How do the osbournes get away with U.S immigration?

#16

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,129

I am a USC and it is important for me to declare my domicile as Britain so that I can claim my UK taxes as foreign tax credits against my US taxes.

#17

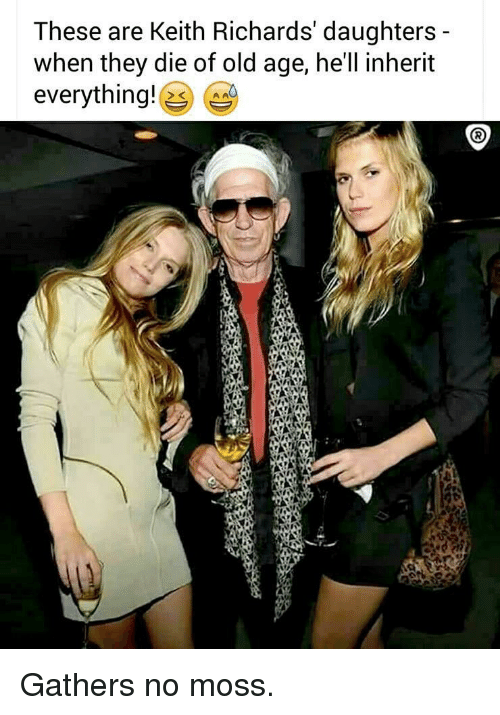

Good for Kieth - his body shows clear signs of wear and tear! I would imagine he has some stories to tell!

I put domiciled in quotes because I was looking for musicians who were British and who resided in the US. The website I read said he was domiciled in CT for tax purposes, so I wasn't sure if that meant he just maintained a property in CT and paid lip-service to living there or not ... obviously not from what you are saying. I assume he has enough money to own and live in homes all over the world. I'm not familiar with the nuances of the term domiciled so put it in quotes. Anyway, good for him getting his act together - lots of temptation when you have that kind of money and access.

I put domiciled in quotes because I was looking for musicians who were British and who resided in the US. The website I read said he was domiciled in CT for tax purposes, so I wasn't sure if that meant he just maintained a property in CT and paid lip-service to living there or not ... obviously not from what you are saying. I assume he has enough money to own and live in homes all over the world. I'm not familiar with the nuances of the term domiciled so put it in quotes. Anyway, good for him getting his act together - lots of temptation when you have that kind of money and access.

#19

Account Closed

Joined: Mar 2004

Posts: 2

Resident and Domicile have various meanings depending on the given situation. There is no standard definition.

#20

Account Closed

Joined: Jan 2006

Posts: 0

#22

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,129

In reality though only those with 6 figure incomes need to worry about actually owing US taxes, foreign earned income exclusion is into the low 6 figures now, $104,100 for 2018. Unless making over that your pretty safe not owing any US taxes, but you would still need to file.

Last edited by durham_lad; Nov 19th 2019 at 8:00 pm.

#23

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,129

#24

Account Closed

Joined: Jan 2006

Posts: 0

Guess being poor I think in too simplistic terms, pensions and investments are not something we have to fuss with.

#25

Oh to be a rock star ...

#26

BE Forum Addict

Joined: Aug 2013

Location: Eee Bah Gum

Posts: 4,129

Do Royalties not count as earned? I would have thought he has a steady stream of royalties from (eg) radio stations that play his music (never understood how that works but that's how I imagine it to be). Also, every time someone buys a Stones album, or downloads a Stones song from iTunes (not likely to be big, but probably a steady flow). And, of course, the guy is still PLAYING! So I presume concert performances generate income ...

Oh to be a rock star ...

Oh to be a rock star ...

Last edited by durham_lad; Nov 19th 2019 at 8:35 pm.

#27

Account Closed

Joined: Oct 2003

Posts: 0

Why is "domiciled" in quotes? Keith cleaned up many years ago. He lives a few miles away from me, and has been nothing but a model citizen in CT, sending his daughters to the local high school -- where he always came to plays and teacher meetings -- and supporting local arts nonprofits not only financially, but by attending events. His nephew owns a restaurant and it's pot luck as to whether he might turn up driving an older Porsche at lunch time and hang out there.