National Insurance Top Up Contributions

#1

Just Joined

Thread Starter

Joined: Feb 2022

Location: Halifax, NS

Posts: 2

My hubby and I have been in Canada since 2000 and have been meaning to top up our NI Contributions in order to get the full state pension (Currently at Approx £185 per week) when we retire but never got round to it.

We have been told that we can go back to 2006 and will be eligible for Class 2 rate (Self Employed in Canada). So the amount will be approx £150 x 17 years which will be approx £2500 each that we will have to pay.

35 years is the max for contributions I believe. So hubby will not have to pay any more but i will need to pay another 9 years paying the £150 Approx per year in order to reach the 35 years.

So seems very worth it to me to pay the top up (even though we know expats in Canada is not index linked, meaning once we start drawing then it will remain the same until we die).

Based on the information I have just posted above. Am I understanding correctly???

We have been told that we can go back to 2006 and will be eligible for Class 2 rate (Self Employed in Canada). So the amount will be approx £150 x 17 years which will be approx £2500 each that we will have to pay.

35 years is the max for contributions I believe. So hubby will not have to pay any more but i will need to pay another 9 years paying the £150 Approx per year in order to reach the 35 years.

So seems very worth it to me to pay the top up (even though we know expats in Canada is not index linked, meaning once we start drawing then it will remain the same until we die).

Based on the information I have just posted above. Am I understanding correctly???

#2

Just Joined

Joined: Dec 2021

Location: Ontario

Posts: 17

If you can top up at the Class 2 rate then it really is worth it IMO, not so convinced about topping up at the Class 3 rate.

#3

BE Enthusiast

Joined: Dec 2010

Location: Whitby, Ontario

Posts: 730

My hubby and I have been in Canada since 2000 and have been meaning to top up our NI Contributions in order to get the full state pension (Currently at Approx £185 per week) when we retire but never got round to it.

We have been told that we can go back to 2006 and will be eligible for Class 2 rate (Self Employed in Canada). So the amount will be approx £150 x 17 years which will be approx £2500 each that we will have to pay.

35 years is the max for contributions I believe. So hubby will not have to pay any more but i will need to pay another 9 years paying the £150 Approx per year in order to reach the 35 years.

So seems very worth it to me to pay the top up (even though we know expats in Canada is not index linked, meaning once we start drawing then it will remain the same until we die).

Based on the information I have just posted above. Am I understanding correctly???

We have been told that we can go back to 2006 and will be eligible for Class 2 rate (Self Employed in Canada). So the amount will be approx £150 x 17 years which will be approx £2500 each that we will have to pay.

35 years is the max for contributions I believe. So hubby will not have to pay any more but i will need to pay another 9 years paying the £150 Approx per year in order to reach the 35 years.

So seems very worth it to me to pay the top up (even though we know expats in Canada is not index linked, meaning once we start drawing then it will remain the same until we die).

Based on the information I have just posted above. Am I understanding correctly???

#4

I have paid Class 2 voluntary contributions since moving to Canada in 2013 and never paid more than 16 GBP a month it's well worth the investment. My wife just set hers up after being constantly nagged by me for the last 9 years  If I recall correctly you will need a UK bank account to set up a monthly payment too.

If I recall correctly you will need a UK bank account to set up a monthly payment too.

If I recall correctly you will need a UK bank account to set up a monthly payment too.

If I recall correctly you will need a UK bank account to set up a monthly payment too.

#5

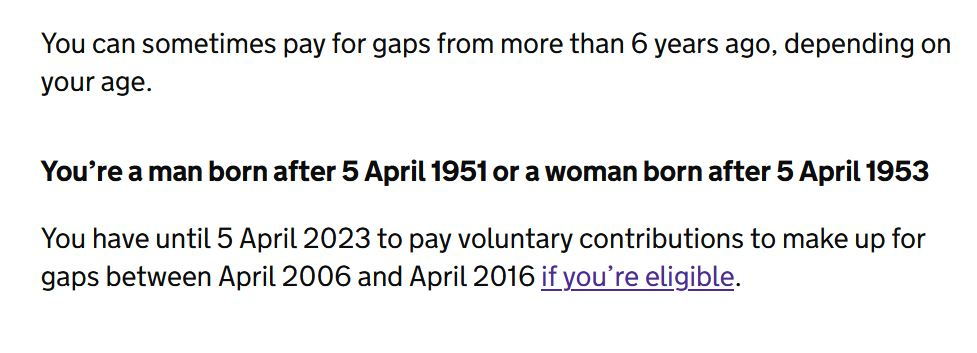

I am not sure who told you that you can go back to 2006 because generally (there are exceptions) you can only contribute for six years in arrears - so a total of seven years, being "this year" plus six prior years, at an aggregate cost of approximately £1,050.

