CGT on sale of property

#107

Curiosity having got the better of me and having a bit of spare time on my hands, I had a bit of a delve into the legal side of things where cases had got as far as the ECJ, in order to see exactly what issues had prompted the new arrangements. This is by no means an exhaustive list - just a sample of 3 cases, all from 2021, which turned up in the results from the terms I searched, and which shed some light on the changes and why they now apply universally, as opposed to only to residents of other EU / EEA member states.

Case A

Case B

Case C

All the documents in each case are available from the page you land on. Cases A & B concern residents of other EU member states, A claiming discrimination on grounds of nationality and B restriction of free movement of capital.

Documentation in A includes an initial opinion (available in English), which is very lengthy and detailed and lays out everything which must be considered and where the possible points of conflict between national and community law are. Well worth ploughing through - complicated, couched in legalese but at the same time clear and pretty much confirming what I thought should be the case in the circs (but adding somewhat to my sketchy knowledge of the salient issues). In the end, the opinion is that PT law in this matter is not at odds with EU law, but that opinion is contradicted in the actual judgement, which goes the other way.

Case B similarly goes against the PT Tax authority (in that one the relevant document for the detail is the one titled "Order", which for some reason isn't available in English, but is in Portuguese).

In both these cases, the complainants had the option to elect to be taxed on the same basis as PT residents (ie 50% of the gain, at scale rates, taking into account worldwide income in the calculation of tax due on the gain) but chose not to exercise that option, instead choosing to be taxed as non-residents and pay 28% on the full gain. I find it odd that, having been presented with the choice, and having freely chosen not to be taxed as a resident would be, they even thought they had grounds for complaint, let alone that the courts also found in their favour. The initial opinion in Case A dwells a little on this point and does suggest the possibility that at least some of those bringing such cases may have had an eye to getting the double benefit of having 50% of the gain disregarded and not, as non-residents, having to declare and have taken into account their worldwide income. A conclusion which is very difficult to find fault with.

Case C was also an interesting one, focusing as it does on a resident of a non EU country and the possible contravention of EU principles of free movement of capital between the EU and the rest of the world. I wasn't aware that existed but in view of the fact that it does and that PT CGT calculation had been found to contravene rules on free movement of capital within the EU (notwithstanding the existence of an option to nullify that), it wasn't then a great surprise to find that one also went against PT. (again, it's the "Order" document, not available in English, for the full details).

Anyway, that seems to cover why we now have the one rule for all, be it residents, non-residents in EU member states or non-residents in the rest of the world. I wonder if there'll be any complaints about that outcome?

It was interesting (for me, at least) to get a fuller flavour of the background rather than just the potted versions which tend to be floated in reports, particularly those aimed at certain audiences.

Case A

Case B

Case C

All the documents in each case are available from the page you land on. Cases A & B concern residents of other EU member states, A claiming discrimination on grounds of nationality and B restriction of free movement of capital.

Documentation in A includes an initial opinion (available in English), which is very lengthy and detailed and lays out everything which must be considered and where the possible points of conflict between national and community law are. Well worth ploughing through - complicated, couched in legalese but at the same time clear and pretty much confirming what I thought should be the case in the circs (but adding somewhat to my sketchy knowledge of the salient issues). In the end, the opinion is that PT law in this matter is not at odds with EU law, but that opinion is contradicted in the actual judgement, which goes the other way.

Case B similarly goes against the PT Tax authority (in that one the relevant document for the detail is the one titled "Order", which for some reason isn't available in English, but is in Portuguese).

In both these cases, the complainants had the option to elect to be taxed on the same basis as PT residents (ie 50% of the gain, at scale rates, taking into account worldwide income in the calculation of tax due on the gain) but chose not to exercise that option, instead choosing to be taxed as non-residents and pay 28% on the full gain. I find it odd that, having been presented with the choice, and having freely chosen not to be taxed as a resident would be, they even thought they had grounds for complaint, let alone that the courts also found in their favour. The initial opinion in Case A dwells a little on this point and does suggest the possibility that at least some of those bringing such cases may have had an eye to getting the double benefit of having 50% of the gain disregarded and not, as non-residents, having to declare and have taken into account their worldwide income. A conclusion which is very difficult to find fault with.

Case C was also an interesting one, focusing as it does on a resident of a non EU country and the possible contravention of EU principles of free movement of capital between the EU and the rest of the world. I wasn't aware that existed but in view of the fact that it does and that PT CGT calculation had been found to contravene rules on free movement of capital within the EU (notwithstanding the existence of an option to nullify that), it wasn't then a great surprise to find that one also went against PT. (again, it's the "Order" document, not available in English, for the full details).

