Class 2 NI. What about us poor expats paying voluntary contributions?

#331

I just received a letter from HMRC and they are telling me the amount to pay for the 2019-20 year. It's 159 GBP, somewhat as expected.

So I went into my UK HSBC account online, and tried to enter the payee details.

The HMRC letter gives the 'Pay To Account Name' as 'GBS Re NICO Receipts HMRC', and the A/C # as 30944793.

HSBC is flagging that combo as an unknown account, and is warning me not to proceed as the money may not go where I expect it to go.

Earlier this year, when I made my 'catch up' payments, the a/c # was the same as above, but the account name was simply 'HMRC NIC RECEIPTS', which I presume would pass the HSBC validation.

So - should I forge ahead and use the account name they give today - 'GBS Re NICO Receipts HMRC', or, use the account name that worked last time 'HMRC NIC RECEIPTS' ...?

I guess I could get up early tomorrow and call them ...

So I went into my UK HSBC account online, and tried to enter the payee details.

The HMRC letter gives the 'Pay To Account Name' as 'GBS Re NICO Receipts HMRC', and the A/C # as 30944793.

HSBC is flagging that combo as an unknown account, and is warning me not to proceed as the money may not go where I expect it to go.

Earlier this year, when I made my 'catch up' payments, the a/c # was the same as above, but the account name was simply 'HMRC NIC RECEIPTS', which I presume would pass the HSBC validation.

So - should I forge ahead and use the account name they give today - 'GBS Re NICO Receipts HMRC', or, use the account name that worked last time 'HMRC NIC RECEIPTS' ...?

I guess I could get up early tomorrow and call them ...

Last edited by Steerpike; Jun 28th 2020 at 8:28 pm.

#332

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I just received a letter from HMRC and they are telling me the amount to pay for the 2019-20 year. It's 159 GBP, somewhat as expected.

So I went into my UK HSBC account online, and tried to enter the payee details.

The HMRC letter gives the 'Pay To Account Name' as 'GBS Re NICO Receipts HMRC', and the A/C # as 30944793.

HSBC is flagging that combo as an unknown account, and is warning me not to proceed as the money may not go where I expect it to go.

Earlier this year, when I made my 'catch up' payments, the a/c # was the same as above, but the account name was simply 'HMRC NIC RECEIPTS', which I presume would pass the HSBC validation.

So - should I forge ahead and use the account name they give today - 'GBS Re NICO Receipts HMRC', or, use the account name that worked last time 'HMRC NIC RECEIPTS' ...?

I guess I could get up early tomorrow and call them ...

So I went into my UK HSBC account online, and tried to enter the payee details.

The HMRC letter gives the 'Pay To Account Name' as 'GBS Re NICO Receipts HMRC', and the A/C # as 30944793.

HSBC is flagging that combo as an unknown account, and is warning me not to proceed as the money may not go where I expect it to go.

Earlier this year, when I made my 'catch up' payments, the a/c # was the same as above, but the account name was simply 'HMRC NIC RECEIPTS', which I presume would pass the HSBC validation.

So - should I forge ahead and use the account name they give today - 'GBS Re NICO Receipts HMRC', or, use the account name that worked last time 'HMRC NIC RECEIPTS' ...?

I guess I could get up early tomorrow and call them ...

