T1135 Foreign Income Verificiation (New Form)

#1

Forum Regular

Thread Starter

Joined: Oct 2011

Location: Whitby, ON

Posts: 225

I'm sure this will affect more than a couple of us on here so thought I would bring this up. I've been looking over this form as I'm going to have to complete it for my 2013 tax return as I have been renting my UK property.

There are a few points to clarify for peace of mind. - I'm interested to know other members interpretations as well as the professional opinion of members such as JonBoy

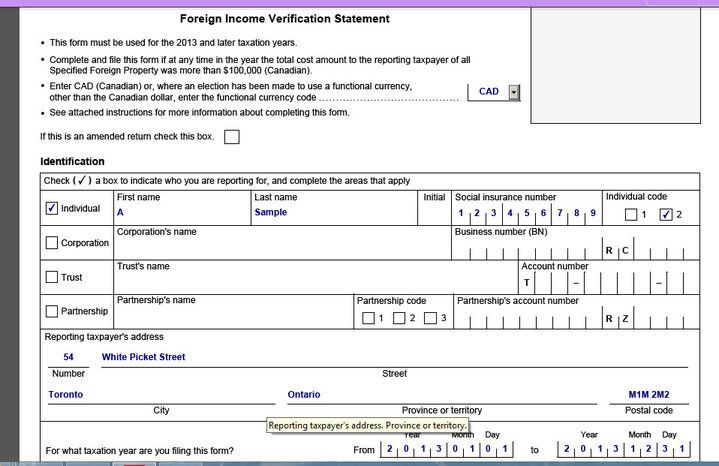

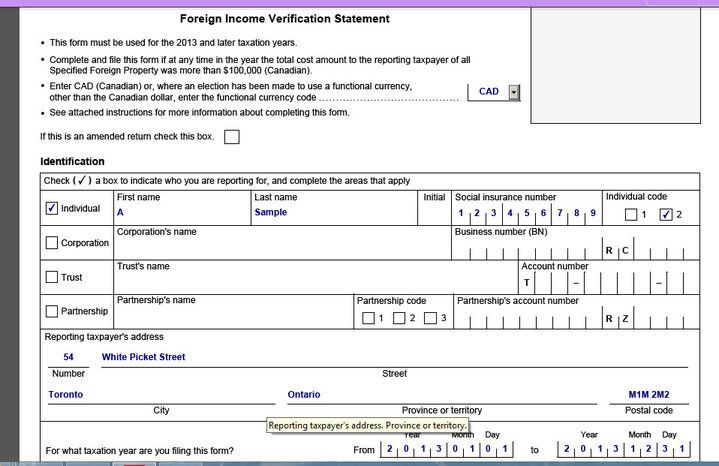

So, the start of the form is straight forward

Who you are (Individual etc)

Name, Sin,

Individual Code. 2) for employed / unemployed 1) Self Employed

Address

Year of the tax return. - I presume this is the calendar year as I have completed below.

Onto the next stage we begin to list our specified foreign property.

As I don't have any foreign assets with a Canadian brokerage I will not be getting a T5 so can leave this box unchecked.

