as insurance for 168 GBP for life at retirement, and you can do that for as many years as you qualify for voluntary contributions. The worst case scenario is that while you are here you pay US SS and UK NICS unnecessarily (because of the reciprocal agreement) but the cost is minimal at 150 GBP a year and the upside is huge. Class 3 is more of a judgement call.

For my knowledge. Under a situation where I work in the United States and pay social security for 9 years and move back to the United Kingdom, what happens to these Social Security contributions? Would they be counted as 9 years contribution towards my UK 35year requirement (if so would this be in addition to any years I contribute as Class 2/3?) Or does it act as an amount I can draw from / transfer out? Based on above if 10+ years I would be able to draw from both, so just trying to understand what happens if less

Thanks again,

Anthony

#294

If you have the cash to buy extra NI years, even at the higher Class 3 rate, it is pretty much a no-brainer, so long as you assume that UK state pensions will be honored and not means tested.

At the Class 2 rate, the investment is pretty much a gift, and at the Class 3 rate is still quite generous, and is (except as noted above) a risk free investment opportunity.

How I see it is that if I need the UK state pension when I retire it will have been very well worth the cost, and if I retire with ample other sources of income and lose out to my UK state pension for example through means testing, then the cost of extra contributions was quite modest and losing out won't have cost me very much anyway. So even though it isn't a "win-win" it is certainly a "large win v small potential loss".

At the Class 2 rate, the investment is pretty much a gift, and at the Class 3 rate is still quite generous, and is (except as noted above) a risk free investment opportunity.

How I see it is that if I need the UK state pension when I retire it will have been very well worth the cost, and if I retire with ample other sources of income and lose out to my UK state pension for example through means testing, then the cost of extra contributions was quite modest and losing out won't have cost me very much anyway. So even though it isn't a "win-win" it is certainly a "large win v small potential loss".

#295

Thank you. Extremely helpful.

For my knowledge. Under a situation where I work in the United States and pay social security for 9 years and move back to the United Kingdom, what happens to these Social Security contributions? Would they be counted as 9 years contribution towards my UK 35year requirement (if so would this be in addition to any years I contribute as Class 2/3?) Or does it act as an amount I can draw from / transfer out? Based on above if 10+ years I would be able to draw from both, so just trying to understand what happens if less

Thanks again,

Anthony

For my knowledge. Under a situation where I work in the United States and pay social security for 9 years and move back to the United Kingdom, what happens to these Social Security contributions? Would they be counted as 9 years contribution towards my UK 35year requirement (if so would this be in addition to any years I contribute as Class 2/3?) Or does it act as an amount I can draw from / transfer out? Based on above if 10+ years I would be able to draw from both, so just trying to understand what happens if less

Thanks again,

Anthony

#296

Lost in BE Cyberspace

Joined: Jan 2006

Location: San Francisco

Posts: 12,865

I do not know the answer to that question with certainty, hopefully someone else can advise. However I am almost certain that if you pay voluntary contributions in the same years that you pay US SS then you will only get one years worth of credit in the UK, so in other words your voluntary contributions would be wasted since you would have gotten credit from your US SS anyway. The benefit comes if you stay 10 years or more because then your US SS contributions contribute to your US social security AND your voluntary NICS contribute to your UK state pension. If you are sure you will not stay here 10 years or more then your money is probably wasted, but that is no different from all insurances that you never use. However as I said life earlier, life does not always play out how you thought it would.

Last edited by Giantaxe; Jan 28th 2020 at 7:30 pm.

#297

And that the "35 years" won't be increased .... it was 30 years until about 5 years ago, and I suspect that at some point it will be increased, probably to 40 years, perhaps the next time they raise the retirement age.

#299

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I submitted the CF83 application in Jan 2019, I got a letter back at the end of April 2019 asking for details of all my employment / self employment from April 2006 to date including which countries it was in etc. This activity today on here reminded me and I finally dug out all the data and responded today, so guessing another long wait to get a response.

now I only need to figure out how to get credit for the years I paid in NZ and Ireland, and if it’s possible / better to credit to the UK or US.

#300

Just tried to log into the online portal at https://www.tax.service.gov.uk/check...ension/account . (6pm Arizona on Saturday, circa 1am UK on Sunday).

I'm asked for my 'Government Gateway user ID' and password, which I enter and they are accepted. It then asks me 'How do you want to get an access code?', and offers to send a text message to either of my two valid already-registered (and previously used) numbers (one a US number, one a UK number), both of which are active and the phones are 'on' (and I sent / received text messages on both, to rule out phone issues).

I've tried choosing both, several times, and never receive the text with a code (waited at least 15 minutes each time). After choosing a number to receive the text, the screen asks for the six digit code but none is forthcoming on the phone(s). I've done this in the past with success. If the 'service' was down for maintenance, I'd expect an appropriate message on the main sign-in page, but the sign-in page let me sign in.

So ... have others experienced this lack of function on the site?

UPDATE - I just tried one more time and ... received a text with a code! And I'm in the site. So this just suggests their service is a bit flakey ... oh well ... moving on ...

I'm asked for my 'Government Gateway user ID' and password, which I enter and they are accepted. It then asks me 'How do you want to get an access code?', and offers to send a text message to either of my two valid already-registered (and previously used) numbers (one a US number, one a UK number), both of which are active and the phones are 'on' (and I sent / received text messages on both, to rule out phone issues).

I've tried choosing both, several times, and never receive the text with a code (waited at least 15 minutes each time). After choosing a number to receive the text, the screen asks for the six digit code but none is forthcoming on the phone(s). I've done this in the past with success. If the 'service' was down for maintenance, I'd expect an appropriate message on the main sign-in page, but the sign-in page let me sign in.

So ... have others experienced this lack of function on the site?

UPDATE - I just tried one more time and ... received a text with a code! And I'm in the site. So this just suggests their service is a bit flakey ... oh well ... moving on ...

Last edited by Steerpike; Feb 23rd 2020 at 1:23 am.