parents sponsored by child

#1

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Hi all - hope everyoen is doing well

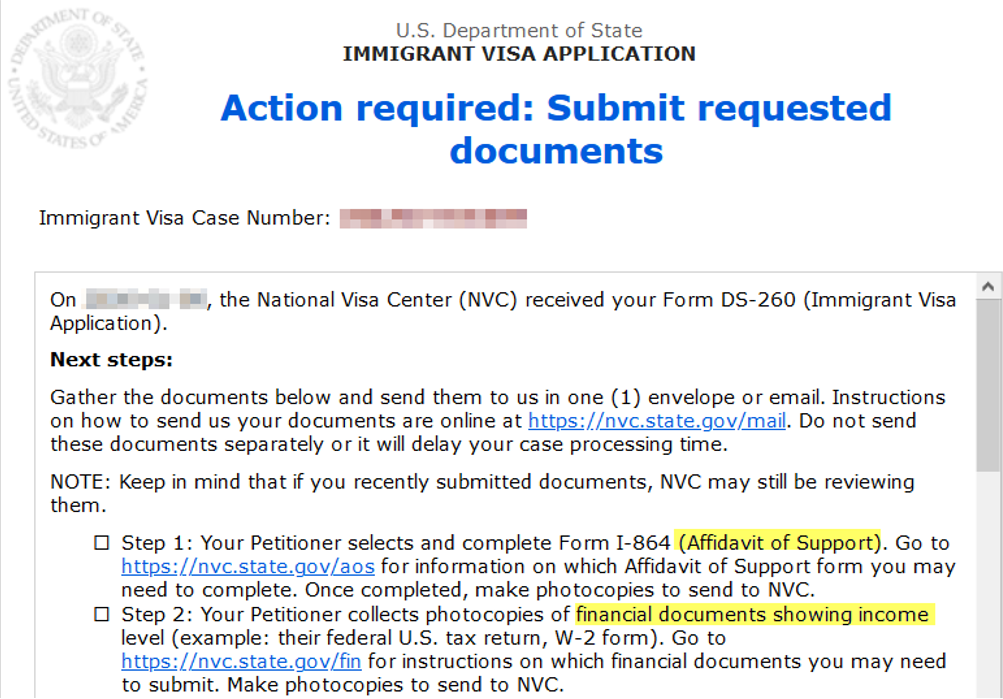

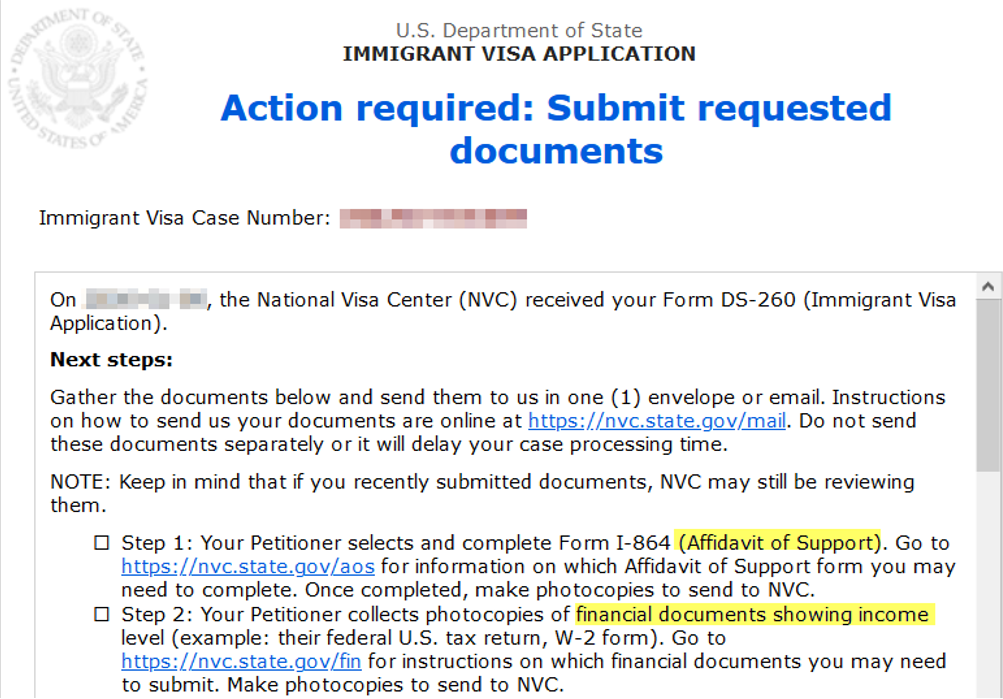

My parents are being sponsored for GC's by my sister who is a US citizen. That said, sister doesnt work, and husband has had work problems due to covid impacting their finances and taxes. Parents are now at interview stage and not sure what to do. I did read somewhere that join sponsorship is possible, as I am a GC holder and my finances are in order. Any help appreciated. Screenshot of case status below in case it helps.

