parents sponsored by child

#16

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

What exactly do you mean by "as part of main person in the household"? If you mean she files jointly with her spouse (i.e. they file one tax return with filing status Married Filing Jointly), then technically that tax return is his tax return and her tax return at the same time; in that case, she has filed a tax return for that year. On the other hand, if you mean someone claimed her as a dependent on their tax return, then that does not mean she has filed a tax return. Being claimed as a dependent and filing a tax return are independent things (someone claimed as a dependent can still file their own tax return, and in some cases must still file their own tax return; it's just that when they file their tax return, they would check the box on form 1040 that says someone can claim them as a dependent). If she did not file a tax return (regardless of whether she was claimed as a dependent), she would have to say she didn't file a tax return. And the only way she can not file a tax return is if her income that year was below the threshold for needing to file. If that is the case, she would check box 25 and attach a statement stating how her income was below the threshold for the relevant years.

#17

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Quick update, and a question.

My sister (the petitioner) has 0 income. Her husband had income in 2019 (the most recent tax year) and was on 1099. The 1099 shows the name of the company they formed to earn that money.

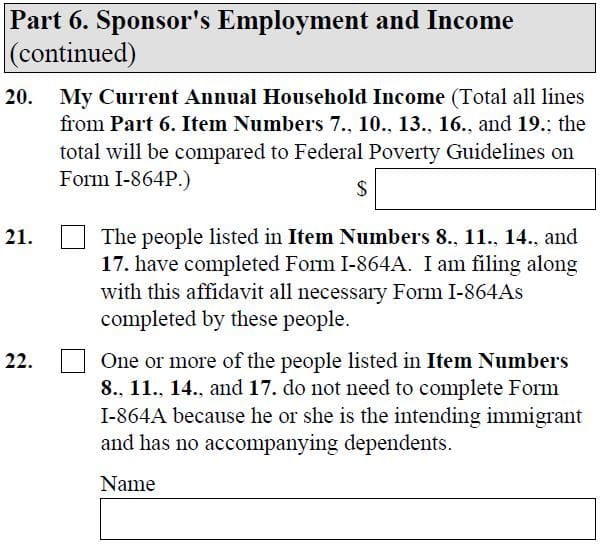

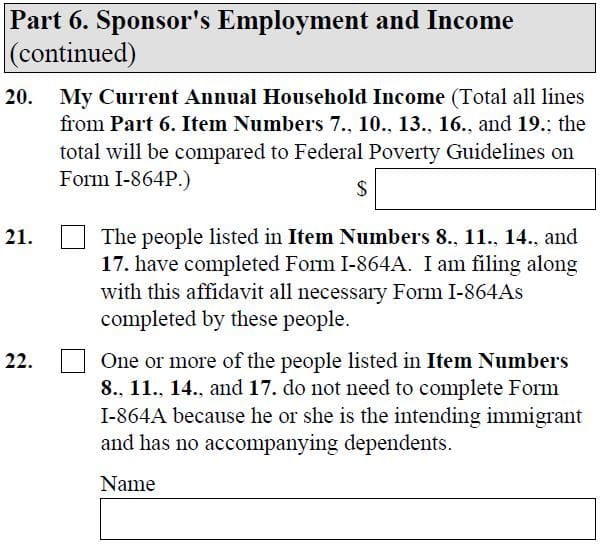

So, shes filled it out so that the total income earned from the household member (her husband) is as on the 1099. For 20 below, that will be the total earned on the 1099. For 21 and 22, does that stay unchecked? Reminder that I (green card holder) will be a joint sponsor that has fulyl filed taxes since the beginning and earn over federal poverty limits. Thanks!

My sister (the petitioner) has 0 income. Her husband had income in 2019 (the most recent tax year) and was on 1099. The 1099 shows the name of the company they formed to earn that money.