Last edited by Pulaski; Feb 22nd 2022 at 4:47 pm.

#6

BE Enthusiast

Joined: Dec 2010

Location: Whitby, Ontario

Posts: 730

I meant to mention that too as it suggested the advice to the OP wasn’t correct. Definitely worth speaking to HMRC to check.

#7

HTH.

#8

Forum Regular

Joined: May 2021

Location: Stony Plain, AB

Posts: 102

Hi, as others say I think you can only go back 6 years. Even Class 3 contributions are a good investment as long as you get to claim your pension for at least 4 years. You do know that at the moment your UK state pension will not get annual uprating? The amount paid will be the pension amount payable at your retirement age for your number of qualifying years. <snip> We get our UK state pension paid into a UK account and transfer the money here as and when we want it or the exchange rate is more favourable. If you do not have a UK account you can set one up by using www.wise.com which you can also use for a good exchange rate into your CAD account. If the UK pay your state pension into your CAD account directly you'll get a worse exchange rate.

Last edited by christmasoompa; Mar 7th 2022 at 5:18 pm. Reason: You cannot promote any society/company you are affiliated with.

#9

BE Forum Addict

Joined: Sep 2005

Location: Vancouver, BC (originally from Huddersfield, W. Yorkshire)

Posts: 1,223

Hi, as others say I think you can only go back 6 years. Even Class 3 contributions are a good investment as long as you get to claim your pension for at least 4 years. You do know that at the moment your UK state pension will not get annual uprating? The amount paid will be the pension amount payable at your retirement age for your number of qualifying years. <snip> We get our UK state pension paid into a UK account and transfer the money here as and when we want it or the exchange rate is more favourable. If you do not have a UK account you can set one up by using www.wise.com which you can also use for a good exchange rate into your CAD account. If the UK pay your state pension into your CAD account directly you'll get a worse exchange rate.

Source: https://www.gov.uk/voluntary-nationa...ions/deadlines

I did it in 2020 and bought back 11 years :-)

Last edited by adele; Mar 10th 2022 at 5:16 am.

#10

Yes I was born 1970 and came to Canada in 2009, I bought back the missing years (mine was 11 or 12 years I think), thanks to Adele who gave me lots of helpful advice.

I just sent them a lump sum actually, it was an outlay but will be well worth it I think. Every little helps in retirement, I don't think my private pension will set the world on fire!

I just sent them a lump sum actually, it was an outlay but will be well worth it I think. Every little helps in retirement, I don't think my private pension will set the world on fire!

#11

limey party pooper

Joined: Jul 2012

Posts: 9,982

As an addon to this thread. If you've retired and want to buy back some years before you claim, you can't. I tried and was told that as i had already stopped working i wasn't able to do this.

#12

I had stopped paying in in 2010 when I reached 30 years. After the rule change to 35 years, I wanted to pay the years in a lump sum, the DWP advisor worked through the numbers and there was no difference in paying the lump sum and reactivating my DD at ~17 pounds a month.

#13

Has anyone got a telephone number that you can contact the pension people with. The ones they have on the app and any correspondence is blocked by telus.

#14

BE Enthusiast

Joined: Dec 2010

Location: Whitby, Ontario

Posts: 730

I had to contact them in December because I’d made a payment for my NI contributions in July last year and it hadn’t been credited to my account. No phone number on correspondence so I think I googled the address - spoke to two different people and did get it sorted but I can’t remember which of the two numbers I was successful on.

The numbers are 0800 731 0181 and +44 135 535 9022.

The numbers are 0800 731 0181 and +44 135 535 9022.

#15

I had to contact them in December because I’d made a payment for my NI contributions in July last year and it hadn’t been credited to my account. No phone number on correspondence so I think I googled the address - spoke to two different people and did get it sorted but I can’t remember which of the two numbers I was successful on.

The numbers are 0800 731 0181 and +44 135 535 9022.

The numbers are 0800 731 0181 and +44 135 535 9022.