CGT on sale of property

#46

BE Forum Addict

Thread Starter

Joined: Mar 2008

Posts: 1,704

( I am not sure if the tax free for over 65s is given to non Spanish residents?)

Given that property prices dont inflate so much over that period, then little CG would be made over that time. I dont see another house price boom such as over the last 3 years due to all central banks pumping money into their systems, giving rise to v low interest rates, which they have now all stopped.

My guess is that, based on known info at the moment, you could easily change from being a PT resident in that 3 years, and become non resident, ( unless there is something that says you have to remain a PT tax resident ) as the CGT implication would be same as a resident. Given little CG i that time UK tax would also be small, if any.

Of course its all based on guess work for the economies, but we are in line for a slowing for sure, and CG as far a s property is concerned is all based on that.

Last edited by wellinever; Jan 8th 2023 at 9:50 am.

#47

BE Enthusiast

Joined: Feb 2019

Posts: 418

We are non residents and sold our holiday home on the Algarve in Dec 2021. We had to pay 28% tax on the full nett gain in our 2022 tax return but having seen the various articles regarding the EU case re discrimination (and advise from Tony Jesus), we raised a claim for 50% and this was eventually accepted and refunded.

As I understand it as of 1 Jan 2023 this has been codified and should therefore be automatically granted without need for a claim.

I also thought residents had the option to select either the 28% tax on 50% or marginal progressive rates on 50%, whichever suited them best?

As I understand it as of 1 Jan 2023 this has been codified and should therefore be automatically granted without need for a claim.

I also thought residents had the option to select either the 28% tax on 50% or marginal progressive rates on 50%, whichever suited them best?

#48

Residents are obliged to declare the gain and their worldwide income. 50% of the gain is taxed at progressive rates after taking into account the other income. They do not have any flat rate option at all.

A non-resident who made a sale in 2021, with income from anywhere in the world in excess of 10,732€ taxable income according to PT rules before the gain, if paying 28% on 50% of the gain is already ahead on what a PT resident must pay, regardless of the size of the gain. On that basis, the more the income from other sources and /or the bigger the gain, the more out of whack it becomes in the non-resident's favour.

We are non residents and sold our holiday home on the Algarve in Dec 2021. We had to pay 28% tax on the full nett gain in our 2022 tax return but having seen the various articles regarding the EU case re discrimination (and advise from Tony Jesus), we raised a claim for 50% and this was eventually accepted and refunded.

As I understand it as of 1 Jan 2023 this has been codified and should therefore be automatically granted without need for a claim.

As I understand it as of 1 Jan 2023 this has been codified and should therefore be automatically granted without need for a claim.

The alterations to the law now leave no option for non-residents to benefit from a flat rate of tax on capital gains on property. Thenceforth, they must declare their worldwide income and be taxed at progressive rates on half the gain, on the same basis as residents.

Last edited by Red Eric; Jan 8th 2023 at 1:32 pm.

#49

Forum Regular

Joined: Feb 2021

Posts: 38

Hi Appman, That’s an excellent update for those in a similar situation. Can I ask you, did you claim via your fiscal rep that presumably like us filed the original AT tax return/bill thereafter or did you claim via a tax lawyer?….or another way. Most grateful.

#50

BE Enthusiast

Joined: Feb 2019

Posts: 418

I raised a gracious complaint myself through the AT website quoting the various EU issues.

However from Red Eric's comments I was very lucky to be able to get the 50% solution and this may not be available any longer although if it came into law in 2023 maybe it will still work for 2022 tax year?

However from Red Eric's comments I was very lucky to be able to get the 50% solution and this may not be available any longer although if it came into law in 2023 maybe it will still work for 2022 tax year?

#51

BE Forum Addict

Thread Starter

Joined: Mar 2008

Posts: 1,704

So just to clarify the situation for this year and beyond would someone like to confirm my understanding of the situation for a non resident Brit

Using actual gain in PT of 100,000e after time owned allowance(£87,000). Using exchange rate of 1.15 throughout

UK resident earning £35,000pa (e40,250)

New tax regime would require UK resident to give income earnings to PT taxman, in oredr to calculate tax rate.

In the case above therefore, total income would be e100,000 + e40,250 = e 140,250.

In this instance the total income would require a tax rate of 48% on 50% of the gain (actual work income not taxed in PT).

So tax would be on 50,000e at 48% less deduction of e8900.

That is then 24,000 less e8900 = e15,100 in tax = (£13,100)

So a tax rate of 15% on the whole gain in PT.

Tax would also be due in the UK CGT for sale of second(holiday home).

That would be in the following manner, as a Tax resident of UK

Gain of e100,000(£87,000) with income of £35,000

Would give rise to a tax bill in UK of £19,400 (at the moment) (see www.taxscouts.com for calculator)

(Capital gain Tax allowance to be reduced from £12,300 to £6700 in April 2023)

With DT having paid £13,100 in PT, UK would want a further £6,300

So in summary in this case, the seller would have paid £13,000 in PT + £6,300 in UK

Making a total of £19,300 tax on a gain of £87,000 or a rate of 22%

What would be interesting is how much would be paid if the seller was a Brit, but resident in PT doing the same thing.