So, shes filled it out so that the total income earned from the household member (her husband) is as on the 1099. For 20 below, that will be the total earned on the 1099. For 21 and 22, does that stay unchecked? Reminder that I (green card holder) will be a joint sponsor that has fulyl filed taxes since the beginning and earn over federal poverty limits. Thanks!

#18

If your sister is the petitioner, and this is her I-864, then her income is zero.

If she is using her husband's income to meet the financial requirement, then there needs to be an I-864A to include that. And if his income is enough to meet the income requirement, there's no need for a joint sponsor.

If his income is not enough, and you will be a joint sponsor, then your sister should put zero for her income, and not bother listing her husband's income.

Rene

If she is using her husband's income to meet the financial requirement, then there needs to be an I-864A to include that. And if his income is enough to meet the income requirement, there's no need for a joint sponsor.

If his income is not enough, and you will be a joint sponsor, then your sister should put zero for her income, and not bother listing her husband's income.

Rene

#19

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

If your sister is the petitioner, and this is her I-864, then her income is zero.

If she is using her husband's income to meet the financial requirement, then there needs to be an I-864A to include that. And if his income is enough to meet the income requirement, there's no need for a joint sponsor.

If his income is not enough, and you will be a joint sponsor, then your sister should put zero for her income, and not bother listing her husband's income.

Rene

If she is using her husband's income to meet the financial requirement, then there needs to be an I-864A to include that. And if his income is enough to meet the income requirement, there's no need for a joint sponsor.

If his income is not enough, and you will be a joint sponsor, then your sister should put zero for her income, and not bother listing her husband's income.

Rene

Her income is indeed 0 however she has no w2 or filed tax returns. She is part of the same household income but the havent filed tax returns for a couple of years now. I am living at the same house but file my own taxes, seperate to them. They Just have a 1099 which is a company she is part of on which her husband worked and earned the money (well above federal poverty).

Sorry for complicating things but I just dont know how to wrap my head around the part when I have to submit the w2/transcript when they dont have anything. I am thinking of doing the following:-

She will be selected as unemployed and earn 0 dollar. Her tax return - NO and N/A for earnings for 2019, 2018 and 2017.

I will be the joint sponsor and have filed all tax returns and can state earnings (again, well above federal poverty lines) for the last 3 years.

Does that sound ok ?

#20

Thanks Rene!

Her income is indeed 0 however she has no w2 or filed tax returns. She is part of the same household income but the havent filed tax returns for a couple of years now. I am living at the same house but file my own taxes, seperate to them. They Just have a 1099 which is a company she is part of on which her husband worked and earned the money (well above federal poverty).

Sorry for complicating things but I just dont know how to wrap my head around the part when I have to submit the w2/transcript when they dont have anything. I am thinking of doing the following:-

She will be selected as unemployed and earn 0 dollar. Her tax return - NO and N/A for earnings for 2019, 2018 and 2017.

I will be the joint sponsor and have filed all tax returns and can state earnings (again, well above federal poverty lines) for the last 3 years.

Does that sound ok ?

Her income is indeed 0 however she has no w2 or filed tax returns. She is part of the same household income but the havent filed tax returns for a couple of years now. I am living at the same house but file my own taxes, seperate to them. They Just have a 1099 which is a company she is part of on which her husband worked and earned the money (well above federal poverty).

Sorry for complicating things but I just dont know how to wrap my head around the part when I have to submit the w2/transcript when they dont have anything. I am thinking of doing the following:-

She will be selected as unemployed and earn 0 dollar. Her tax return - NO and N/A for earnings for 2019, 2018 and 2017.

I will be the joint sponsor and have filed all tax returns and can state earnings (again, well above federal poverty lines) for the last 3 years.

Does that sound ok ?

You keep saying "they have a 1099" -- what do you mean? And why haven't they filed any taxes? A 1099 is a form that indicates how much was earned as an independent contractor. It is then used to complete the 1040, the main tax return form.