Anyway, that seems to cover why we now have the one rule for all, be it residents, non-residents in EU member states or non-residents in the rest of the world. I wonder if there'll be any complaints about that outcome?

It was interesting (for me, at least) to get a fuller flavour of the background rather than just the potted versions which tend to be floated in reports, particularly those aimed at certain audiences.

#108

Forum Regular

Joined: Jun 2021

Location: North West England and Eastern Algarve

Posts: 125

Curiosity having got the better of me and having a bit of spare time on my hands, I had a bit of a delve into the legal side of things where cases had got as far as the ECJ, in order to see exactly what issues had prompted the new arrangements. This is by no means an exhaustive list - just a sample of 3 cases, all from 2021, which turned up in the results from the terms I searched, and which shed some light on the changes and why they now apply universally, as opposed to only to residents of other EU / EEA member states.

Case A

Case B

Case C

All the documents in each case are available from the page you land on. Cases A & B concern residents of other EU member states, A claiming discrimination on grounds of nationality and B restriction of free movement of capital.

Documentation in A includes an initial opinion (available in English), which is very lengthy and detailed and lays out everything which must be considered and where the possible points of conflict between national and community law are. Well worth ploughing through - complicated, couched in legalese but at the same time clear and pretty much confirming what I thought should be the case in the circs (but adding somewhat to my sketchy knowledge of the salient issues). In the end, the opinion is that PT law in this matter is not at odds with EU law, but that opinion is contradicted in the actual judgement, which goes the other way.

Case B similarly goes against the PT Tax authority (in that one the relevant document for the detail is the one titled "Order", which for some reason isn't available in English, but is in Portuguese).

In both these cases, the complainants had the option to elect to be taxed on the same basis as PT residents (ie 50% of the gain, at scale rates, taking into account worldwide income in the calculation of tax due on the gain) but chose not to exercise that option, instead choosing to be taxed as non-residents and pay 28% on the full gain. I find it odd that, having been presented with the choice, and having freely chosen not to be taxed as a resident would be, they even thought they had grounds for complaint, let alone that the courts also found in their favour. The initial opinion in Case A dwells a little on this point and does suggest the possibility that at least some of those bringing such cases may have had an eye to getting the double benefit of having 50% of the gain disregarded and not, as non-residents, having to declare and have taken into account their worldwide income. A conclusion which is very difficult to find fault with.

Case C was also an interesting one, focusing as it does on a resident of a non EU country and the possible contravention of EU principles of free movement of capital between the EU and the rest of the world. I wasn't aware that existed but in view of the fact that it does and that PT CGT calculation had been found to contravene rules on free movement of capital within the EU (notwithstanding the existence of an option to nullify that), it wasn't then a great surprise to find that one also went against PT. (again, it's the "Order" document, not available in English, for the full details).

Anyway, that seems to cover why we now have the one rule for all, be it residents, non-residents in EU member states or non-residents in the rest of the world. I wonder if there'll be any complaints about that outcome?

It was interesting (for me, at least) to get a fuller flavour of the background rather than just the potted versions which tend to be floated in reports, particularly those aimed at certain audiences.

Case A

Case B

Case C

All the documents in each case are available from the page you land on. Cases A & B concern residents of other EU member states, A claiming discrimination on grounds of nationality and B restriction of free movement of capital.

Documentation in A includes an initial opinion (available in English), which is very lengthy and detailed and lays out everything which must be considered and where the possible points of conflict between national and community law are. Well worth ploughing through - complicated, couched in legalese but at the same time clear and pretty much confirming what I thought should be the case in the circs (but adding somewhat to my sketchy knowledge of the salient issues). In the end, the opinion is that PT law in this matter is not at odds with EU law, but that opinion is contradicted in the actual judgement, which goes the other way.

Case B similarly goes against the PT Tax authority (in that one the relevant document for the detail is the one titled "Order", which for some reason isn't available in English, but is in Portuguese).

In both these cases, the complainants had the option to elect to be taxed on the same basis as PT residents (ie 50% of the gain, at scale rates, taking into account worldwide income in the calculation of tax due on the gain) but chose not to exercise that option, instead choosing to be taxed as non-residents and pay 28% on the full gain. I find it odd that, having been presented with the choice, and having freely chosen not to be taxed as a resident would be, they even thought they had grounds for complaint, let alone that the courts also found in their favour. The initial opinion in Case A dwells a little on this point and does suggest the possibility that at least some of those bringing such cases may have had an eye to getting the double benefit of having 50% of the gain disregarded and not, as non-residents, having to declare and have taken into account their worldwide income. A conclusion which is very difficult to find fault with.

