Simple income tax calculation question.

#1

BE Enthusiast

Thread Starter

Joined: Jul 2016

Location: Alvaiázere, central Portugal

Posts: 591

On another thread about RNH the question has arisen about deductions from income, with a figure of about 4104 euros in mind. Many of us are puzzled, and understandable explanations of this are not yet unearthed. Do you, as a taxpayer or who knows the position of a taxpayer, have personal knowledge and can throw some light on this?

This is what we are wondering.

This is what we are wondering.

- Is there such a personal deduction?

- If so (disregarding other possible deductions) is its size related to income?

- Is it applied for working people and pensioners alike?

- Is it per person?

- does taxable income start at and above that deductible amount?

#2

BE Forum Addict

Joined: Jul 2009

Posts: 1,835

http://info.portaldasfinancas.gov.pt...ges/irs53.aspx suggests it's a deduction from pension income.

#3

BE Enthusiast

Thread Starter

Joined: Jul 2016

Location: Alvaiázere, central Portugal

Posts: 591

http://info.portaldasfinancas.gov.pt...ges/irs53.aspx suggests it's a deduction from pension income.

So it would appear to me that is is in fact identical in use to a UK personal allowance, And that an income of (for example) 14,104 euros would have ‘taxable’ income of 10,000. Hence 7120 at 2020 levels would be taxed at 14.5%, and the remainder taxed at the next band rate of 23%. Nothing would be taxes at the next rate, which starts at 10,732.

Agree with this?

#5

BE Forum Addict

Joined: Mar 2008

Posts: 1,705

This is what I was talkig about, its as if no one that looks at this forum actually pays any tax in Portugal!!

#6

BE Forum Addict

Joined: Mar 2008

Posts: 1,705

Presume someone will finally be able to bottom this question,

With a fluctuating £/€, with Sterling increasing in value against the Euro (and IMO likely to go much higher over the next couple of years), how does the IRS in Portugal determine the income value in Euros??

With a fluctuating £/€, with Sterling increasing in value against the Euro (and IMO likely to go much higher over the next couple of years), how does the IRS in Portugal determine the income value in Euros??

#7

I'll just add a little to what Richard's already said and apologies in advance if I unnecessarily repeat anything.

Yes, it exists and yes it's identical for dependent employment and pension income with the exception that if Social Security contributions exceed that sum the deduction is the higher amount. There's a proviso on that latter point on the exact nature of the SS contributions but presumably you're not bothered with that at the moment. Other than that, the amount won't vary.

Yes it's per person on a joint declaration, so you get twice the deduction but that's provided both of you have qualifying income. If only one of you does, you only get it once.

Yes, you make the deduction from your gross income and then apply the scale rates.

Going back to the PWC simulator you posted a link to on the other thread, if you feed in a gross figure for employment or pension, it does actually do the calculation correctly. So, on this for example :

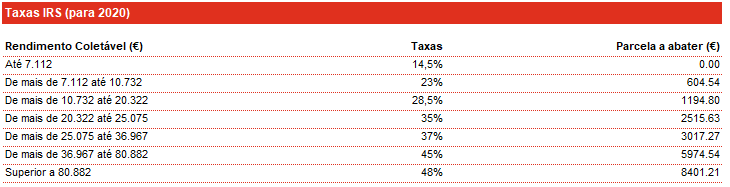

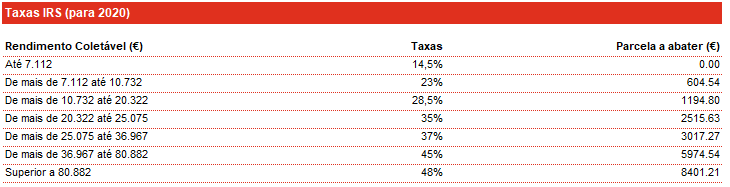

(I'm going to split hairs with you here, as we're dealing with actual figures and I'm going to work it through 3 ways. 7,120 should read 7,112  , otherwise agreed).

, otherwise agreed).

That's 7,112 @ 14.5% = 1,031.24

plus 2,888 @ 23% = 664.24

Total 1,695.48

Alternatively, from the information tab on the simulator :

You take your 10,000 and multiply it by 23% giving 2,300 and knock off the figure of 604.54 in the "parcela a abater" column leaving 1,695.46

And if you feed 14,104 in either to the work or pension income fields in the simulator sheet, it also returns 1,695.46 tax due, although it doesn't itemise the 4,104 deduction from gross anywhere in the results.

This is what we are wondering.

- Is there such a personal deduction?

- If so (disregarding other possible deductions) is its size related to income?

- Is it applied for working people and pensioners alike?