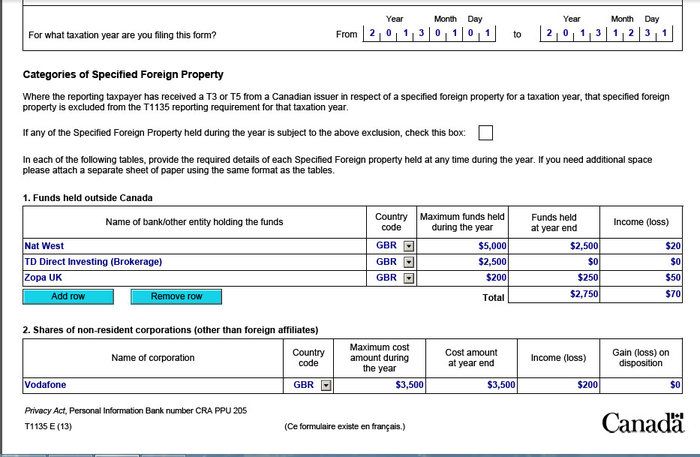

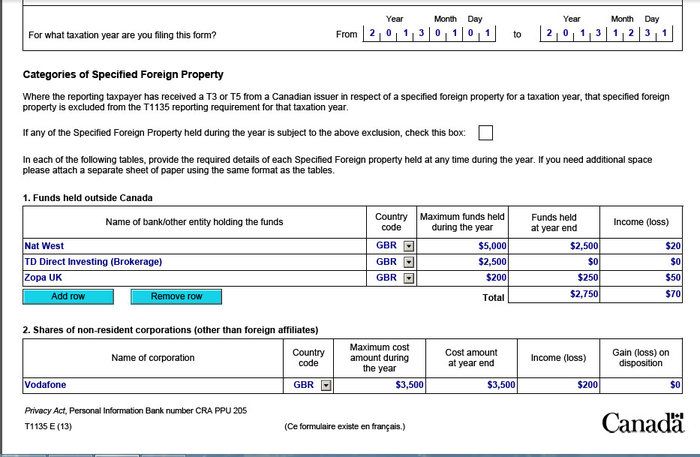

Funds held outside Canada.

Natwest - I assume this can encompass all accounts under the one listing. savings, ISA & current account.

Figures I believe are the maximum balance carried at a given point throughout the year and the closing balance on December 31st. I would assume the income portion of this would relate to any interest earned. I have no idea how you could have a loss here. Unless my money was in Cyprus.

TD Direct Investing.

Now this I am unsure of. Dividends would be paid into this so I assume the cash balance should be listed in this portion. So the maximum held in dividends payments and cash was $2500 - I either withdrew or purchased more stock with it so my closing balance is 0 and the holding account doesn't pay interest so no money was earned. Would this be acceptable? I assume you don't need to list the portfolio balance as you are listing the stocks separately.

Zopa UK - This is a peer to peer lender. I'm unsure if I should list this here or under indebtedness?

What else should be listed under funds held? When you read the notes it even mentions pre paid credit cards!!! So I assume if I like a flutter on ladbrokes once in a while then any funds held with them should be listed. Of course this creates a grey area as I could win and list an income but as it's gambling it's non taxable? I'm thinking this could then be begging for an audit as you would be recording an income here which would then not be listed on the tax return. Should you include any funds held with a bookmaker?

Shares

So here I list my holdings. maximum cost during the year. Now they state when you move to Canada it's the FMV on the day you arrive. So if no transactions have taken place I assume this to be the "Maximum Cost"

In the Vodafone example it was $3500 when I arrived. I haven't purchased or sold anything and have received $200 in dividends. Is it correct that the end of year cost is the same? I believe from my interpretation that as no transactions have taken place the cost basis is the same and that the market price is not required in this field.