Case C was also an interesting one, focusing as it does on a resident of a non EU country and the possible contravention of EU principles of free movement of capital between the EU and the rest of the world. I wasn't aware that existed but in view of the fact that it does and that PT CGT calculation had been found to contravene rules on free movement of capital within the EU (notwithstanding the existence of an option to nullify that), it wasn't then a great surprise to find that one also went against PT. (again, it's the "Order" document, not available in English, for the full details).

Anyway, that seems to cover why we now have the one rule for all, be it residents, non-residents in EU member states or non-residents in the rest of the world. I wonder if there'll be any complaints about that outcome?

It was interesting (for me, at least) to get a fuller flavour of the background rather than just the potted versions which tend to be floated in reports, particularly those aimed at certain audiences.

Last edited by ARCNET; Jan 14th 2023 at 3:10 pm.

#109

BE Enthusiast

Joined: Feb 2019

Posts: 418

Great work Red Eric although I'll rely on your reading thanks.  By the way the restrictions on movements of capital to and from non-Member States was covered in this case back in 2018. The law does grind slow doesn't it!

By the way the restrictions on movements of capital to and from non-Member States was covered in this case back in 2018. The law does grind slow doesn't it!

By the way the restrictions on movements of capital to and from non-Member States was covered in this case back in 2018. The law does grind slow doesn't it!

By the way the restrictions on movements of capital to and from non-Member States was covered in this case back in 2018. The law does grind slow doesn't it!Last edited by appman999; Jan 14th 2023 at 3:13 pm.

#110

...By the way the restrictions on movements of capital to and from non-Member States was covered in this case back in 2018. ...

Anyway, water under the bridge now. Suffice to say that the point of contention in all these cases was not actually about fairness or discrimination against persons but about whether or not the provisions in PT law offended against the principle of free movement of capital, and they had to delve very deeply to make that case. Just so we're all cognisant of the main (or only, in fact) concern, since even the case that was brought on grounds including discrimination on the basis of nationality (or residence) had those complaints discarded and only capital movement considered. And right up to the highest authorities, it still certainly isn't unanimously agreed that PT was offending.

#111

Forum Regular

Joined: Apr 2013

Location: Newcastle and Tavira

Posts: 146

Red Eric,

Have just stumbled on this thread, and wanted to say how impressed I was at the depth of info which you have posted.

In my own case, I am a PT property owner for around 10 years, but still UK resident. We stay here for part of the year and rent out the rest of the year on an official (AL) basis. All done officially, and annual tax returns are filed by our local fiscal rep.

We are now considering selling up in PT in 2024, and moving any proceeds back to the UK, and had previously assumed we would have to pay 28% CGT on any profit.

Your comments that this CGT liability may now be reduced by 50% are very welcome, so I hope you don’t mind if I lurk on this thread to see what happens over time.

Have just stumbled on this thread, and wanted to say how impressed I was at the depth of info which you have posted.

In my own case, I am a PT property owner for around 10 years, but still UK resident. We stay here for part of the year and rent out the rest of the year on an official (AL) basis. All done officially, and annual tax returns are filed by our local fiscal rep.

We are now considering selling up in PT in 2024, and moving any proceeds back to the UK, and had previously assumed we would have to pay 28% CGT on any profit.

Your comments that this CGT liability may now be reduced by 50% are very welcome, so I hope you don’t mind if I lurk on this thread to see what happens over time.

#112

BE Enthusiast

Joined: Feb 2019

Posts: 418

AFAIK as a UK resident you are also liable for CGT in the UK but can set your Portuguese tax against that.

As I'm sure you are aware in April 2024 the UK CGT tax free allowance halves from £6,000 to £3,000 so if you are selling in 2024 might be safest to do before April?

Of course it all depends on the income in each country and level of gain.

As I'm sure you are aware in April 2024 the UK CGT tax free allowance halves from £6,000 to £3,000 so if you are selling in 2024 might be safest to do before April?

Of course it all depends on the income in each country and level of gain.

#113

Forum Regular

Joined: Apr 2013

Location: Newcastle and Tavira

Posts: 146

Good point ! - as it happens, April 2024 will also be the 10th anniversary of our PT house purchase, but as there does not seem to be any CGT benefit in terms of length of property ownership, that doesn’t seem to be relevant?

#115

Forum Regular

Joined: Jun 2021

Location: North West England and Eastern Algarve

Posts: 125

#116

BE Forum Addict

Thread Starter

Joined: Mar 2008

Posts: 1,705

Red Eric,

Have just stumbled on this thread, and wanted to say how impressed I was at the depth of info which you have posted.