Using actual gain in PT of 100,000e after time owned allowance(£87,000). Using exchange rate of 1.15 throughout

UK resident earning £35,000pa (e40,250)

New tax regime would require UK resident to give income earnings to PT taxman, in oredr to calculate tax rate.

In the case above therefore, total income would be e100,000 + e40,250 = e 140,250.

In this instance the total income would require a tax rate of 48% on 50% of the gain (actual work income not taxed in PT).

So tax would be on 50,000e at 48% less deduction of e8900.

That is then 24,000 less e8900 = e15,100 in tax = (£13,100)

So a tax rate of 15% on the whole gain in PT.

Tax would also be due in the UK CGT for sale of second(holiday home).

That would be in the following manner, as a Tax resident of UK

Gain of e100,000(£87,000) with income of £35,000

Would give rise to a tax bill in UK of £19,400 (at the moment) (see www.taxscouts.com for calculator)

(Capital gain Tax allowance to be reduced from £12,300 to £6700 in April 2023)

With DT having paid £13,100 in PT, UK would want a further £6,300

So in summary in this case, the seller would have paid £13,000 in PT + £6,300 in UK

Making a total of £19,300 tax on a gain of £87,000 or a rate of 22%

What would be interesting is how much would be paid if the seller was a Brit, but resident in PT doing the same thing.

#52

I'm only going to address the PT side of the above, in euros.

Given that the calculation should now be identical for residents and non-residents :

I'm going to have to work this 2 ways to show what the tax on the capital gain alone is - once as tax on the income prior to the gain and once including the gain.

40,250€ in earned income or pension for a PT resident has a deduction applied of 4,104€ to arrive at the taxable sum of 36,146€, tax (on 2023 tables) at 37% with abatement of 3,299.12 works out to 10,074.90€ tax.

36,146 + 50,000 taxable portion of gain = 86,146€, tax at 48% with abatement of 8,932.68 works out to 32,417.40€ tax

So the tax in this instance on the capital gain part is 22,342.50€, ie an overall tax rate of 22.34% on your full gain.

Given that the calculation should now be identical for residents and non-residents :

I'm going to have to work this 2 ways to show what the tax on the capital gain alone is - once as tax on the income prior to the gain and once including the gain.

40,250€ in earned income or pension for a PT resident has a deduction applied of 4,104€ to arrive at the taxable sum of 36,146€, tax (on 2023 tables) at 37% with abatement of 3,299.12 works out to 10,074.90€ tax.

36,146 + 50,000 taxable portion of gain = 86,146€, tax at 48% with abatement of 8,932.68 works out to 32,417.40€ tax

So the tax in this instance on the capital gain part is 22,342.50€, ie an overall tax rate of 22.34% on your full gain.

#53

BE Forum Addict

Thread Starter

Joined: Mar 2008

Posts: 1,704

Thnks Red.I was not sure if, as a resident, when you sold and made a gain, that your work/pension income was taxed at the the normal rate for that income bracket (43.5%) or added to any CG and then ALL income taxed at that rate. It appears that in that case the whole income attracts a rate of 48% ...

But then a non resident would not pay tax on their UK income in PT so only pay tax of e22,342 in PT. and £4500 income tax in UK, making a total of €27,517 compared with €32,417 as a resident.

But then a non resident would not pay tax on their UK income in PT so only pay tax of e22,342 in PT. and £4500 income tax in UK, making a total of €27,517 compared with €32,417 as a resident.

#54

Forum Regular

Joined: Jun 2021

Location: North West England and Eastern Algarve

Posts: 124

I raised a gracious complaint myself through the AT website quoting the various EU issues.

However from Red Eric's comments I was very lucky to be able to get the 50% solution and this may not be available any longer although if it came into law in 2023 maybe it will still work for 2022 tax year?

However from Red Eric's comments I was very lucky to be able to get the 50% solution and this may not be available any longer although if it came into law in 2023 maybe it will still work for 2022 tax year?

#55

Thnks Red.I was not sure if, as a resident, when you sold and made a gain, that your work/pension income was taxed at the the normal rate for that income bracket (43.5%) or added to any CG and then ALL income taxed at that rate. It appears that in that case the whole income attracts a rate of 48% ...

You don't pay tax at a rate of 48% on all the income - you pay at the rate shown in each bracket for that portion of income. In that respect, low incomes and high incomes are treated equally tax-wise at any point they match on the scale. Where one bracket ends and another begins, a new rate is applied to that portion of income, and so on.