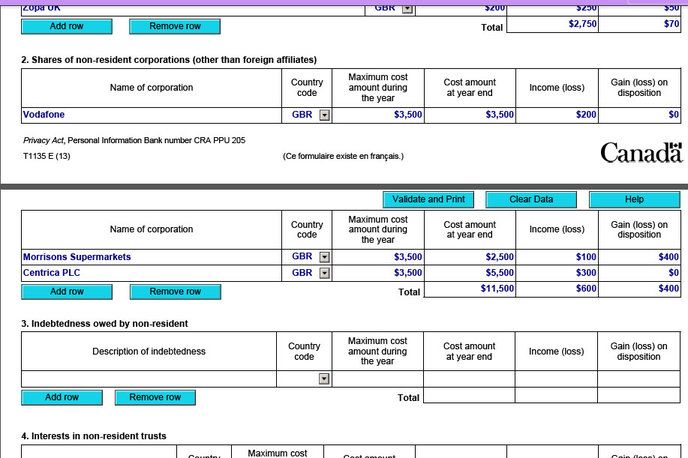

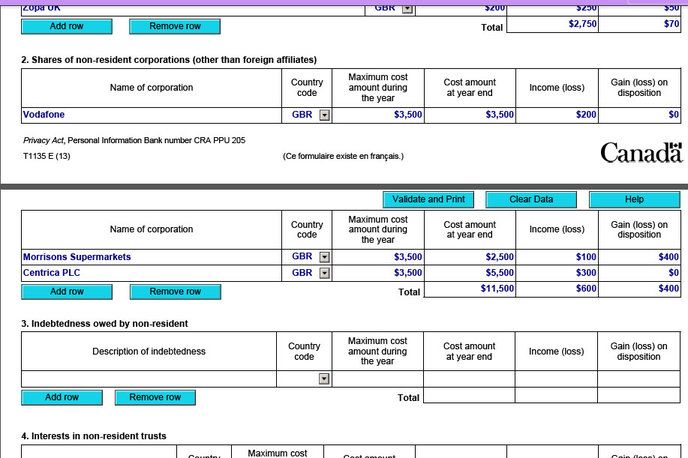

Morrisons - $3500 value on arrival into Canada. $2500 at year end as I sold some of my holdings. $100 in dividends and $400 capital gain on the partial sale.

Centrica - $3500 on arrival and later added to the holdings so my final cost is $5500 with $300 in income. Here as I type this I now realise my own mistake as the maximum cost amount should also be $5500 as this is my highest cost basis throughout the year.

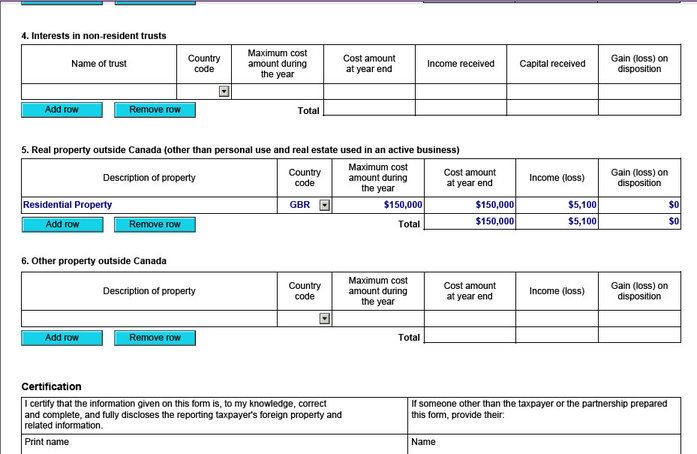

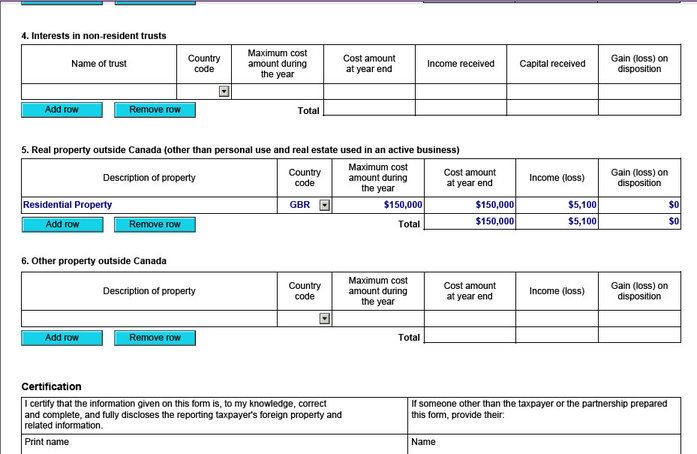

Finally my residential property which I have let out.

Value $150000 on arrival. No capital expenditure so $150000 recorded as present value. I assume if I was claiming CCA then you would reduce the end of year figure by this amount.

Thanks for any input on this. I'm interested to know others thoughts and ensure I get this right when the time comes to file.