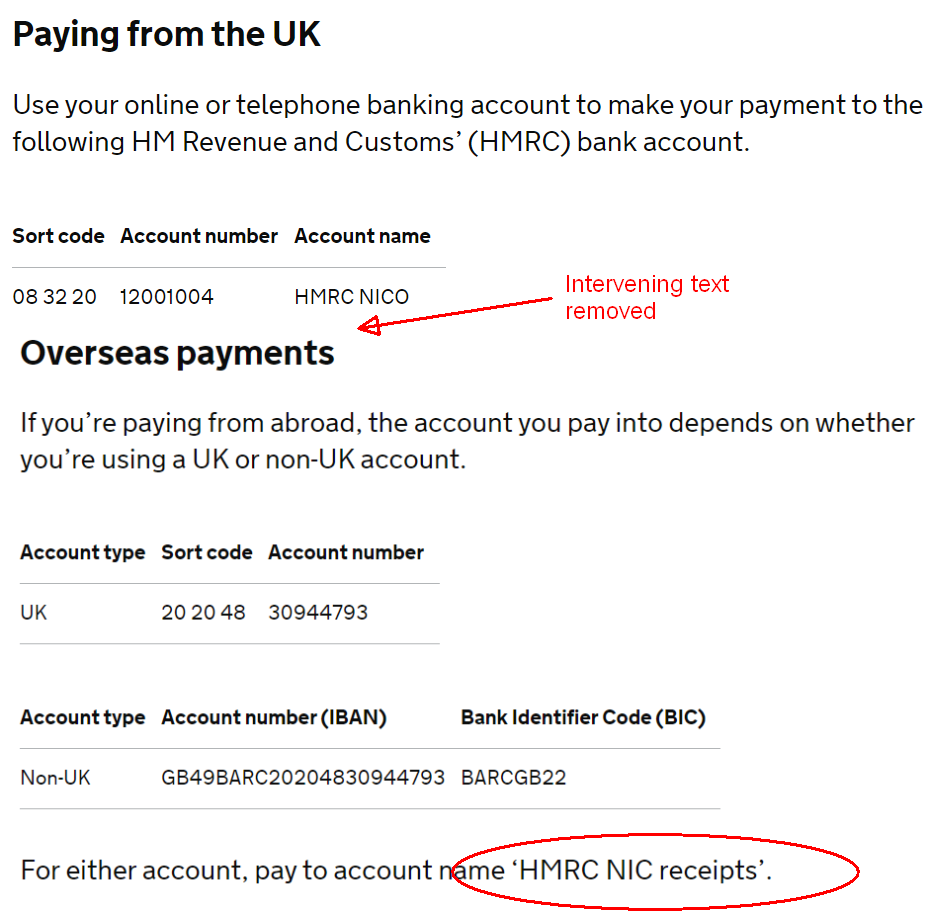

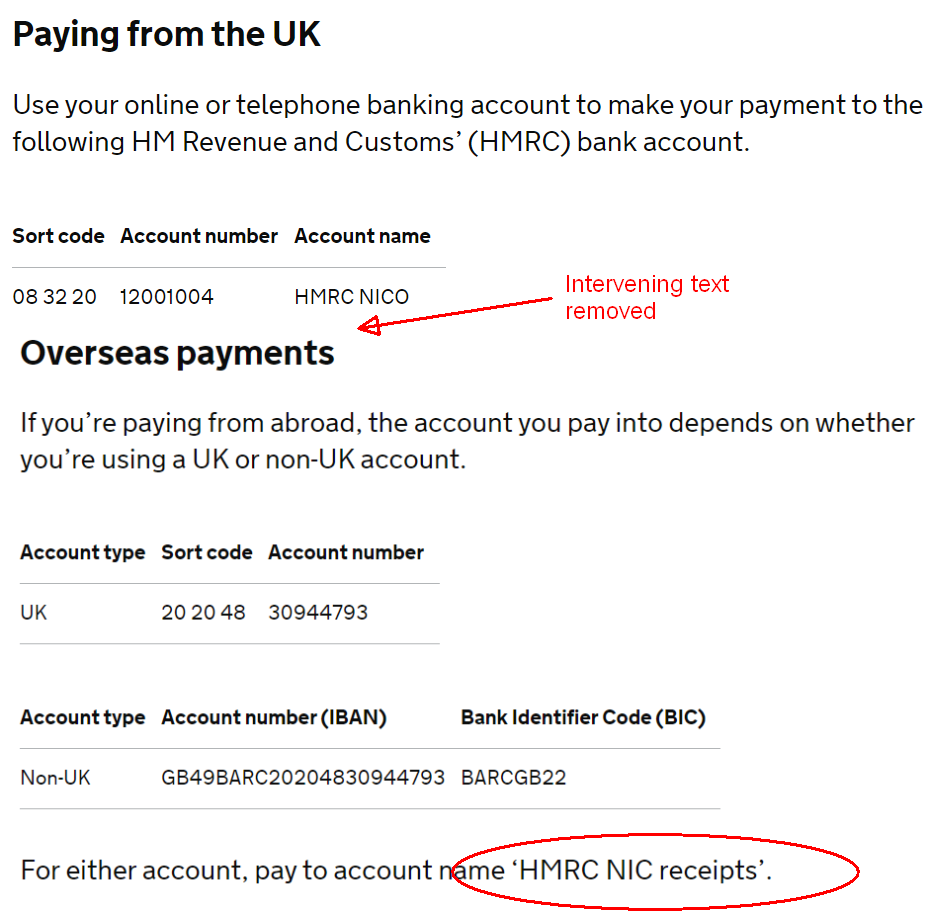

https://www.gov.uk/pay-class-2-natio...e/bank-details

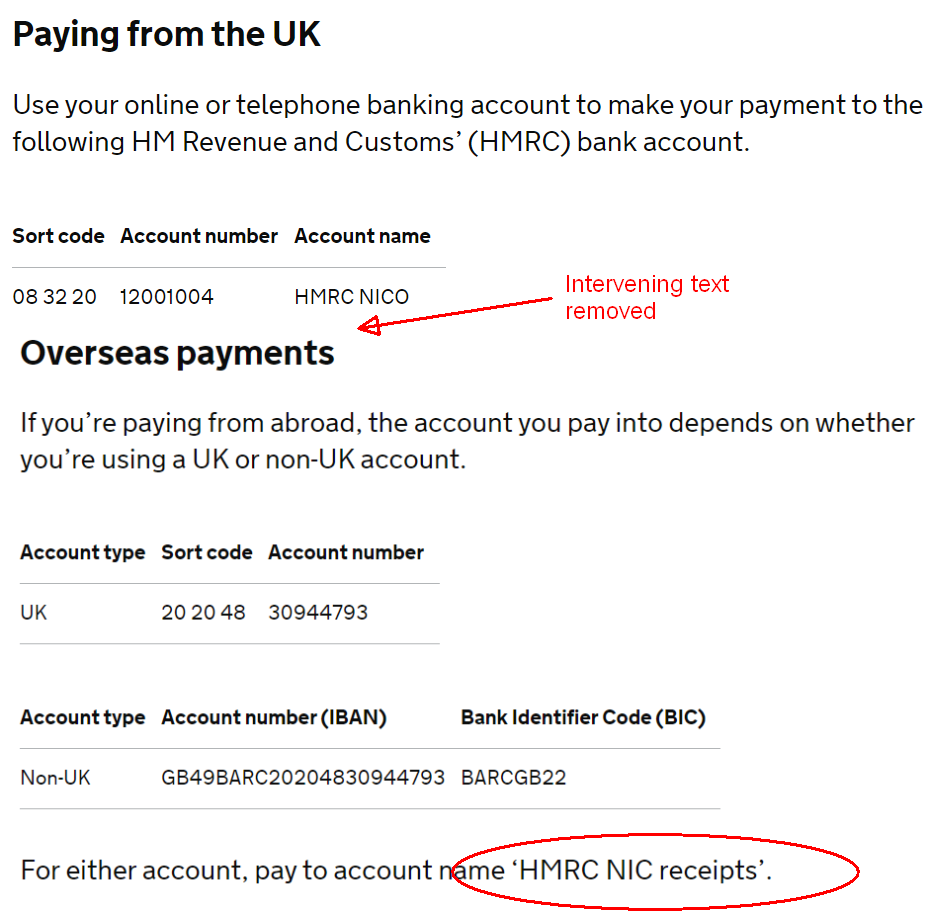

Paying from the UK

Use your online or telephone banking account to make your payment to the following HM Revenue and Customs’ (HMRC) bank account.Sort code Account number Account name 08 32 20 12001004 HMRC NICO

it looks like you are trying to use the international account details, but paying form the UK?