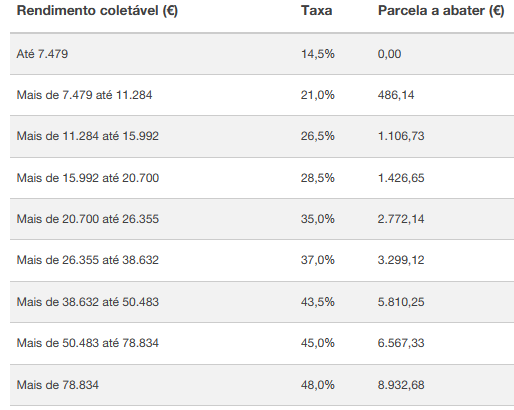

For ease of calculation, it is simpler to display this as a table which has an extra column - one which shows how much to deduct if using only the uppermost figure on the total income, in order to take into account that any income in lower brackets is taxed at lower rates. It comes to exactly the same thing as dividing the income into a portion for each bracket, applying the relevant percentage and summing the results.

Let's hoik in a table for reference :

So, for example, having 20,000 income, applying 28.5% tax rate to it and deducting the abatement figure of 1,426.65 is exactly the same as applying 14.5% to 7,479, 21% to 3,805 26, 26.5% to 4,708 and 28.5% to 4,008 and then totting that lot up, except that the former method is a darned sight easier.

As far as the order of consideration with regard to the capital gain is concerned, it is added to the other income, as opposed to the other way around. Thus the same monetary amount of gain will not result in the same amount of tax being levied in 2 separate cases unless their income prior to the gain is equivalent.

As you can see by referring to the above table, using your earlier example of taxable income of 36,146 + a capital gain of 100,000 of which 50,000 is disregarded, you have the first chunk of the taxable 50,000 occupying the remainder of the 37% bracket, and the rest being variously taxed at 43.5%, 45% and 48%

On the other hand, if you had half the other income, you'd be taxed on the gain at rates of 28.5% through to 45% and end up with a different amount payable on the gain altogether. Wait till the troops get to find out about that and how they'll manage to distort it!

#56

BE Forum Addict

Thread Starter

Joined: Mar 2008

Posts: 1,704

Yes Red I am well versed n the abater business, but wa snotg sure just how MV fitted in. But clearly its a simple sum using top rate of tax and the e9K abater.

But my interest is the difference in total tax for resident against non resident, and clearly as a Brit, to be a non resident is more favourable in the figs used.

But another thing, if NON PT residents are to be treated as a PT resident, is it possible for a non PT resident to be allowed to make a reinvestment in PT or any other EU country, with appropriate tax savings that brings to PT residents?

But my interest is the difference in total tax for resident against non resident, and clearly as a Brit, to be a non resident is more favourable in the figs used.

But another thing, if NON PT residents are to be treated as a PT resident, is it possible for a non PT resident to be allowed to make a reinvestment in PT or any other EU country, with appropriate tax savings that brings to PT residents?

#57

Yes Red I am well versed n the abater business, but wa snotg sure just how MV fitted in. But clearly its a simple sum using top rate of tax and the e9K abater.

But my interest is the difference in total tax for resident against non resident, and clearly as a Brit, to be a non resident is more favourable in the figs used.

But my interest is the difference in total tax for resident against non resident, and clearly as a Brit, to be a non resident is more favourable in the figs used.

A non-resident, by definition, cannot be selling their principal residence.

#59

BE Enthusiast

Joined: Feb 2019

Posts: 418

#60

Forum Regular

Joined: Feb 2021

Posts: 38

The reinvestment opportunity for non PT resident but EU resident is an interesting question. All I’ve heard is it’s open for PT residents to reinvest across the EU as a whole. On another theme….So reading all of the above….which actually now prevails for the non-resident? a) taxed at flat 28% for now 50% of the gain or b) taxed at the progressive rate based on worldwide income submission? The refund Appman received points to a) but the accurate end of discrimination per se points to b) But which is it?

If it is b) the non resident, UK say, has therefore to submit to PT their annual income in the year the sale was made to know the point the progressive tax band starts. Given that the UK tax year is April to April and not Jan to Dec as in PT, what figure presentation is given? An annual UK tax return is clearly not relevant as it does not cover Jan-Dec. One could give a best efforts but clearly the PT tax office would only accept a formal account not a rough analysis on a slip of paper? So I am tempted to veer to a) as Appman experienced. Net for the PT tax office a) is straightforward and b) cannot present a verifiable account of ‘PT annual income’ from the UK tax office…….so which is it?

If it is b) the non resident, UK say, has therefore to submit to PT their annual income in the year the sale was made to know the point the progressive tax band starts. Given that the UK tax year is April to April and not Jan to Dec as in PT, what figure presentation is given? An annual UK tax return is clearly not relevant as it does not cover Jan-Dec. One could give a best efforts but clearly the PT tax office would only accept a formal account not a rough analysis on a slip of paper? So I am tempted to veer to a) as Appman experienced. Net for the PT tax office a) is straightforward and b) cannot present a verifiable account of ‘PT annual income’ from the UK tax office…….so which is it?