There are a few points to clarify for peace of mind. - I'm interested to know other members interpretations as well as the professional opinion of members such as JonBoy

So, the start of the form is straight forward

Who you are (Individual etc)

Name, Sin,

Individual Code. 2) for employed / unemployed 1) Self Employed

Address

Year of the tax return. - I presume this is the calendar year as I have completed below.

Onto the next stage we begin to list our specified foreign property.

As I don't have any foreign assets with a Canadian brokerage I will not be getting a T5 so can leave this box unchecked.

Funds held outside Canada.

Natwest - I assume this can encompass all accounts under the one listing. savings, ISA & current account.

Figures I believe are the maximum balance carried at a given point throughout the year and the closing balance on December 31st. I would assume the income portion of this would relate to any interest earned. I have no idea how you could have a loss here. Unless my money was in Cyprus.

TD Direct Investing.

Now this I am unsure of. Dividends would be paid into this so I assume the cash balance should be listed in this portion. So the maximum held in dividends payments and cash was $2500 - I either withdrew or purchased more stock with it so my closing balance is 0 and the holding account doesn't pay interest so no money was earned. Would this be acceptable? I assume you don't need to list the portfolio balance as you are listing the stocks separately.

Zopa UK - This is a peer to peer lender. I'm unsure if I should list this here or under indebtedness?

What else should be listed under funds held? When you read the notes it even mentions pre paid credit cards!!! So I assume if I like a flutter on ladbrokes once in a while then any funds held with them should be listed. Of course this creates a grey area as I could win and list an income but as it's gambling it's non taxable? I'm thinking this could then be begging for an audit as you would be recording an income here which would then not be listed on the tax return. Should you include any funds held with a bookmaker?

Shares

So here I list my holdings. maximum cost during the year. Now they state when you move to Canada it's the FMV on the day you arrive. So if no transactions have taken place I assume this to be the "Maximum Cost"

In the Vodafone example it was $3500 when I arrived. I haven't purchased or sold anything and have received $200 in dividends. Is it correct that the end of year cost is the same? I believe from my interpretation that as no transactions have taken place the cost basis is the same and that the market price is not required in this field.

Morrisons - $3500 value on arrival into Canada. $2500 at year end as I sold some of my holdings. $100 in dividends and $400 capital gain on the partial sale.

Centrica - $3500 on arrival and later added to the holdings so my final cost is $5500 with $300 in income. Here as I type this I now realise my own mistake as the maximum cost amount should also be $5500 as this is my highest cost basis throughout the year.

Finally my residential property which I have let out.

Value $150000 on arrival. No capital expenditure so $150000 recorded as present value. I assume if I was claiming CCA then you would reduce the end of year figure by this amount.

Thanks for any input on this. I'm interested to know others thoughts and ensure I get this right when the time comes to file.

#2

Binned by Muderators

Joined: Jul 2007

Location: White Rock BC

Posts: 11,682

I have not seen any detailed guidance on this yet, but these are my thoughts ...

This is new, and a little confusing. On virtually every other CRA form an individual code is 1 for single ownership and 2 for joint ownership. The language in the notes is also less than crystal clear. I see that they have changed the due date for filing from April 30th for everybody to the date you have to file your tax return. (There was a well reported case in the Tax Court on this.) If either you or your spouse is self-employed then the due date for your tax return is June 15th so you check box 1. Otherwise check box 2.

Yes, for an individual it is always a calendar year.

I don't see why not.

Yes to this.

Is the TD account in Canada? If not:

Yes. If there was nothing in the brokerage account when you became a tax-resident of Canada the cost of this account will just be whatever you have put in and is still there during the year. I think what you have said makes sense.

I would probably choose indebtedness, but I doubt they woud send you to jail if you included it in this section.

Yes, funds in a bookmaker's account should be reported. Income, for tax purposes, is income from a source. Sources include office, employment, business and property. Gambling is not a source (unless it is undertaken in a systematic manner when it can be classified as a business) so gambling winnings are not income and are not reported or taxed.