Last edited by tht; Jun 28th 2020 at 9:53 pm.

#333

My last payment (May 2020) was from a UK account to HMRC, the details I used are what is online, and it has since credited:

https://www.gov.uk/pay-class-2-natio...e/bank-details

Sort code Account number Account name 08 32 20 12001004 HMRC NICO

it looks like you are trying to use the international account details, but paying form the UK?

https://www.gov.uk/pay-class-2-natio...e/bank-details

Paying from the UK

Use your online or telephone banking account to make your payment to the following HM Revenue and Customs’ (HMRC) bank account.Sort code Account number Account name 08 32 20 12001004 HMRC NICO

it looks like you are trying to use the international account details, but paying form the UK?

. If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation.

. If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation. The relevant bit of their letter is below, with red marks around the bits that apply to me:

And the only difference between this instruction, and the one I got verbally over the phone last time I called the help center for my catch-up payments, was that the 'account name' was 'HMRC NIC RECEIPTS' while here it is 'GBS Re NICO Receipts HMRC'.

Again, I agree it seems odd that they would have different instructions for paying using an online UK account, depending on where you are physically located (in UK or 'overseas'), but that seems to be what they are suggesting.

#335

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Well this is confusing  . If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation.

. If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation.

The relevant bit of their letter is below, with red marks around the bits that apply to me:

And the only difference between this instruction, and the one I got verbally over the phone last time I called the help center for my catch-up payments, was that the 'account name' was 'HMRC NIC RECEIPTS' while here it is 'GBS Re NICO Receipts HMRC'.

Again, I agree it seems odd that they would have different instructions for paying using an online UK account, depending on where you are physically located (in UK or 'overseas'), but that seems to be what they are suggesting.

. If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation.

. If you are paying using 'online banking' from a UK account, then where you are physically located seems somewhat irrelevant. However, they do seem to have specific instructions for someone who is physically overseas, but using a UK bank account - my situation.The relevant bit of their letter is below, with red marks around the bits that apply to me:

And the only difference between this instruction, and the one I got verbally over the phone last time I called the help center for my catch-up payments, was that the 'account name' was 'HMRC NIC RECEIPTS' while here it is 'GBS Re NICO Receipts HMRC'.

Again, I agree it seems odd that they would have different instructions for paying using an online UK account, depending on where you are physically located (in UK or 'overseas'), but that seems to be what they are suggesting.

for 2018-2019 and the full GBP 159 for 2019-2020 today. So may need another call to split it, but then will be up to date and assume sending the amount advised each year for the additional 12 years to get to the max will be more straightforward.

#336

Looking at their website, https://www.gov.uk/pay-class-2-natio...e/bank-details even the website contains the same confusing information .... clearly they have different instructions depending on 'where you are', even if you are using an online UK account!

This is a copy/paste from the website, having removed intervening text between the sections ...

But now I notice a contradiction between the website and my letter (which I copied and posted earlier). Here on the website, they say the 'pay to account name' is 'HMRC NIC receipts'. On my letter, it says the 'pay to account name' is 'GBS Re NICO Receipts HMRC'.

So I'll see if my HSBC online account gives me the same warning if I use 'HRMC NIC receipts'.

You would think they could get this a little clearer!