#21

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

They ran into financial issues then covid came and made it worse, do they couldnt pay the taxes on the 1099. So they have a 1099 from their employer (C2C) but not sent their 1040 off for at least the last 2 years.

#22

You say the husband's income is above the poverty guideline for the household plus 2 immigrants (the parents)? If that is correct, then there's no need for you to be a joint sponsor.

The I-864 asks for the most recent tax return. If their most recent tax return is 2018, then that's the one they use, along with a statement saying why the more recent tax returns are missing.

One thing to keep in mind when self employed is that only the personal income can be used, not the entire business income. For example, if the business earned $100K, but there were $20K in business expenses, then the amount that counts on the I-864 is $80K.

You also mention your sister is part of her husband's business, but you said she had no income. If her name is on the business then I would say it's her business, too, and thus her income as well. Whose name(s) are exactly on the 1099?

If your sister is NOT in the business and truly has 0 income, then the easiest way would be for her to state 0 income (not using her husband's income) and have you be the joint sponsor. She would still need to provide her tax return, with a statement and proof of how that income shown is not hers, but her husband's.

Rene

The I-864 asks for the most recent tax return. If their most recent tax return is 2018, then that's the one they use, along with a statement saying why the more recent tax returns are missing.

One thing to keep in mind when self employed is that only the personal income can be used, not the entire business income. For example, if the business earned $100K, but there were $20K in business expenses, then the amount that counts on the I-864 is $80K.

You also mention your sister is part of her husband's business, but you said she had no income. If her name is on the business then I would say it's her business, too, and thus her income as well. Whose name(s) are exactly on the 1099?

If your sister is NOT in the business and truly has 0 income, then the easiest way would be for her to state 0 income (not using her husband's income) and have you be the joint sponsor. She would still need to provide her tax return, with a statement and proof of how that income shown is not hers, but her husband's.

Rene

#23

Also want to add, the I-864 situation sounds complicated in your case. You and your sister might want to have a1-time consultation with an immigration attorney to discuss the best way forward.

Rene

Rene

#24

Lost in BE Cyberspace

Joined: May 2010

Location: San Diego, California

Posts: 9,652

Thanks Rene!

Her income is indeed 0 however she has no w2 or filed tax returns. She is part of the same household income but the havent filed tax returns for a couple of years now. I am living at the same house but file my own taxes, seperate to them. They Just have a 1099 which is a company she is part of on which her husband worked and earned the money (well above federal poverty).

Sorry for complicating things but I just dont know how to wrap my head around the part when I have to submit the w2/transcript when they dont have anything. I am thinking of doing the following:-

She will be selected as unemployed and earn 0 dollar. Her tax return - NO and N/A for earnings for 2019, 2018 and 2017.

I will be the joint sponsor and have filed all tax returns and can state earnings (again, well above federal poverty lines) for the last 3 years.

Does that sound ok ?

Her income is indeed 0 however she has no w2 or filed tax returns. She is part of the same household income but the havent filed tax returns for a couple of years now. I am living at the same house but file my own taxes, seperate to them. They Just have a 1099 which is a company she is part of on which her husband worked and earned the money (well above federal poverty).

Sorry for complicating things but I just dont know how to wrap my head around the part when I have to submit the w2/transcript when they dont have anything. I am thinking of doing the following:-

She will be selected as unemployed and earn 0 dollar. Her tax return - NO and N/A for earnings for 2019, 2018 and 2017.

I will be the joint sponsor and have filed all tax returns and can state earnings (again, well above federal poverty lines) for the last 3 years.

Does that sound ok ?

While I understand that the sister is the main sponsor because she is the US citizen, neither she nor husband have the resources to sponsor parents. The OP is only a Green Card holder, so how come if he is joint sponsor (and the one actually providing the resources to sponsor parents) this can be done? Green card holders cannot sponsor parents can they? Is this a workaround?