Yes to the above.

Yes.

Yes.

No, claiming CCA does not change the original cost. The property will always have a tax-cost of $150,000 unless you make additional capital expenditures.

Address

Year of the tax return. - I presume this is the calendar year as I have completed below.

Year of the tax return. - I presume this is the calendar year as I have completed below.

Onto the next stage we begin to list our specified foreign property.

As I don't have any foreign assets with a Canadian brokerage I will not be getting a T5 so can leave this box unchecked.

Funds held outside Canada.

Natwest - I assume this can encompass all accounts under the one listing. savings, ISA & current account.

As I don't have any foreign assets with a Canadian brokerage I will not be getting a T5 so can leave this box unchecked.

Funds held outside Canada.

Natwest - I assume this can encompass all accounts under the one listing. savings, ISA & current account.

Figures I believe are the maximum balance carried at a given point throughout the year and the closing balance on December 31st. I would assume the income portion of this would relate to any interest earned.

TD Direct Investing.

Now this I am unsure of. Dividends would be paid into this so I assume the cash balance should be listed in this portion. So the maximum held in dividends payments and cash was $2500 - I either withdrew or purchased more stock with it so my closing balance is 0 and the holding account doesn't pay interest so no money was earned. Would this be acceptable? I assume you don't need to list the portfolio balance as you are listing the stocks separately.

Now this I am unsure of. Dividends would be paid into this so I assume the cash balance should be listed in this portion. So the maximum held in dividends payments and cash was $2500 - I either withdrew or purchased more stock with it so my closing balance is 0 and the holding account doesn't pay interest so no money was earned. Would this be acceptable? I assume you don't need to list the portfolio balance as you are listing the stocks separately.

Yes. If there was nothing in the brokerage account when you became a tax-resident of Canada the cost of this account will just be whatever you have put in and is still there during the year. I think what you have said makes sense.

Zopa UK - This is a peer to peer lender. I'm unsure if I should list this here or under indebtedness?

What else should be listed under funds held? When you read the notes it even mentions pre paid credit cards!!! So I assume if I like a flutter on ladbrokes once in a while then any funds held with them should be listed. Of course this creates a grey area as I could win and list an income but as it's gambling it's non taxable? I'm thinking this could then be begging for an audit as you would be recording an income here which would then not be listed on the tax return. Should you include any funds held with a bookmaker?

Shares

So here I list my holdings. maximum cost during the year. Now they state when you move to Canada it's the FMV on the day you arrive. So if no transactions have taken place I assume this to be the "Maximum Cost" In the Vodafone example it was $3500 when I arrived. I haven't purchased or sold anything and have received $200 in dividends. Is it correct that the end of year cost is the same? I believe from my interpretation that as no transactions have taken place the cost basis is the same and that the market price is not required in this field.

So here I list my holdings. maximum cost during the year. Now they state when you move to Canada it's the FMV on the day you arrive. So if no transactions have taken place I assume this to be the "Maximum Cost" In the Vodafone example it was $3500 when I arrived. I haven't purchased or sold anything and have received $200 in dividends. Is it correct that the end of year cost is the same? I believe from my interpretation that as no transactions have taken place the cost basis is the same and that the market price is not required in this field.

Morrisons - $3500 value on arrival into Canada. $2500 at year end as I sold some of my holdings. $100 in dividends and $400 capital gain on the partial sale.

Centrica - $3500 on arrival and later added to the holdings so my final cost is $5500 with $300 in income. Here as I type this I now realise my own mistake as the maximum cost amount should also be $5500 as this is my highest cost basis throughout the year.

Finally my residential property which I have let out.

Value $150000 on arrival. No capital expenditure so $150000 recorded as present value. I assume if I was claiming CCA then you would reduce the end of year figure by this amount.

