Planning for retirement/topping up UK state pension

#1

So, having crossed the horrible 50 threashold recently I finally started thinking about retirement, doing so sooner would've been better but here we are.

The various online calculators tell me my super is on track to provide a reasonable income, surprising as we only arrived 9 years ago, although we're both making max extra contributions.

One thing I did discover is the ability to top-up our UK state pension, I won't qualify for one from Aus, as its means tested but the UK one isn't. I wanted to share this info as it seems an absolute bargain. If you pass the means test I think you can get the Aus stae pension if you've lived here for 10 years, which seems generous (in spirit, not amount).

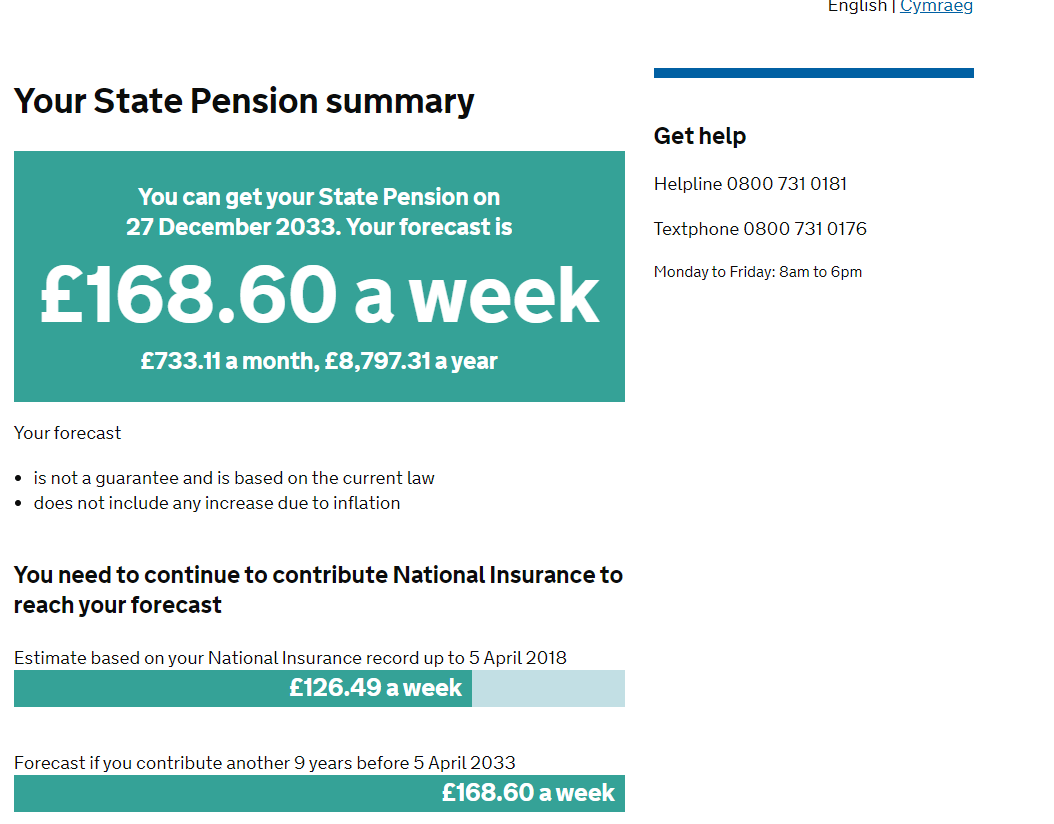

If my wife and I top up our UK NI to 35 years contributions we'll get a very useful $37k per year from the UK govt, on top of my UK private pension and Aus Super, since I need another 12 years of NI contributions I'll need to pay out $1,300 for each of these 12 years but the increase in UK pension means I'll be in profit after about 3.5 years, just need to live that long!

The above is just my understanding, please do your own due dilligence but sharing it as there is a time limit to do the top up (think you can only go back 6 years).