My parents are being sponsored for GC's by my sister who is a US citizen. That said, sister doesnt work, and husband has had work problems due to covid impacting their finances and taxes. Parents are now at interview stage and not sure what to do. I did read somewhere that join sponsorship is possible, as I am a GC holder and my finances are in order. Any help appreciated. Screenshot of case status below in case it helps.

#2

Correct. Your sister can use a joint sponsor. Any USC or LPR living in the USA who earns the right amount can be a joint sponsor.

Rene

Rene

#4

Don't forget you will need two I-864 packages. One for each parent.

Your sister still needs to submit her own I-864 package (one for each parent), even if she doesn't qualify financially.

Rene

Your sister still needs to submit her own I-864 package (one for each parent), even if she doesn't qualify financially.

Rene

#5

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Oh I didnt know that. I was wondering if the requirement for her to submit the 864 will disappear once I upload my joint sponsor stuff. I cant help wondering if what she submits will puts the case at riskor if her submitted is simply formality. Her financial and tax situ is pertty bad (e.g. tax records not up to date for a couple of years now).

#6

She is the sponsor, so she MUST submit the I-864. USCIS will see that she doesn't qualify financially and will look to the joint sponsor's I-864 to fulfill the requirements.

Rene

Rene

#7

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Will the fact that shes not in good standing for tax returns with the IRS pose a potential problem ?

I, as the joint sponsor, have been totally on top of taxes, loans, debt etc.

I, as the joint sponsor, have been totally on top of taxes, loans, debt etc.

#8

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

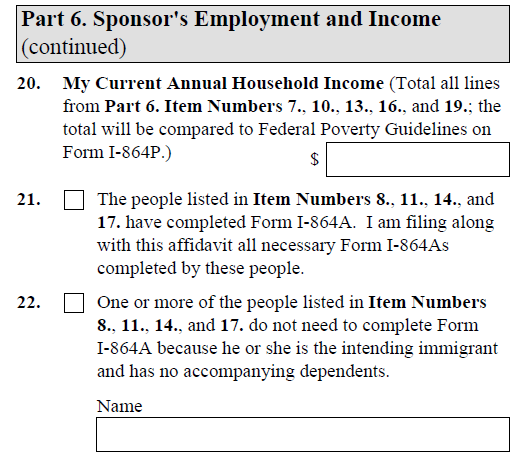

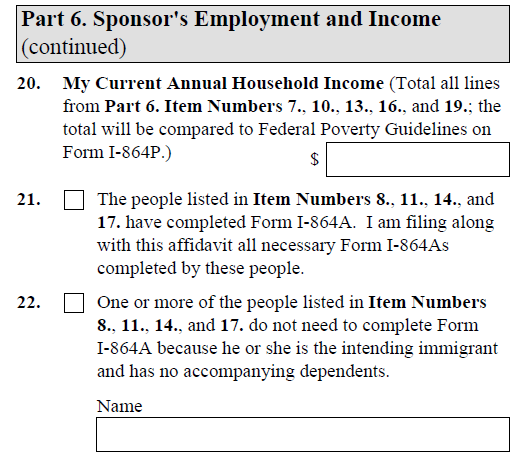

On the i 864 in part 5 "household Size", there are boxes to add income from additional persons. Given my sister will be completing her i864, albeit she wont have the finances to support, do I need to include her into Part 5? If so, how would I complete this part 6 ...

#9

Rene

#10

Rene

#11

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Thank you Noorah!

#12

BE Enthusiast

Thread Starter

Joined: Feb 2008

Posts: 703

Ok another thing I am now wondering - if I sister isnt working, and she hasnt filed taxes herself (just as part of main person in the household) then does she say her tax forms werent returned? Thre is a box for that ...

#13

Filing a joint return is still filing a return, your SSN is included on the form.

#15

Forum Regular

Joined: Jan 2017

Posts: 246

What exactly do you mean by "as part of main person in the household"? If you mean she files jointly with her spouse (i.e. they file one tax return with filing status Married Filing Jointly), then technically that tax return is his tax return and her tax return at the same time; in that case, she has filed a tax return for that year. On the other hand, if you mean someone claimed her as a dependent on their tax return, then that does not mean she has filed a tax return. Being claimed as a dependent and filing a tax return are independent things (someone claimed as a dependent can still file their own tax return, and in some cases must still file their own tax return; it's just that when they file their tax return, they would check the box on form 1040 that says someone can claim them as a dependent). If she did not file a tax return (regardless of whether she was claimed as a dependent), she would have to say she didn't file a tax return. And the only way she can not file a tax return is if her income that year was below the threshold for needing to file. If that is the case, she would check box 25 and attach a statement stating how her income was below the threshold for the relevant years.