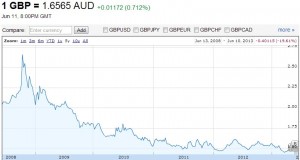

Aussie Dollar continues to fall - £1 buys $1.66

#1

Forum Regular

Thread Starter

Joined: Mar 2013

Location: London

Posts: 248

Sterling has continued to be the most successful currency against the Australian Dollar, having been knocked by poor economic growth data. China is the main culprit as far as the Australian and New Zealand Dollars are concerned. A slowdown is starting to be felt and that impacts Aussie and Kiwi Exporters.

If you're looking at buying Australian Dollars using Sterling then it is worth considering a trade of at least a portion of your funds around the current market levels. If you would like to try and squeeze a bit more from the market, then I would strongly urge you to consider the placement of a stop loss order. A stop loss order is effectively a safety net, which would kick in should the market start to move against you once more. The highs we've seen are not expected to last long-term so buying sooner rather than later is key.

If you're looking at buying Australian Dollars using Sterling then it is worth considering a trade of at least a portion of your funds around the current market levels. If you would like to try and squeeze a bit more from the market, then I would strongly urge you to consider the placement of a stop loss order. A stop loss order is effectively a safety net, which would kick in should the market start to move against you once more. The highs we've seen are not expected to last long-term so buying sooner rather than later is key.

#2

Lost in BE Cyberspace

Joined: Dec 2010

Posts: 14,040

Sterling has continued to be the most successful currency against the Australian Dollar, having been knocked by poor economic growth data. China is the main culprit as far as the Australian and New Zealand Dollars are concerned. A slowdown is starting to be felt and that impacts Aussie and Kiwi Exporters.

If you're looking at buying Australian Dollars using Sterling then it is worth considering a trade of at least a portion of your funds around the current market levels. If you would like to try and squeeze a bit more from the market, then I would strongly urge you to consider the placement of a stop loss order. A stop loss order is effectively a safety net, which would kick in should the market start to move against you once more. The highs we've seen are not expected to last long-term so buying sooner rather than later is key.

If you're looking at buying Australian Dollars using Sterling then it is worth considering a trade of at least a portion of your funds around the current market levels. If you would like to try and squeeze a bit more from the market, then I would strongly urge you to consider the placement of a stop loss order. A stop loss order is effectively a safety net, which would kick in should the market start to move against you once more. The highs we've seen are not expected to last long-term so buying sooner rather than later is key.

#3

How do you view the change in the GBP-AUD values ?

or

Both graphs are right

Australian Exporters are getting happier again

#4

Lost in BE Cyberspace

Joined: Dec 2010

Posts: 14,040

So what is the poster saying or suggesting?

If you're looking at buying Australian Dollars using Sterling then it is worth considering a trade of at least a portion of your funds around the current market levels.

The highs we've seen are not expected to last long-term so buying sooner rather than later is key.

This suggests the Aussie against the Sterling has bottomed out and will go back to the levels of a month or 2 ago.

Really .... that's not what the economists are staying ..... perhaps the poster knows something the economists don't.

Or is this just a cheap sales pitch?

#5

Forum Regular

Joined: Nov 2008

Posts: 195

Yeah that part had me confused too. I've been watching the EUR->AUD conversion rates for the past year as I want to transfer savings over. The rate is at its best in nearly 2 years, but still, economists are expecting the AUD to fall to .80USD (currently at 0.946426USD). If it gets anywhere near that, it's definitely worth waiting for a bit to convert from GBP/EUR to AUD.

#7

There's a long way for it to go to unwind the dutch disease - and it might get there if china goes into reverse or resources customers go elsewhere.

#8

Lost in BE Cyberspace

Joined: Dec 2010

Posts: 14,040

#9

Well actually you could do a stop-loss even if you thought the price had further to move. However you have to make the gap between current and stop-loss price large enough that they can't catch you out by manipulating the price with a temporary 'blip' in the market.

#10

OP is a dealer; figures with AUD being mid $1.60's vs £ rather than mid/high $1.40's that he may be able to drum up some business on the movement. It's a better time to change £'s into $'s than recently and there is also the possibility it might be better to get more £'s for your $'s now if the trend continues. Either way, looking for business.

#11

Forum Regular

Joined: Jun 2006

Posts: 200

You'd have to be a mug to transfer a significant part of your savings from £ to $ right now. The australian economy is heading into some serious headwinds just as the uk is starting to recover. There are many other factors of course but that points to the aussie falling further than it does it heading back to 70p. If the aussie breaks downwards through the 60p barrier it could keep heading south in a hurry.

#12

Migration Agent

Joined: May 2002

Location: Offices in Melbourne, Brisbane, Perth, Geelong (Australia), and Southampton (UK)

Posts: 6,459

... just as the uk is starting to recover ...

Hmmm ... that remains to be seen. One swallow doesn't make a summer.

Onwards!

Hmmm ... that remains to be seen. One swallow doesn't make a summer.

Onwards!

#13

The hard decisions still need to be made

#14

Just at this moment in time, I'd really like the value of the Aus to keep going down.

I'm currently trying to buy a house and that involves me tranfering GBP over, so it's purely selfish. However I can see that a weaker AUD has economic advantages here too because export of everything other than commodities is suffering and has been for a long time.

Also a big drop may stop some of the Automotive manufacturing rot thats really starting to set in... It now costs TWICE as much to make a car here as it does in Europe... and FOUR times the cost of manufacturing it in the SE Asia.... It's little wonder Ford are taking their ball home it just doesn't make sense to carry on.

I'm currently trying to buy a house and that involves me tranfering GBP over, so it's purely selfish. However I can see that a weaker AUD has economic advantages here too because export of everything other than commodities is suffering and has been for a long time.

Also a big drop may stop some of the Automotive manufacturing rot thats really starting to set in... It now costs TWICE as much to make a car here as it does in Europe... and FOUR times the cost of manufacturing it in the SE Asia.... It's little wonder Ford are taking their ball home it just doesn't make sense to carry on.

#15

Lost in BE Cyberspace

Joined: Dec 2010

Posts: 14,040

Also a big drop may stop some of the Automotive manufacturing rot thats really starting to set in... It now costs TWICE as much to make a car here as it does in Europe... and FOUR times the cost of manufacturing it in the SE Asia.... It's little wonder Ford are taking their ball home it just doesn't make sense to carry on.