Voluntary National Insurance contributions

#76

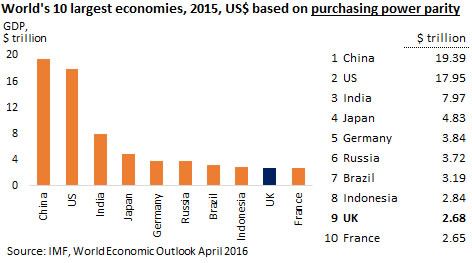

or 9th largest economy, that was before Brexit

https://fullfact.org/economy/uk-worl...rgest-economy/

Last edited by mrken30; Nov 14th 2016 at 5:24 pm.

#77

GDP is not usually adjusted for purchasing power parity, and to do so is subjective and IMO not especially useful.

BTW I adjusted my previous post, I think it's fifth, behind the US, China, Japan and Germany.

BTW I adjusted my previous post, I think it's fifth, behind the US, China, Japan and Germany.

#78

US, China, Japan and Germany are in the top 5 using either method.

#80

BE Forum Addict

Joined: Aug 2013

Location: Athens GA

Posts: 2,134

OK so it has dropped about 15% against the USD, which is not surprising given the unexpected BREXIT vote and the resulting uncertainty. Just wait for it to recover as the uncertainty unwinds.

Last edited by MidAtlantic; Nov 14th 2016 at 8:27 pm.

#81

'Uncertainty unwinds' isn't a phrase I'm familiar with. But since the uncertainty about Britain's terms of exit from the EU is going to span at least two more years, and its attempts to form trading partnerships with the EU and the rest of the world are likely to take several more years after that, when do you envisage this 'unwinding' occurring? Only, I'm in my sixties, so am I likely to live that long?

#82

Forum Regular

Joined: Nov 2016

Location: Rural BC

Posts: 256

I had 25 years contributions and sent them a payment for 4 more years up to 29.

This went from 114 a week to 130 a week.

I can make another 6 years before 2019 and get it to 155, at today's rates.

This went from 114 a week to 130 a week.

I can make another 6 years before 2019 and get it to 155, at today's rates.

#83

BE Forum Addict

Joined: Mar 2011

Posts: 1,274

I'm confused what these pension fund agreements mean to the pensioner.

If a UK pensioner lives in Slovakia they get OAP index-linked to UK inflation but if living in Canada they don't.

What practical difference is there except the pensioner receives considerably less money.

If a UK pensioner lives in Slovakia they get OAP index-linked to UK inflation but if living in Canada they don't.

What practical difference is there except the pensioner receives considerably less money.

#84

I'm confused what these pension fund agreements mean to the pensioner.

If a UK pensioner lives in Slovakia they get OAP index-linked to UK inflation but if living in Canada they don't.

What practical difference is there except the pensioner receives considerably less money.

If a UK pensioner lives in Slovakia they get OAP index-linked to UK inflation but if living in Canada they don't.

What practical difference is there except the pensioner receives considerably less money.

#86

A Canadian 'old age pensioner' (OAS recipient) that has lived 20 years in Canada after the age of 18 who resides outside of Canada will continue to receive their OAS + any yearly increases

The Canadian OAS ('old age pension) is based on years of residency in Canada with the minimum requirement of 10 years of residency to qualify for & to receive the OAS.

If a OAS recipient has only 10 -19 years of residency then leaves Canada - the OAS will only be paid to them outside Canada for 6 months, then it stops. If they return then they must make a claim for OAS once again providing proof that they are resident in Canada

Unlike those living in the US or the EU, any UK state pension recipient living in Canada, Australia, NZ, SA & a few other countries will not get yearly increases in UK state pension

https://www.gov.uk/government/public...-state-pension

.

Last edited by not2old; Nov 17th 2016 at 7:41 pm. Reason: added link

#87

Old Age Security pension

A Canadian 'old age pensioner' (OAS recipient) that has lived 20 years in Canada after the age of 18 who resides outside of Canada will continue to receive their OAS + any yearly increases

A Canadian 'old age pensioner' (OAS recipient) that has lived 20 years in Canada after the age of 18 who resides outside of Canada will continue to receive their OAS + any yearly increases

#88

The Canadian Government has a separate company that operates, manages & invests the CPP money just like any other 'pension fund'

Once a person qualifies for (and is awarded) who begins collecting the CPP pension, it moves with them no matter where they are & it is indexed. It stops when they die, then a one-time 'death benefit' of max $2500 + the survivor/spouse will collect a percentage of what the recipient was getting, depending on age ... usually 60% if over 65

Survivor's Pension

No time stamp on CPP as far as residency I was told

In the following

Canada Pension Plan- While on CPP

.

Last edited by not2old; Nov 18th 2016 at 12:16 am.

#89

So the bit about Brits in Canada not being uprated and Canadians in the UK not having theirs uprated, in mrken's post, isn't true.

#90

Should mrken30 have info to the contrary, maybe he can post it to this thread?