Value $150000 on arrival. No capital expenditure so $150000 recorded as present value. I assume if I was claiming CCA then you would reduce the end of year figure by this amount.

#3

This new form is badly designed, I've just been talking to the CRA about it.

This is apparently causing a lot of confusion, it's causing me confusion.

In essence, say you hold $100,000 in specified foreign assets and one penny of it was reported to the CRA on a T3 or a T5, you don't have to file a T1135, I just confirmed that with them.

The one thing that confused me was why only T3 or T5, why not say, a T4RSP slip or an RRSP slip? The reason why is because an RRSP is not technically owned by you, it's an account held in trust by a financial institution so it doesn't go on the T1135 either. Hands up anyone who could tell that by reading this form.

Also I'm not quite clear on foreign mutual funds, but they told me that is a non-resident trust so yes it has to be reported on that line.

Also the tax year question is stupid, previously you only needed to do that for say corporations with different year ends.

Anyway a lot of people have complained he said, they're looking again at the instructions for the form.

Where the reporting taxpayer has received a T3 or T5 from a Canadian issuer in respect of a specified foreign property for a taxation year, that specified foreign property is excluded from the T1135 reporting requirement for that taxation year.

If any of the Specified Foreign Property held during the year is subject to the above exclusion, check this box

If any of the Specified Foreign Property held during the year is subject to the above exclusion, check this box

In essence, say you hold $100,000 in specified foreign assets and one penny of it was reported to the CRA on a T3 or a T5, you don't have to file a T1135, I just confirmed that with them.

The one thing that confused me was why only T3 or T5, why not say, a T4RSP slip or an RRSP slip? The reason why is because an RRSP is not technically owned by you, it's an account held in trust by a financial institution so it doesn't go on the T1135 either. Hands up anyone who could tell that by reading this form.

Also I'm not quite clear on foreign mutual funds, but they told me that is a non-resident trust so yes it has to be reported on that line.

Also the tax year question is stupid, previously you only needed to do that for say corporations with different year ends.

Anyway a lot of people have complained he said, they're looking again at the instructions for the form.

#4

Forum Regular

Joined: Mar 2010

Location: Red Deer, AB

Posts: 217

So has anyone properly worked out this form yet? I'm just looking at it for the first time... I've just about managed to fill in the top bit (though the Individual code is confusing...).

All I have is funds held outside of Canada, which is a bank account that I use to pump money between my management agent and my mortgage & insurance companies (and has not received any interest), and a house.

So in Section 1 (Funds held outside of Canada), I guess I just put in the maximum amount and the year end amount and put the Income (Loss) as zero? But can I put the amount in GBP or do I have to convert to CAD?

Section 5, the cost amount appears to be the fair market value of the property when I immigrated, so is the maximum value and the cost amount at year end the same number? Income appears to be the gross rental income? And as I haven't disposed of it, I'm guessing that number is zero?

Last year was much simpler... Thanks for any help

All I have is funds held outside of Canada, which is a bank account that I use to pump money between my management agent and my mortgage & insurance companies (and has not received any interest), and a house.

So in Section 1 (Funds held outside of Canada), I guess I just put in the maximum amount and the year end amount and put the Income (Loss) as zero? But can I put the amount in GBP or do I have to convert to CAD?

Section 5, the cost amount appears to be the fair market value of the property when I immigrated, so is the maximum value and the cost amount at year end the same number? Income appears to be the gross rental income? And as I haven't disposed of it, I'm guessing that number is zero?

Last year was much simpler... Thanks for any help

#5

Slob

Joined: Sep 2009

Location: Ottineau

Posts: 6,342

That God I use an accountant!

That form has been the bane of my life in the past and it looks even worse now.

That form has been the bane of my life in the past and it looks even worse now.

#6

So the accountant can screw it up and when the CRA ask you for information you haven't got a clue what they're on about.

My tax return this year is super duper complicated and I played around with UFile, Studiotax, Simpletax and Turbotax - none of them came up with the right answer, although simpletax did give me a couple of clues (as it summarized information from the CRA that I had skipped over) that enables me to figure out how to do it on paper.