In my own case, I am a PT property owner for around 10 years, but still UK resident. We stay here for part of the year and rent out the rest of the year on an official (AL) basis. All done officially, and annual tax returns are filed by our local fiscal rep.

We are now considering selling up in PT in 2024, and moving any proceeds back to the UK, and had previously assumed we would have to pay 28% CGT on any profit.

Your comments that this CGT liability may now be reduced by 50% are very welcome, so I hope you don’t mind if I lurk on this thread to see what happens over time.

Have just stumbled on this thread, and wanted to say how impressed I was at the depth of info which you have posted.

In my own case, I am a PT property owner for around 10 years, but still UK resident. We stay here for part of the year and rent out the rest of the year on an official (AL) basis. All done officially, and annual tax returns are filed by our local fiscal rep.

We are now considering selling up in PT in 2024, and moving any proceeds back to the UK, and had previously assumed we would have to pay 28% CGT on any profit.

Your comments that this CGT liability may now be reduced by 50% are very welcome, so I hope you don’t mind if I lurk on this thread to see what happens over time.

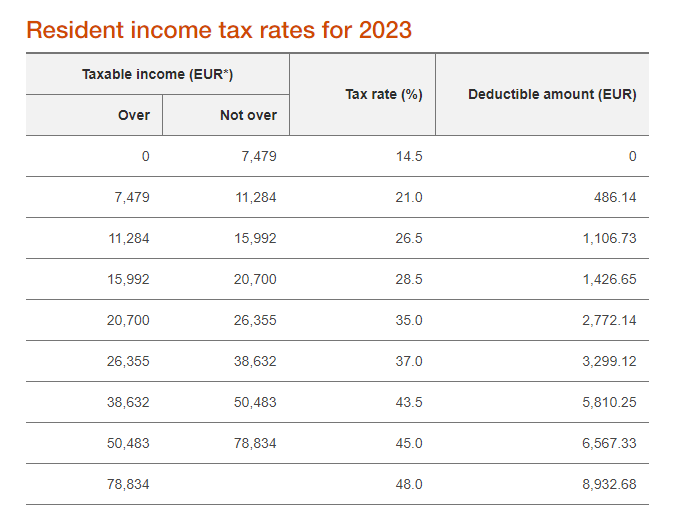

PT tax rates can be found here......First €4104 is tax free.

#117

Its not quite that simple. In order to be taxed in that way, the capital gain is indeed halved, but you must add your worldwide income for the year if sale to that figure. Thats then taxed at the PT tax rates for income. Capital gain in PT is considered as income rather than having a separate tax regime. But I am not sure about any tax already paid on income from UK, whether that is allowable against PT tax, maybe someone knows.

The other income is declared and used in the calculation to determine which band(s) the gain should be taxed at.

Assuming that the income includes at least that amount of salary or pension.

That deduction doesn't apply to other categories of income.

#118

Forum Regular

Joined: Feb 2021

Posts: 38

Ok 3 things to consider.

We declared our gain to PT last year. This was based on 28% of 100% gain. We now know this was an overcharge and are now applying to reduce this by half.

The CGT in PT is very high compared to the UK (however the recent allowance reduction in the UK increases the UK tax due so beware) so we declared first in PT and then declared in the UK. The UK tax authority then took into consideration the PT tax paid and we reduced our tax bill in the UK to zero.

If you are selling up then try and reduce your income (UK presumably) as much as poss for that tax year. That way your tax bracket for PT CG will be lower and you might pay less PT tax.

Interesting question remains. Given the UK tax year is April to April and the PT is Jan-Dec, How do you prove your income to PT for their Jan-Dec tax year. A formal UK tax bill for a UK year will not be relevant, so you have to do a crib sheet fag packet calculation. Not sure how the PT authorities will accept this…..but in principle they might.

Good luck.

We declared our gain to PT last year. This was based on 28% of 100% gain. We now know this was an overcharge and are now applying to reduce this by half.

The CGT in PT is very high compared to the UK (however the recent allowance reduction in the UK increases the UK tax due so beware) so we declared first in PT and then declared in the UK. The UK tax authority then took into consideration the PT tax paid and we reduced our tax bill in the UK to zero.

If you are selling up then try and reduce your income (UK presumably) as much as poss for that tax year. That way your tax bracket for PT CG will be lower and you might pay less PT tax.

Interesting question remains. Given the UK tax year is April to April and the PT is Jan-Dec, How do you prove your income to PT for their Jan-Dec tax year. A formal UK tax bill for a UK year will not be relevant, so you have to do a crib sheet fag packet calculation. Not sure how the PT authorities will accept this…..but in principle they might.

Good luck.