The various online calculators tell me my super is on track to provide a reasonable income, surprising as we only arrived 9 years ago, although we're both making max extra contributions.

One thing I did discover is the ability to top-up our UK state pension, I won't qualify for one from Aus, as its means tested but the UK one isn't. I wanted to share this info as it seems an absolute bargain. If you pass the means test I think you can get the Aus stae pension if you've lived here for 10 years, which seems generous (in spirit, not amount).

If my wife and I top up our UK NI to 35 years contributions we'll get a very useful $37k per year from the UK govt, on top of my UK private pension and Aus Super, since I need another 12 years of NI contributions I'll need to pay out $1,300 for each of these 12 years but the increase in UK pension means I'll be in profit after about 3.5 years, just need to live that long!

The above is just my understanding, please do your own due dilligence but sharing it as there is a time limit to do the top up (think you can only go back 6 years).

Last edited by freebo; Sep 17th 2019 at 4:15 am.

#2

BE Enthusiast

Joined: Feb 2008

Posts: 457

I did this 15 years ago, when I could then get my UK state pension at 60. My break even point of the amount paid to equal the increase in pension was 2 years, so 13 years later was well worth it. I don’t know if this still applies or is relevant, but I was given 17 years off from paying contributions for child rearing! as we had 3 children and i hadn’t worked, so that was a bonus.

Dont forget the bad news that your UK state pension is frozen from the day you receive it I f you live in Australia, but if you go to UK on holiday you should notify the pensions department of your flight dates and your pension is increased to what it should be had you stayed in UK, the daft thing is, it then reverts back to the original frozen amount on your return to Australia. As we go back to UK for 3 months most years we make sure we get every penny!!

Dont forget the bad news that your UK state pension is frozen from the day you receive it I f you live in Australia, but if you go to UK on holiday you should notify the pensions department of your flight dates and your pension is increased to what it should be had you stayed in UK, the daft thing is, it then reverts back to the original frozen amount on your return to Australia. As we go back to UK for 3 months most years we make sure we get every penny!!

#3

Not sure how you get $37k. Even two UK pensions don’t add up to that. What figure are you using?

#4

I did this 15 years ago, when I could then get my UK state pension at 60. My break even point of the amount paid to equal the increase in pension was 2 years, so 13 years later was well worth it. I don’t know if this still applies or is relevant, but I was given 17 years off from paying contributions for child rearing! as we had 3 children and i hadn’t worked, so that was a bonus.

Dont forget the bad news that your UK state pension is frozen from the day you receive it I f you live in Australia, but if you go to UK on holiday you should notify the pensions department of your flight dates and your pension is increased to what it should be had you stayed in UK, the daft thing is, it then reverts back to the original frozen amount on your return to Australia. As we go back to UK for 3 months most years we make sure we get every penny!!

Dont forget the bad news that your UK state pension is frozen from the day you receive it I f you live in Australia, but if you go to UK on holiday you should notify the pensions department of your flight dates and your pension is increased to what it should be had you stayed in UK, the daft thing is, it then reverts back to the original frozen amount on your return to Australia. As we go back to UK for 3 months most years we make sure we get every penny!!

Or if you dont qualify for the Aus Government Pension because of assets and income, how do you get around the no Pension Card, for subsidies on things like Prescriptions, car rego, Utility benefits etc?

#6

Home and Happy

Joined: Dec 2002

Location: Keep true friends and puppets close, trust no-one else...

Posts: 93,807

Wouldn't that increase just come off of your Aus Government Pension when you came back here though? As though it were increased earnings for that given financial year?

Or if you dont qualify for the Aus Government Pension because of assets and income, how do you get around the no Pension Card, for subsidies on things like Prescriptions, car rego, Utility benefits etc?

Or if you dont qualify for the Aus Government Pension because of assets and income, how do you get around the no Pension Card, for subsidies on things like Prescriptions, car rego, Utility benefits etc?

And I'm told that without being eligible for a pension, one cannot be eligible for a concession card.