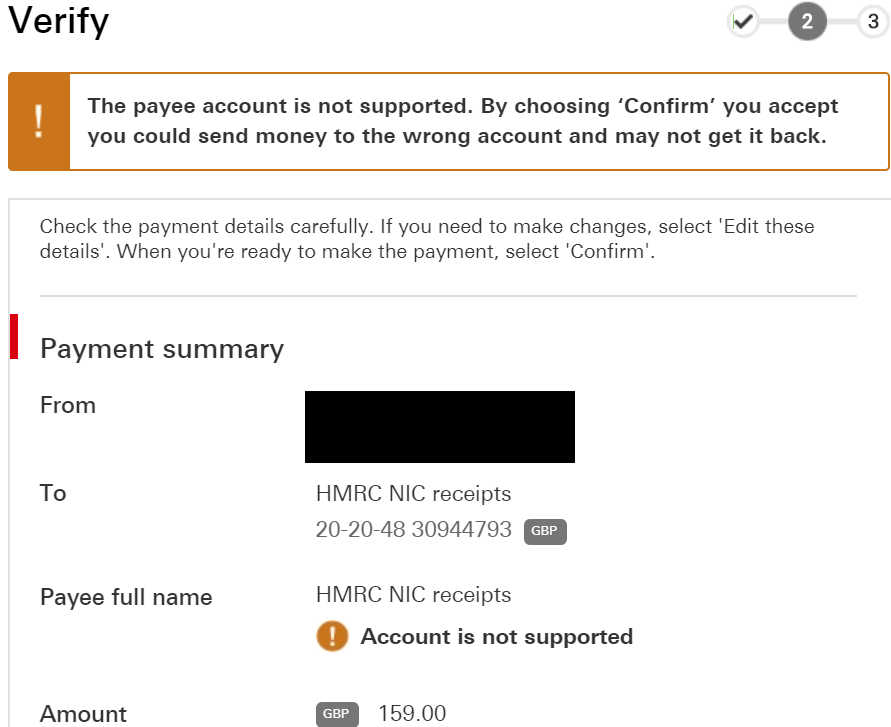

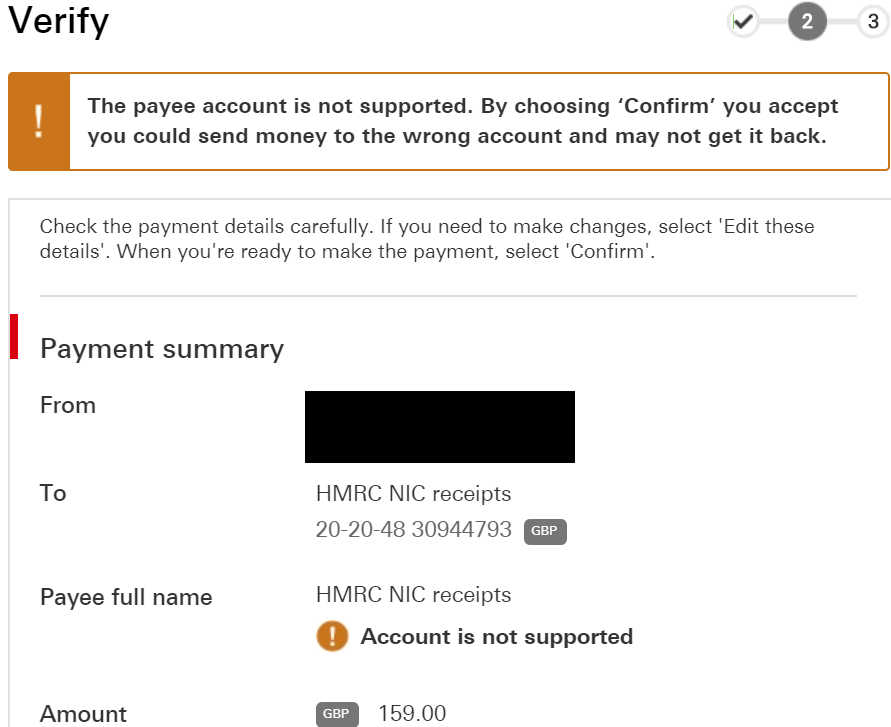

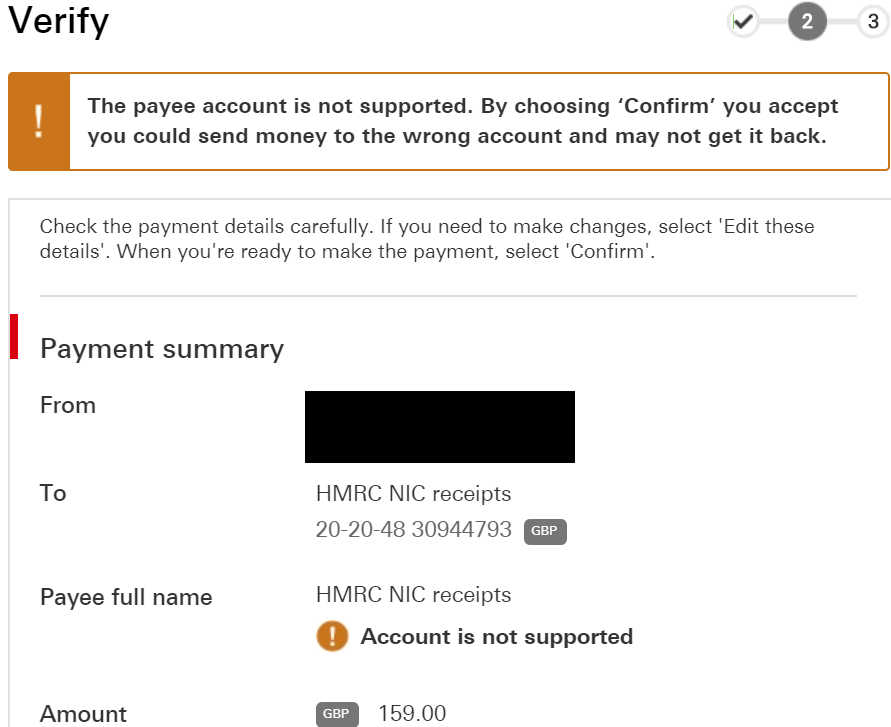

I decided to forge ahead and risk it. When entering the Account name as 'HMRC NIC receipts', I got this warning from HSBC:

and later,

So - we shall see if it works or not!

Last edited by Steerpike; Jun 29th 2020 at 6:22 pm.

#337

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I don't have a check book with my HSBC account, so that's not an option.

Looking at their website, https://www.gov.uk/pay-class-2-natio...e/bank-details even the website contains the same confusing information .... clearly they have different instructions depending on 'where you are', even if you are using an online UK account!

This is a copy/paste from the website, having removed intervening text between the sections ...

But now I notice a contradiction between the website and my letter (which I copied and posted earlier). Here on the website, they say the 'pay to account name' is 'HMRC NIC receipts'. On my letter, it says the 'pay to account name' is 'GBS Re NICO Receipts HMRC'.

So I'll see if my HSBC online account gives me the same warning if I use 'HRMC NIC receipts'.

You would think they could get this a little clearer!

I decided to forge ahead and risk it. When entering the Account name as 'HMRC NIC receipts', I got this warning from HSBC:

and later,

So - we shall see if it works or not!