#25

It's not a workaround. Only a USC can petition a parent for an immigrant visa (which the sister is). If a petitioner is unable to meet the financial requirement, they are allowed to use a joint sponsor. The joint sponsor does not have to be a USC. It can be any PR or even someone working here on a work visa who meets the financial requirement.

In this case, the fact that the joint sponsor is the brother is not relevant. It could be anyone.

Rene

In this case, the fact that the joint sponsor is the brother is not relevant. It could be anyone.

Rene

Last edited by Noorah101; Feb 6th 2021 at 7:08 pm.

#26

Lost in BE Cyberspace

Joined: May 2010

Location: San Diego, California

Posts: 9,652

It's not a workaround. Only a USC can petition a parent for an immigrant visa (which the sister is). If a petitioner is unable to meet the financial requirement, they are allowed to use a joint sponsor. The joint sponsor does not have to be a USC. It can be any PR or even someone working here on a work visa who meets the financial requirement.

In this case, the fact that the joint sponsor is the brother is not relevant. It could be anyone.

Rene

In this case, the fact that the joint sponsor is the brother is not relevant. It could be anyone.

Rene

#27

Rene

#28

Lost in BE Cyberspace

Joined: May 2010

Location: San Diego, California

Posts: 9,652

I'm going to take a guess that's it's fairly rare to have a USC petitioner who doesn't qualify, to use an LPR sibling as a joint sponsor. But the fact is, the USC can use anyone they want as a joint sponsor. Would it still be pointless if the joint sponsor were a friend? I think this case is unusual and maybe seems unfair because the joint sponsor happens to be a sibling. But it's within the law.

Rene

Rene

#29

Fair enough.

Rene

#30

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

You say the husband's income is above the poverty guideline for the household plus 2 immigrants (the parents)? If that is correct, then there's no need for you to be a joint sponsor.

The I-864 asks for the most recent tax return. If their most recent tax return is 2018, then that's the one they use, along with a statement saying why the more recent tax returns are missing.

One thing to keep in mind when self employed is that only the personal income can be used, not the entire business income. For example, if the business earned $100K, but there were $20K in business expenses, then the amount that counts on the I-864 is $80K.

You also mention your sister is part of her husband's business, but you said she had no income. If her name is on the business then I would say it's her business, too, and thus her income as well. Whose name(s) are exactly on the 1099?

If your sister is NOT in the business and truly has 0 income, then the easiest way would be for her to state 0 income (not using her husband's income) and have you be the joint sponsor. She would still need to provide her tax return, with a statement and proof of how that income shown is not hers, but her husband's.

Rene

The I-864 asks for the most recent tax return. If their most recent tax return is 2018, then that's the one they use, along with a statement saying why the more recent tax returns are missing.

One thing to keep in mind when self employed is that only the personal income can be used, not the entire business income. For example, if the business earned $100K, but there were $20K in business expenses, then the amount that counts on the I-864 is $80K.

You also mention your sister is part of her husband's business, but you said she had no income. If her name is on the business then I would say it's her business, too, and thus her income as well. Whose name(s) are exactly on the 1099?

If your sister is NOT in the business and truly has 0 income, then the easiest way would be for her to state 0 income (not using her husband's income) and have you be the joint sponsor. She would still need to provide her tax return, with a statement and proof of how that income shown is not hers, but her husband's.

Rene

1099 has no names on it, just the name of the company.

Sister is worried about getting into trouble for not returning taxes yet. They are between a rock and a hard place at the moment financially, even though the husband earns ok (been out of work a long time, high outgoings).

An option is selecting 0 incomig for her (because I think it truly is 0) and then adding myself as a household income on her 864. Then I can complete and attach my own 864 as required. The problem is again the tax return forms. She hasnt filed for at least 2019 and 2018. Do we just add 2017 ones? Wouldnt that open up their tax affairs to scrutiny ? Trying to get through the form best I can and avoid them getting into tax into issues.