- Is it per person?

- does taxable income start at and above that deductible amount?

Yes it's per person on a joint declaration, so you get twice the deduction but that's provided both of you have qualifying income. If only one of you does, you only get it once.

Yes, you make the deduction from your gross income and then apply the scale rates.

Going back to the PWC simulator you posted a link to on the other thread, if you feed in a gross figure for employment or pension, it does actually do the calculation correctly. So, on this for example :

So it would appear to me that is is in fact identical in use to a UK personal allowance, And that an income of (for example) 14,104 euros would have ‘taxable’ income of 10,000. Hence 7120 at 2020 levels would be taxed at 14.5%, and the remainder taxed at the next band rate of 23%. Nothing would be taxes at the next rate, which starts at 10,732.

Agree with this?

Agree with this?

, otherwise agreed).

, otherwise agreed).That's 7,112 @ 14.5% = 1,031.24

plus 2,888 @ 23% = 664.24

Total 1,695.48

Alternatively, from the information tab on the simulator :

You take your 10,000 and multiply it by 23% giving 2,300 and knock off the figure of 604.54 in the "parcela a abater" column leaving 1,695.46

And if you feed 14,104 in either to the work or pension income fields in the simulator sheet, it also returns 1,695.46 tax due, although it doesn't itemise the 4,104 deduction from gross anywhere in the results.

Last edited by Red Eric; Jan 27th 2020 at 7:37 am.

#8

BE Forum Addict

Joined: Mar 2008

Posts: 1,705

Using my own thoughts it works like this: in case of income from pension of €14,000

up to €7112 @14.5% (in practice is €3000 @ 14.5% = €435 435

7112 - 10732 @23% (in practice is €3600 @ 23% = €828 1263

10732 - 20322 @28.5% (in practice is €3300 @ 28.5% =€ 940 2203

SO total tax bill of €2203 - €604 = €1599.00 tax to pay in total on pension income of €14,000

(Taxable amount would increase if Sterling rises against the Euro orthe opposite if Sterling drops).

Yet to determine at what exchange rate income in € is calculated (i think its a figure taken at a mid year point value??)

up to €7112 @14.5% (in practice is €3000 @ 14.5% = €435 435

7112 - 10732 @23% (in practice is €3600 @ 23% = €828 1263

10732 - 20322 @28.5% (in practice is €3300 @ 28.5% =€ 940 2203

SO total tax bill of €2203 - €604 = €1599.00 tax to pay in total on pension income of €14,000

(Taxable amount would increase if Sterling rises against the Euro orthe opposite if Sterling drops).

Yet to determine at what exchange rate income in € is calculated (i think its a figure taken at a mid year point value??)

#9

BE Enthusiast

Thread Starter

Joined: Jul 2016

Location: Alvaiázere, central Portugal

Posts: 591

I am beginning to get a glimmer of understanding, here!

Nicely explained, Red Eric - many thanks!

where is the 96 euro tax difference between RE and wellinever come from?

Nicely explained, Red Eric - many thanks!

where is the 96 euro tax difference between RE and wellinever come from?

Last edited by Diddion; Jan 27th 2020 at 9:21 am.

#10

BE Forum Addict

Joined: Mar 2008

Posts: 1,705

hi

Must admit I am not sure about the abater.

It may be that you also get a `part allowance` of the abater of €1194, for the income between €10,700 - €14,000.

The way I would work that out is that you would have €3300 out of €9600 which is 34%, which would be 34% of €1194 = €400.

That way the final tax bill would be €1599 - €400 = €1199

Must admit I am not sure about the abater.

It may be that you also get a `part allowance` of the abater of €1194, for the income between €10,700 - €14,000.

The way I would work that out is that you would have €3300 out of €9600 which is 34%, which would be 34% of €1194 = €400.

That way the final tax bill would be €1599 - €400 = €1199

#12

BE Enthusiast

Thread Starter

Joined: Jul 2016

Location: Alvaiázere, central Portugal

Posts: 591

I did wonder if that was the case.....The way wellinever has approached it is to assume the deduction remains the same across the entire band, which would not make sense - since, a 1 euro difference when you cross from 1 band to another would make a big stepwise deduction in tax. Now I am getting there, | do think that the way it is presented is somewhat opaque.

Last edited by Diddion; Jan 27th 2020 at 9:46 am.

#14

Just Joined

Joined: Nov 2017

Posts: 18

Hello,

Put simply: the deduction you are referring to does not work like the UK personal allowance.

It is a deduction applied to employment-based income, extended also to pensions, for example.

Put simply: the deduction you are referring to does not work like the UK personal allowance.

It is a deduction applied to employment-based income, extended also to pensions, for example.