Looking at their website, https://www.gov.uk/pay-class-2-natio...e/bank-details even the website contains the same confusing information .... clearly they have different instructions depending on 'where you are', even if you are using an online UK account!

This is a copy/paste from the website, having removed intervening text between the sections ...

But now I notice a contradiction between the website and my letter (which I copied and posted earlier). Here on the website, they say the 'pay to account name' is 'HMRC NIC receipts'. On my letter, it says the 'pay to account name' is 'GBS Re NICO Receipts HMRC'.

So I'll see if my HSBC online account gives me the same warning if I use 'HRMC NIC receipts'.

You would think they could get this a little clearer!

I decided to forge ahead and risk it. When entering the Account name as 'HMRC NIC receipts', I got this warning from HSBC:

and later,

So - we shall see if it works or not!

#338

Forum Regular

Joined: Jan 2017

Location: Connecticut

Posts: 107

I had the same issue with my HSBC UK payment. I decided to accept the warning and proceed, on the basis the sort code and account number are correct and I included the payment reference including my NI Number. Hopefully it will be posted correctly.

#340

Another area of confusion with all this is that the reference number is limited to 18 characters. They tell you that in one place, but not in several other places. On my letter, it just said use NI number, + IC, + last name + first initial. But my last name is long, and I had to truncate it.