#7

We are self-funded retirees. Get no Australian pension and are not likely to.

There is a (highly-prized) card called the Commonwealth Seniors Health Card designed for people who do not get a pension. Gets you subsidised scripts. Still has an income test but it's more generous than the income test used to qualify for the pension in the first place.

There is a (highly-prized) card called the Commonwealth Seniors Health Card designed for people who do not get a pension. Gets you subsidised scripts. Still has an income test but it's more generous than the income test used to qualify for the pension in the first place.

#8

BE Enthusiast

Joined: Feb 2008

Posts: 457

Wouldn't that increase just come off of your Aus Government Pension when you came back here though? As though it were increased earnings for that given financial year?

Or if you dont qualify for the Aus Government Pension because of assets and income, how do you get around the no Pension Card, for subsidies on things like Prescriptions, car rego, Utility benefits etc?

Or if you dont qualify for the Aus Government Pension because of assets and income, how do you get around the no Pension Card, for subsidies on things like Prescriptions, car rego, Utility benefits etc?

We are self funded retirees

#9

We are self-funded retirees. Get no Australian pension and are not likely to.

There is a (highly-prized) card called the Commonwealth Seniors Health Card designed for people who do not get a pension. Gets you subsidised scripts. Still has an income test but it's more generous than the income test used to qualify for the pension in the first place.

There is a (highly-prized) card called the Commonwealth Seniors Health Card designed for people who do not get a pension. Gets you subsidised scripts. Still has an income test but it's more generous than the income test used to qualify for the pension in the first place.

The other point is the UK pension is frozen, so eventually most people under the assets test, which is quite generious, would eventually qualify for the Australian Pension.

From what I can gather the UK pension rate for a single is circa 234 AUD per week, Where as the Australian governmention Pension seems to be 450 AUD per week,(It's quoted fornightly at 933 AUD for a single person) so one should be getting topped up to the tune of almost double from the Australian pension?

Actually seems a massive difference to me, with the Australian pension being far more lucrative..... maybe I've got something wrong?

Hhere is the UK state pension....

https://www.gov.uk/state-pension/what-youll-get

Here are the Australian government pension figures. What I take this to mean is, even if you qualify for the full UK pension, you should still get something from the Australian Governement, as long as you have less than 785,000 AUD in Assets. With that seniors card being the golden chalice.

https://www.superguide.com.au/access...-pension-rates

#10

GBP168.60*52*2 = GBP 17,534.4 at todays exchange rate = $31,932

Last edited by freebo; Sep 17th 2019 at 11:12 pm.

#12

BE Enthusiast

Joined: Feb 2008

Posts: 457

apart from prescriptions all the others are subsidised just by having a seniors card,

#13

My take is that if you get to retire and have enough that you don't need a government provided pension, discount card or some other taxpayer-funded bullshit, you've worked, saved and done well in life

Not requiring any assistance is something to be proud of

Not requiring any assistance is something to be proud of

#14

Meantime I'm about to research the difference in Government Pension payments between the UK and Australia, as It's looking more and more like a lot of UK people dont realise they are entitled to a part Australian Pension to top up the UK pension. From what I can tell, the Aus Government pension is circa 150 AUD more weekly than the UK pension and if you are within the assets test limit one automatically qualifies for the Aus Pension. The Aus Assets test starts at 457,000 AUD. before one gets a reduced Australian pension... then reduces by 3 dollars per fortnight in every 1000 dollars over that amount.

That seems a massive difference, I repeat is it correct. ? 150 bucks per week?

Maybe people should be having a appointment with Centerlink, not that I recommend that organisation.

Last edited by ozzieeagle; Sep 18th 2019 at 6:32 am.

#15

The UK one may be less but its not means tested so a nice $32k pa top up on the super, hence me saying it seems worth filling in the NI gaps. I think if you get the full amount for both it adds up to about $55k per year as a couple, from age 67, all figures in todays money of course.