Which firmly convinced me of my earlier conviction that tax software is pretty much pointless. Either your tax return is so simple, say you've got a T4, T5 and an RRSP contribution slip that you don't need it, or it's too complex and you make it more complex by figuring out the software and which button you need to press.

I've certainly made mistakes in the past and no doubt I'll make mistakes in the future but at least (a) I've cut out the middleman and (b) I haven't made any mistakes resulting in any penalties to date.

My tax return this year is super duper complicated and I played around with UFile, Studiotax, Simpletax and Turbotax - none of them came up with the right answer, although simpletax did give me a couple of clues (as it summarized information from the CRA that I had skipped over) that enables me to figure out how to do it on paper.

Which firmly convinced me of my earlier conviction that tax software is pretty much pointless. Either your tax return is so simple, say you've got a T4, T5 and an RRSP contribution slip that you don't need it, or it's too complex and you make it more complex by figuring out the software and which button you need to press.

I've certainly made mistakes in the past and no doubt I'll make mistakes in the future but at least (a) I've cut out the middleman and (b) I haven't made any mistakes resulting in any penalties to date.

#7

Slob

Joined: Sep 2009

Location: Ottineau

Posts: 6,342

So the accountant can screw it up and when the CRA ask you for information you haven't got a clue what they're on about.

My tax return this year is super duper complicated and I played around with UFile, Studiotax, Simpletax and Turbotax - none of them came up with the right answer, although simpletax did give me a couple of clues (as it summarized information from the CRA that I had skipped over) that enables me to figure out how to do it on paper.

Which firmly convinced me of my earlier conviction that tax software is pretty much pointless. Either your tax return is so simple, say you've got a T4, T5 and an RRSP contribution slip that you don't need it, or it's too complex and you make it more complex by figuring out the software and which button you need to press.

I've certainly made mistakes in the past and no doubt I'll make mistakes in the future but at least (a) I've cut out the middleman and (b) I haven't made any mistakes resulting in any penalties to date.

My tax return this year is super duper complicated and I played around with UFile, Studiotax, Simpletax and Turbotax - none of them came up with the right answer, although simpletax did give me a couple of clues (as it summarized information from the CRA that I had skipped over) that enables me to figure out how to do it on paper.

Which firmly convinced me of my earlier conviction that tax software is pretty much pointless. Either your tax return is so simple, say you've got a T4, T5 and an RRSP contribution slip that you don't need it, or it's too complex and you make it more complex by figuring out the software and which button you need to press.

I've certainly made mistakes in the past and no doubt I'll make mistakes in the future but at least (a) I've cut out the middleman and (b) I haven't made any mistakes resulting in any penalties to date.

#8

Forum Regular

Joined: Oct 2010

Location: Calgary, from South East England

Posts: 114

Does anyone know whether I'm also supposed to report assets (shares, bonds, unit trust units, etc) that are held in UK Self Invested Personal Pension (SIPP). I note that the form is called a 'Foreign Income Verification Form', and as I currently don't derive any income from these assets (ie I am not yet drawing a pension) I'm not sure if I need to include them.

Any help much appreciated.

Any help much appreciated.

#9

I would never get someone else to do it because it forces me to examine my finances, which I find to be a useful exercise.

It's just something I feel I should know how it works, how much tax do I pay, what am I paying it on, why am I being taxed?

I really hate tax systems like the UK where they supposedly "simplify" it for you but in reality they're trying to hide how much tax you're paying, e.g. including VAT in the price. Oh don't worry you don't need to file a tax return, it's all been collected through PAYE, through withholding on your bank account etc.

No, I want to know how much you're taking off me. If that causes you, the government a problem, then you know what? Get rid of the tax or collect it in a simpler way. I don't have any trust in a government that collects taxes covertly.

Yeah the UK has the lowest income tax rate in Europe. Mmm. Because of all the other taxes.