#341

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

I made my final payment to get me up to date on 6/29, called on 6/30 to tell them the years to allocate it to (they said the reason I had the wrong amount showing online was someone had classified last year as Class 3 so it only shows a partial year... anyway they put in a request to the back office and I logged in today on 7/2 and it shows them all up to date to 2019-20.

I had issues with the reference as well, which was not on my letter. I used:

The below format:

AB123456A - NI number

ICW

SURNAM - first 6 letters submitted as:

AB123456AICWSURNAM

I thought I needed 35 full years for the max, but I habe 22 full years to date and it says I need 11 more to reach the max. I had 2 years when I was at University that show some paid employment, but “Year is not full”.

I had issues with the reference as well, which was not on my letter. I used:

The below format:

AB123456A - NI number

ICW

SURNAM - first 6 letters submitted as:

AB123456AICWSURNAM

I thought I needed 35 full years for the max, but I habe 22 full years to date and it says I need 11 more to reach the max. I had 2 years when I was at University that show some paid employment, but “Year is not full”.

#342

I made my final payment to get me up to date on 6/29, called on 6/30 to tell them the years to allocate it to (they said the reason I had the wrong amount showing online was someone had classified last year as Class 3 so it only shows a partial year... anyway they put in a request to the back office and I logged in today on 7/2 and it shows them all up to date to 2019-20.

I had issues with the reference as well, which was not on my letter. I used:

The below format:

AB123456A - NI number

ICW

SURNAM - first 6 letters submitted as:

AB123456AICWSURNAM

I thought I needed 35 full years for the max, but I habe 22 full years to date and it says I need 11 more to reach the max. I had 2 years when I was at University that show some paid employment, but “Year is not full”.

I had issues with the reference as well, which was not on my letter. I used:

The below format:

AB123456A - NI number

ICW

SURNAM - first 6 letters submitted as:

AB123456AICWSURNAM

I thought I needed 35 full years for the max, but I habe 22 full years to date and it says I need 11 more to reach the max. I had 2 years when I was at University that show some paid employment, but “Year is not full”.

With a 9 character NI number, and 2 characters for 'IC', that leaves only 7 characters for last name/1st initial, which is what they don't tell you here (but I did see this confirmed in other reference docs).

When I last looked online, after making the bulk catch-up payment, but before making any 'current' contributions for 1029/20, I saw that I have

21 years of full contributions

5 years to contribute before 5 April 2024

24 years when you did not contribute enough.

So that would suggest, if I make all the possible future payments, I'll have (21+5)= 26 full years. Another letter available online says this would give me 131.60 GBP/week. Works for me!

#343

Lost in BE Cyberspace

Joined: Nov 2012

Location: bute

Posts: 9,740

In the Prehistoric Period when I made payments for NICs overseas I used to send a bank draft. Do they still exist ? I suspect not.

#344

DE-UK-NZ-IE-US... the TYP

Joined: Mar 2010

Posts: 2,855

Interesting that you chose to use 'ICW' in your ref. number; my letter had this instruction (basically, just use 'IC'): Presumably you saw a guidance somewhere to use 'ICW'.

With a 9 character NI number, and 2 characters for 'IC', that leaves only 7 characters for last name/1st initial, which is what they don't tell you here (but I did see this confirmed in other reference docs).

When I last looked online, after making the bulk catch-up payment, but before making any 'current' contributions for 1029/20, I saw that I have

21 years of full contributions

5 years to contribute before 5 April 2024

24 years when you did not contribute enough.

So that would suggest, if I make all the possible future payments, I'll have (21+5)= 26 full years. Another letter available online says this would give me 131.60 GBP/week. Works for me!

With a 9 character NI number, and 2 characters for 'IC', that leaves only 7 characters for last name/1st initial, which is what they don't tell you here (but I did see this confirmed in other reference docs).

When I last looked online, after making the bulk catch-up payment, but before making any 'current' contributions for 1029/20, I saw that I have

21 years of full contributions

5 years to contribute before 5 April 2024

24 years when you did not contribute enough.

So that would suggest, if I make all the possible future payments, I'll have (21+5)= 26 full years. Another letter available online says this would give me 131.60 GBP/week. Works for me!