It's just something I feel I should know how it works, how much tax do I pay, what am I paying it on, why am I being taxed?

I really hate tax systems like the UK where they supposedly "simplify" it for you but in reality they're trying to hide how much tax you're paying, e.g. including VAT in the price. Oh don't worry you don't need to file a tax return, it's all been collected through PAYE, through withholding on your bank account etc.

No, I want to know how much you're taking off me. If that causes you, the government a problem, then you know what? Get rid of the tax or collect it in a simpler way. I don't have any trust in a government that collects taxes covertly.

Yeah the UK has the lowest income tax rate in Europe. Mmm. Because of all the other taxes.

#10

Does anyone know whether I'm also supposed to report assets (shares, bonds, unit trust units, etc) that are held in UK Self Invested Personal Pension (SIPP). I note that the form is called a 'Foreign Income Verification Form', and as I currently don't derive any income from these assets (ie I am not yet drawing a pension) I'm not sure if I need to include them.

Any help much appreciated.

Any help much appreciated.

Not obvious. The RRSP thing isn't obvious so that's even less obvious, I would call them and check.

This is an informational thing to make sure you're not a tax cheat, so over reporting doesn't really hurt you if you're not sure.

#11

Binned by Muderators

Joined: Jul 2007

Location: White Rock BC

Posts: 11,682

I don't believe that you need to report foreign assets held in a registered account (RRSP/TFSA).

#12

Binned by Muderators

Joined: Jul 2007

Location: White Rock BC

Posts: 11,682

Does anyone know whether I'm also supposed to report assets (shares, bonds, unit trust units, etc) that are held in UK Self Invested Personal Pension (SIPP). I note that the form is called a 'Foreign Income Verification Form', and as I currently don't derive any income from these assets (ie I am not yet drawing a pension) I'm not sure if I need to include them.

Any help much appreciated.

Any help much appreciated.

IMO opinion the SIPP should be reported because it is not "maintained primarily for the benefit of non-resident individuals."

There are no penalties for over-reporting so my advice would be: if in doubt report it.

#13

Foreign pension plans are exluded by ITA 233.2(1) (a) and (b). Generally, if the foreign pension trust is exempt from tax in its jurisdiction, it exists primarily to provide pensions to foreigners, and your interest in the trust relates to a period of employment outside Canada, then you don't need to report it.

I don't believe that you need to report foreign assets held in a registered account (RRSP/TFSA).

I don't believe that you need to report foreign assets held in a registered account (RRSP/TFSA).

Yeah and the RRSP and TFSA are exempt, CRA are already aware of them obviously due to reporting by the FI, checked on that.

This is so much fun.

#14

Slob

Joined: Sep 2009

Location: Ottineau

Posts: 6,342

That form is a bitch.

I'm covered by the "trusts" bit. The trust (discretionary) gets its money from dividends paid out on shares it holds in a limited company.

The trust itself probably has no market value and I have no capital. All I can do is tell the CRA how much I received and how much UK tax was paid on it before I saw my money (foreign tax credit).

I've been audited on that twice. I feel number three coming on later this year.

I'm covered by the "trusts" bit. The trust (discretionary) gets its money from dividends paid out on shares it holds in a limited company.

The trust itself probably has no market value and I have no capital. All I can do is tell the CRA how much I received and how much UK tax was paid on it before I saw my money (foreign tax credit).

I've been audited on that twice. I feel number three coming on later this year.

#15

Sounds like a very complicated way to pay yourself. Why don't you just become self-employed and invoice the UK corporation?

Anyway I've come to the conclusion I don't need to file this form, after all that. So it did force me to look at things in more detail, so much of it is covered by a small mountain of tax slips I had lost track of what was where and what was being reported to the CRA already.

Anyway I've come to the conclusion I don't need to file this form, after all that. So it did force me to look at things in more detail, so much of it is covered by a small mountain of tax slips I had lost track of what was where and what was being reported to the CRA already.